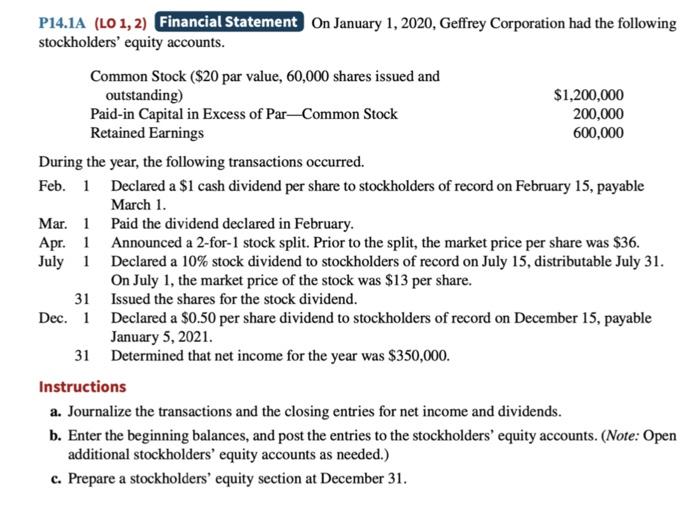

P14.1A, its an example of how i need to do it. I need part A from P14-4B

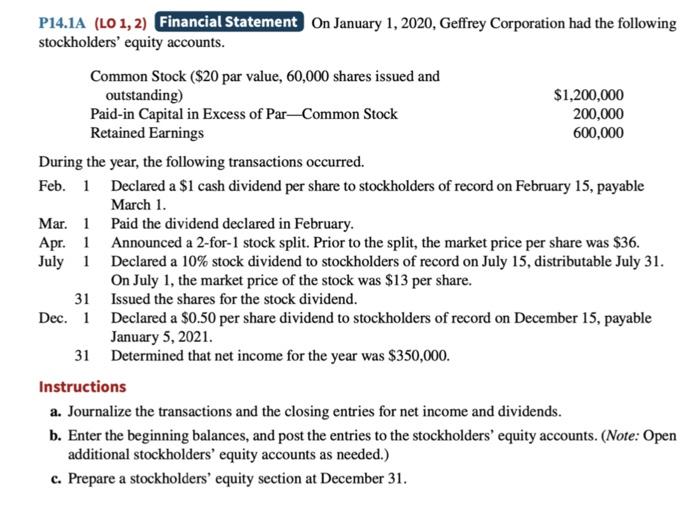

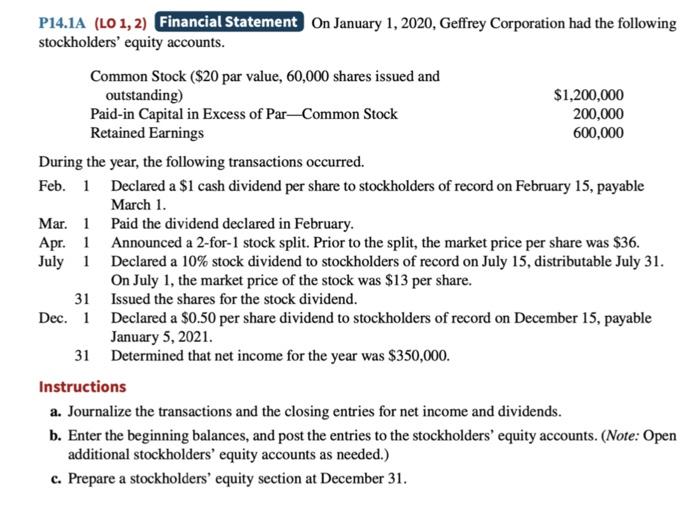

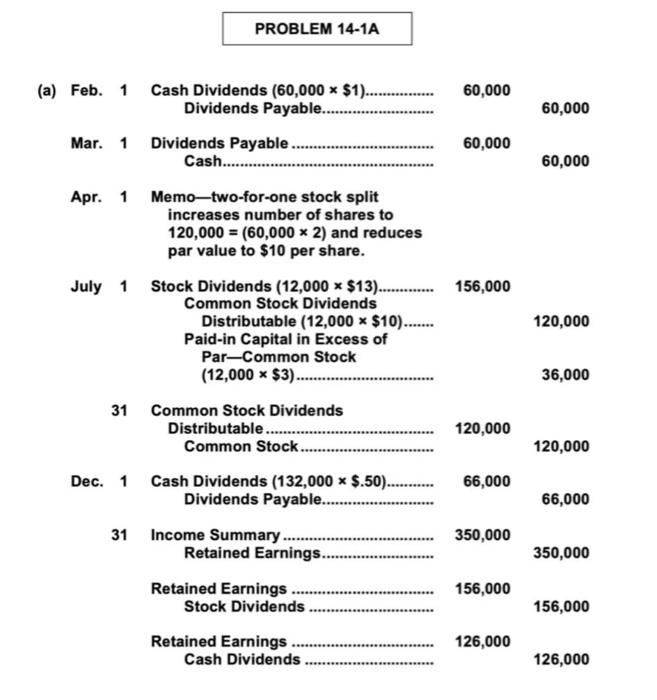

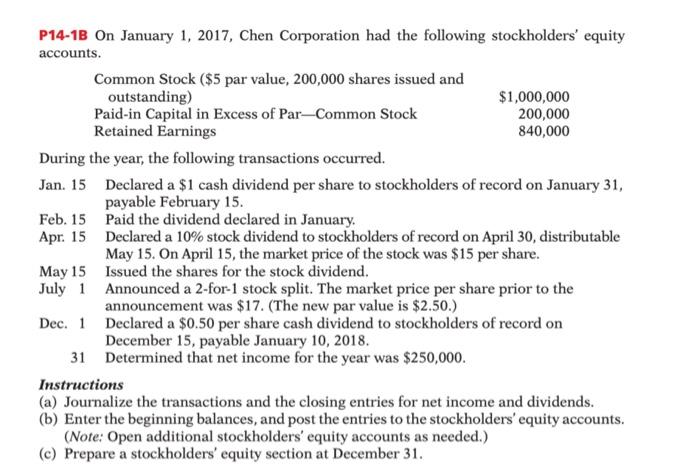

P14.1A (LO 1, 2) Financial Statement On January 1, 2020, Geffrey Corporation had the following stockholders' equity accounts. Common Stock ($20 par value, 60,000 shares issued and outstanding) $1,200,000 200,000 Paid-in Capital in Excess of Par-Common Stock Retained Earnings 600,000 During the year, the following transactions occurred. Feb. 1 Declared a $1 cash dividend per share to stockholders of record on February 15, payable March 1. Mar. 1 Paid the dividend declared in February. Apr. 1 July 1 Announced a 2-for-1 stock split. Prior to the split, the market price per share was $36. Declared a 10% stock dividend to stockholders of record on July 15, distributable July 31. On July 1, the market price of the stock was $13 per share. 31 Issued the shares for the stock dividend. Dec. 1 Declared a $0.50 per share dividend to stockholders of record on December 15, payable January 5, 2021. 31 Determined that net income for the year was $350,000. Instructions a. Journalize the transactions and the closing entries for net income and dividends. b. Enter the beginning balances, and post the entries to the stockholders' equity accounts. (Note: Open additional stockholders' equity accounts as needed.) c. Prepare a stockholders' equity section at December 31. (a) Feb. 1 PROBLEM 14-1A Cash Dividends (60,000 x $1)................ Dividends Payable......... 60,000 60,000 Mar. 1 Dividends Payable. Cash................. Apr. 1 Memo-two-for-one stock split increases number of shares to 120,000 = (60,000 x 2) and reduces par value to $10 per share. July 1 Stock Dividends (12,000 $13).............156,000 Common Stock Dividends Distributable (12,000 x $10).. Paid-in Capital in Excess of Par Common Stock (12,000 $3).. 31 Common Stock Dividends Distributable............. 120,000 Common Stock..... 66,000 Dec. 1 Cash Dividends (132,000 x $.50)............ Dividends Payable... 31 Income Summary. 350,000 Retained Earnings... Retained Earnings. 156,000 ************* Stock Dividends ***************** Retained Earnings. 126,000 Cash Dividends ****************** ********** 60,000 60,000 120,000 36,000 120,000 66,000 350,000 156,000 126,000 P14-1B On January 1, 2017, Chen Corporation had the following stockholders' equity accounts. Common Stock ($5 par value, 200,000 shares issued and outstanding) $1,000,000 200,000 Paid-in Capital in Excess of Par-Common Stock Retained Earnings 840,000 During the year, the following transactions occurred. Jan. 15 Declared a $1 cash dividend per share to stockholders of record on January 31, payable February 15. Feb. 15 Paid the dividend declared in January. Apr. 15 Declared a 10% stock dividend to stockholders of record on April 30, distributable May 15. On April 15, the market price of the stock was $15 per share. May 15 Issued the shares for the stock dividend. July 1 Announced a 2-for-1 stock split. The market price per share prior to the announcement was $17. (The new par value is $2.50.) Dec. 1 Declared a $0.50 per share cash dividend to stockholders of record on December 15, payable January 10, 2018. 31 Determined that net income for the year was $250,000. Instructions (a) Journalize the transactions and the closing entries for net income and dividends. (b) Enter the beginning balances, and post the entries to the stockholders' equity accounts. (Note: Open additional stockholders' equity accounts as needed.) (c) Prepare a stockholders' equity section at December 31. P14.1A (LO 1, 2) Financial Statement On January 1, 2020, Geffrey Corporation had the following stockholders' equity accounts. Common Stock ($20 par value, 60,000 shares issued and outstanding) $1,200,000 200,000 Paid-in Capital in Excess of Par-Common Stock Retained Earnings 600,000 During the year, the following transactions occurred. Feb. 1 Declared a $1 cash dividend per share to stockholders of record on February 15, payable March 1. Mar. 1 Paid the dividend declared in February. Apr. 1 July 1 Announced a 2-for-1 stock split. Prior to the split, the market price per share was $36. Declared a 10% stock dividend to stockholders of record on July 15, distributable July 31. On July 1, the market price of the stock was $13 per share. 31 Issued the shares for the stock dividend. Dec. 1 Declared a $0.50 per share dividend to stockholders of record on December 15, payable January 5, 2021. 31 Determined that net income for the year was $350,000. Instructions a. Journalize the transactions and the closing entries for net income and dividends. b. Enter the beginning balances, and post the entries to the stockholders' equity accounts. (Note: Open additional stockholders' equity accounts as needed.) c. Prepare a stockholders' equity section at December 31. (a) Feb. 1 PROBLEM 14-1A Cash Dividends (60,000 x $1)................ Dividends Payable......... 60,000 60,000 Mar. 1 Dividends Payable. Cash................. Apr. 1 Memo-two-for-one stock split increases number of shares to 120,000 = (60,000 x 2) and reduces par value to $10 per share. July 1 Stock Dividends (12,000 $13).............156,000 Common Stock Dividends Distributable (12,000 x $10).. Paid-in Capital in Excess of Par Common Stock (12,000 $3).. 31 Common Stock Dividends Distributable............. 120,000 Common Stock..... 66,000 Dec. 1 Cash Dividends (132,000 x $.50)............ Dividends Payable... 31 Income Summary. 350,000 Retained Earnings... Retained Earnings. 156,000 ************* Stock Dividends ***************** Retained Earnings. 126,000 Cash Dividends ****************** ********** 60,000 60,000 120,000 36,000 120,000 66,000 350,000 156,000 126,000 P14-1B On January 1, 2017, Chen Corporation had the following stockholders' equity accounts. Common Stock ($5 par value, 200,000 shares issued and outstanding) $1,000,000 200,000 Paid-in Capital in Excess of Par-Common Stock Retained Earnings 840,000 During the year, the following transactions occurred. Jan. 15 Declared a $1 cash dividend per share to stockholders of record on January 31, payable February 15. Feb. 15 Paid the dividend declared in January. Apr. 15 Declared a 10% stock dividend to stockholders of record on April 30, distributable May 15. On April 15, the market price of the stock was $15 per share. May 15 Issued the shares for the stock dividend. July 1 Announced a 2-for-1 stock split. The market price per share prior to the announcement was $17. (The new par value is $2.50.) Dec. 1 Declared a $0.50 per share cash dividend to stockholders of record on December 15, payable January 10, 2018. 31 Determined that net income for the year was $250,000. Instructions (a) Journalize the transactions and the closing entries for net income and dividends. (b) Enter the beginning balances, and post the entries to the stockholders' equity accounts. (Note: Open additional stockholders' equity accounts as needed.) (c) Prepare a stockholders' equity section at December 31