Answered step by step

Verified Expert Solution

Question

1 Approved Answer

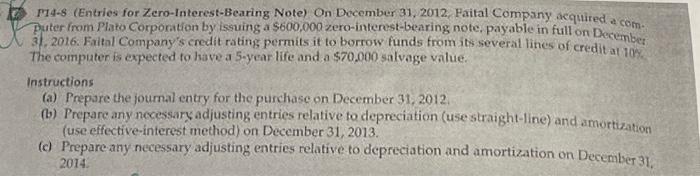

P14-8 (Entries for Zero-Interest-Bearing Note) On December 31, 2012, Faital Company acquired a com- puter from Plato Corporation by issuing a $600,000 zero-interest-bearing note, payable

P14-8 (Entries for Zero-Interest-Bearing Note) On December 31, 2012, Faital Company acquired a com- puter from Plato Corporation by issuing a $600,000 zero-interest-bearing note, payable in full on December 31, 2016. Faital Company's credit rating permits it to borrow funds from its several lines of credit at 10% The computer is expected to have a 5-year life and a $70,000 salvage value. Instructions (a) Prepare the journal entry for the purchase on December 31, 2012. (b) Prepare any necessary adjusting entries relative to depreciation (use straight-line) and amortization (use effective-interest method) on December 31, 2013. (c) Prepare any necessary adjusting entries relative to depreciation and amortization on December 31, 2014.

1. prepare any necessary adjusting entries relative to depreciation (use straight-line) and amortization (use effective- interest method) on december 31,2013.

2. Prepare any necessary adjusting entries relative to depreciation and amortization on december 31,2014.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started