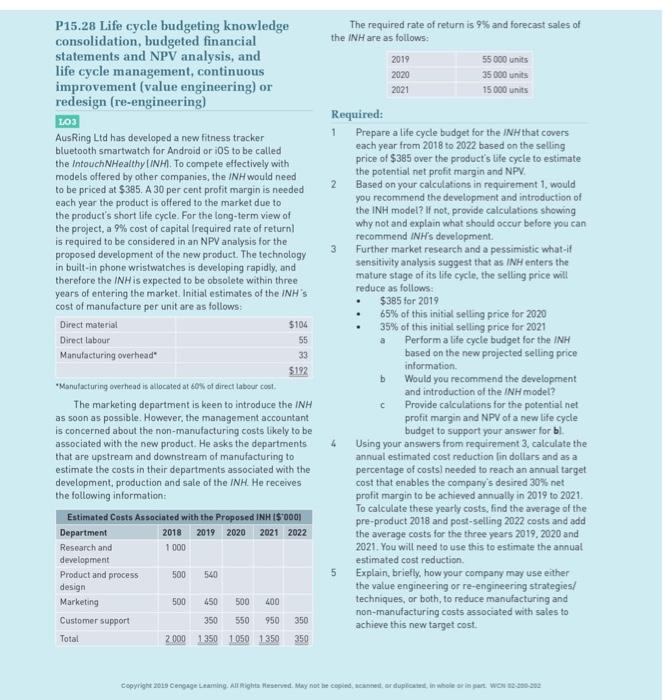

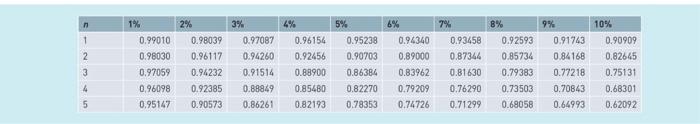

P15.28 Life cycle budgeting knowledge consolidation, budgeted financial statements and NPV analysis, and life cycle management, continuous improvement (value engineering) or redesign (re-engineering) LO3 AusRing Ltd has developed a new fitness tracker bluetooth smartwatch for Android or iOS to be called the IntouchHealthy LINH. To compete effectively with models offered by other companies, the INH would need to be priced at $385, A 30 per cent profit margin is needed each year the product is offered to the market due to the product's short life cycle. For the long-term view of the project, a 9% cost of capital frequired rate of return! is required to be considered in an NPV analysis for the proposed development of the new product. The technology in built-in phone wristwatches is developing rapidly, and therefore the INH is expected to be obsolete within three years of entering the market. Initial estimates of the INH's cost of manufacture per unit are as follows: Direct materiat $104 Direct labour 55 Manufacturing overhead 33 $192 Manufacturing overhead is allocated at 60% of direct labour cost The marketing department is keen to introduce the INH as soon as possible. However, the management accountant is concerned about the non-manufacturing costs likely to be associated with the new product. He asks the departments that are upstream and downstream of manufacturing to estimate the costs in their departments associated with the development, production and sale of the INH. He receives the following information: Estimated Costs Associated with the Proposed INH1$ 0001 Department 2018 2019 2020 2021 2022 Research and 1 000 development Product and process 500 540 design Marketing 500 450 Customer support 350 550 950 350 Total 2000 1350 1050 1350 350 The required rate of return is 9% and forecast sales of the INH are as follows: 2019 55 000 units 2020 35 000 units 2021 15 000 units Required: 1 Prepare a life cycle budget for the INH that covers each year from 2018 to 2022 based on the selling price of $385 over the product's life cycle to estimate the potential net profit margin and NPV. 2 Based on your calculations in requirement 1. would you recommend the development and introduction of the INH model? If not, provide calculations showing why not and explain what should occur before you can recommend INH's development. 3 Further market research and a pessimistic what-if sensitivity analysis suggest that as INH enters the mature stage of its life cycle, the selling price will reduce as follows: $385 for 2019 65% of this initial selling price for 2020 35% of this initial selling price for 2021 Perform a life cycle budget for the INH based on the new projected selling price information b Would you recommend the development and introduction of the INH model? Provide calculations for the potential net profit margin and NPV of a new life cycle budget to support your answer for bl Using your answers from requirement 3 calculate the annual estimated cost reduction lin dollars and as a percentage of costs) needed to reach an annual target cost that enables the company's desired 30% net profit margin to be achieved annually in 2019 to 2021. To calculate these yearly costs, find the average of the pre-product 2018 and post-selling 2022 costs and add the average costs for the three years 2019, 2020 and 2021. You will need to use this to estimate the annual estimated cost reduction 5 Explain, briefly, how your company may use either the value engineering or re-engineering strategies/ techniques, or both, to reduce manufacturing and non-manufacturing costs associated with sales to achieve this new target cost. c 500 400 Copyright 2018 Cengage Leaming. All Rights Reserved. May not be copied or duplicat, in whole 1% 1 2 3 0.99010 0.98030 0.97059 0,96098 0.95147 2% 0.98039 0.96117 0.94232 0.92385 0.90573 3% 0.97087 0.94260 0.91514 0.88849 0.86261 4% 0.96154 0.92456 0.88900 0.85480 0.82193 5% 0.95238 0.90703 0.86384 0.82270 0.78353 6% 0.94340 0.89000 0.83962 0.79209 0.74726 7% 0.93458 0.87344 0.81630 0.76290 0.71299 B% 0.92593 0.85734 0.79383 0.73503 0.68058 9% 0.91743 0.84168 0.77218 0.70843 0.64993 10% 0.90909 0.82645 0.75131 0.68301 0.62092 4 5 P15.28 Life cycle budgeting knowledge consolidation, budgeted financial statements and NPV analysis, and life cycle management, continuous improvement (value engineering) or redesign (re-engineering) LO3 AusRing Ltd has developed a new fitness tracker bluetooth smartwatch for Android or iOS to be called the IntouchHealthy LINH. To compete effectively with models offered by other companies, the INH would need to be priced at $385, A 30 per cent profit margin is needed each year the product is offered to the market due to the product's short life cycle. For the long-term view of the project, a 9% cost of capital frequired rate of return! is required to be considered in an NPV analysis for the proposed development of the new product. The technology in built-in phone wristwatches is developing rapidly, and therefore the INH is expected to be obsolete within three years of entering the market. Initial estimates of the INH's cost of manufacture per unit are as follows: Direct materiat $104 Direct labour 55 Manufacturing overhead 33 $192 Manufacturing overhead is allocated at 60% of direct labour cost The marketing department is keen to introduce the INH as soon as possible. However, the management accountant is concerned about the non-manufacturing costs likely to be associated with the new product. He asks the departments that are upstream and downstream of manufacturing to estimate the costs in their departments associated with the development, production and sale of the INH. He receives the following information: Estimated Costs Associated with the Proposed INH1$ 0001 Department 2018 2019 2020 2021 2022 Research and 1 000 development Product and process 500 540 design Marketing 500 450 Customer support 350 550 950 350 Total 2000 1350 1050 1350 350 The required rate of return is 9% and forecast sales of the INH are as follows: 2019 55 000 units 2020 35 000 units 2021 15 000 units Required: 1 Prepare a life cycle budget for the INH that covers each year from 2018 to 2022 based on the selling price of $385 over the product's life cycle to estimate the potential net profit margin and NPV. 2 Based on your calculations in requirement 1. would you recommend the development and introduction of the INH model? If not, provide calculations showing why not and explain what should occur before you can recommend INH's development. 3 Further market research and a pessimistic what-if sensitivity analysis suggest that as INH enters the mature stage of its life cycle, the selling price will reduce as follows: $385 for 2019 65% of this initial selling price for 2020 35% of this initial selling price for 2021 Perform a life cycle budget for the INH based on the new projected selling price information b Would you recommend the development and introduction of the INH model? Provide calculations for the potential net profit margin and NPV of a new life cycle budget to support your answer for bl Using your answers from requirement 3 calculate the annual estimated cost reduction lin dollars and as a percentage of costs) needed to reach an annual target cost that enables the company's desired 30% net profit margin to be achieved annually in 2019 to 2021. To calculate these yearly costs, find the average of the pre-product 2018 and post-selling 2022 costs and add the average costs for the three years 2019, 2020 and 2021. You will need to use this to estimate the annual estimated cost reduction 5 Explain, briefly, how your company may use either the value engineering or re-engineering strategies/ techniques, or both, to reduce manufacturing and non-manufacturing costs associated with sales to achieve this new target cost. c 500 400 Copyright 2018 Cengage Leaming. All Rights Reserved. May not be copied or duplicat, in whole 1% 1 2 3 0.99010 0.98030 0.97059 0,96098 0.95147 2% 0.98039 0.96117 0.94232 0.92385 0.90573 3% 0.97087 0.94260 0.91514 0.88849 0.86261 4% 0.96154 0.92456 0.88900 0.85480 0.82193 5% 0.95238 0.90703 0.86384 0.82270 0.78353 6% 0.94340 0.89000 0.83962 0.79209 0.74726 7% 0.93458 0.87344 0.81630 0.76290 0.71299 B% 0.92593 0.85734 0.79383 0.73503 0.68058 9% 0.91743 0.84168 0.77218 0.70843 0.64993 10% 0.90909 0.82645 0.75131 0.68301 0.62092 4 5