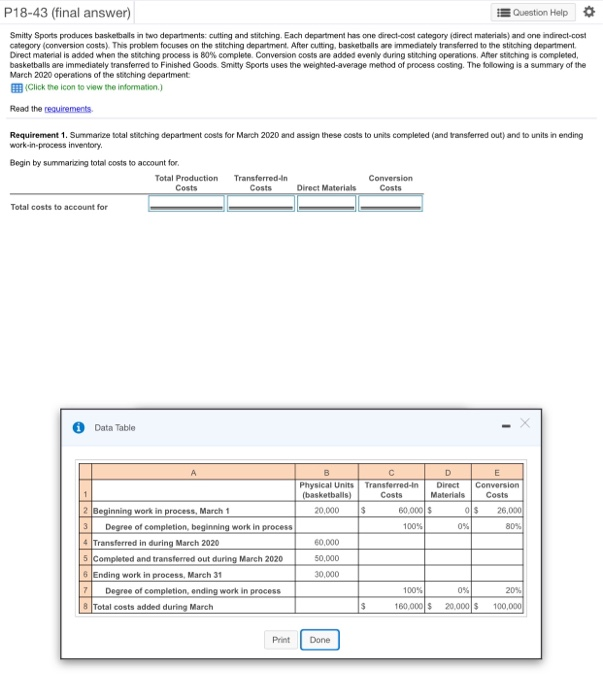

P18-43 (final answer) Question Help Smitty Sports produces basketballs in two departments: cutting and stitching. Each department has one direct-cost category (direct materials) and one indirect-cost category (conversion costs). This problem focuses on the stitching department. After cutting, basketballs are immediately transferred to the stitching department Direct material is added when the stitching process is 80% complete. Conversion costs are added evenly during stitching operations. After stitching is completed, basketballs are immediately transferred to Finished Goods. Smitty Sports uses the weighted average method of process costing. The following is a summary of the March 2020 operations of the stitching department: (Click the icon to view the information.) Read the requirements Requirement 1. Summarize total stitching department costs for March 2020 and assign these costs to units completed (and transferred out) and to units in ending work-in-process inventory Begin by summarizing total costs to account for. Total Production Transferred-In Conversion Costs Direct Materials Costs Costs Total costs to account for Requirements 1. Summarize total stitching department costs for March 2020 and assign these costs to units completed (and transferred out) and to units in ending work-in-process inventory 2. Prepare journal entries for March transfers from the cutting department to the stitching department and from the stitching department to Finished Goods. Print Done P18-43 (final answer) Question Help Smitty Sports produces basketballs in two departments: cutting and stitching. Each department has one direct-cost category direct materials) and one indirect-cost Category (conversion costs). This problem focuses on the stitching department. After cutting, basketballs are immediately transferred to the stitching department Direct material is added when the stitching process is 80% complete Conversion costs are added evenly during stitching operations. After stitching is completed, basketballs are immediately transferred to Finished Goods Smitty Sports uses the weighted average method of process costing. The following is a summary of the March 2020 operations of the stitching department Click the icon to view the information) Read the requirements Requirement 1. Summarize total stiching department costs for March 2020 and assign these costs to units completed (and transferred out) and to units in ending work-in-process inventory Begin by summarizing total costs to account for Total Production Transferred in Conversion Costs Costs Direct Materials Costs Total costs to account for Data Table 1 Physical Units (basketballs) 20.000 D E Transferred-in Direct Conversion Costs Materials Costs $ 60.000$ ols 26,000 100% 0% 80% 2 Beginning work in process, March 1 3 Degree of completion, beginning work in process Transferred in during March 2020 5 Completed and transferred out during March 2020 6 Ending work in process, March 31 7 Degree of completion, ending work in process Total costs added during March 60,000 50,000 30,000 0% 100% 160,000 $ 20% 100,000 $ 20,000 $ Print Done