Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P19-3B Qlgivie Company had a bad year in 2016. For the first time in its history, it operated at a loss. The company's income statement

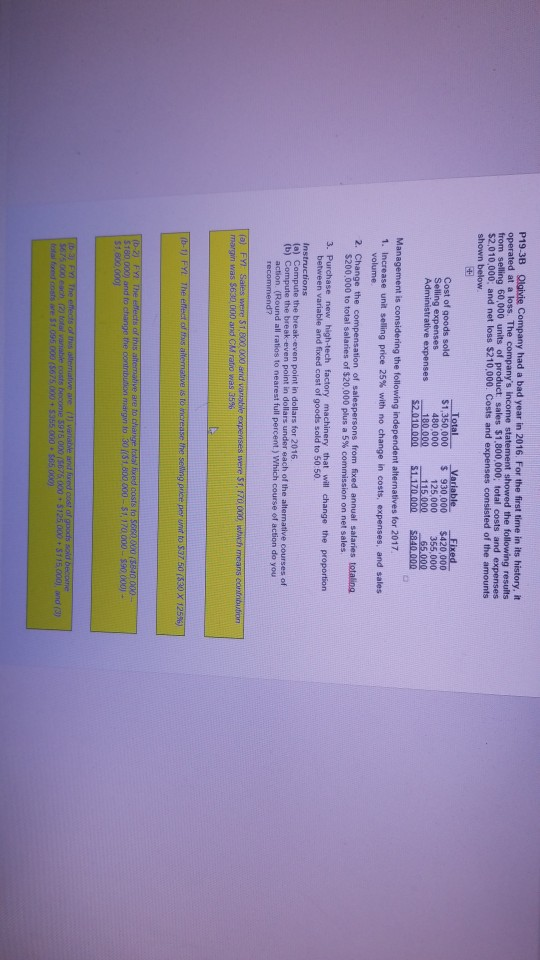

P19-3B Qlgivie Company had a bad year in 2016. For the first time in its history, it operated at a loss. The company's income statement showed the following results from selling 60,000 units of product: sales $1,800,000; total costs and expenses $2,010,000; and net loss $210,000. Costs and expenses consisted of the amounts shown below Cost of goods sold Selling expenses Administrative expenses Total $1,350,000 480,000 180.000 $2.010.000 Variable $ 930.000 125,000 115.000 S1.170.000 Fixed $420,000 355,000 65.000 S840.000 Management is considering the following independent alternatives for 2017 1. Increase unit selling price 25 % with no change in costs, expenses, and sales volume. 2. Change the compensation of salespersons from fixed annual salaries totaling $200,000 to total salaries of $20,000 plus a 5 % commission on net sales 3. Purchase new high-tech factory machinery that will change the proportion between variable and fixed cost of goods sold to 50:50. Instructions (a) Compute the break even point in dollars for 2016. (b) Compute the break-even point in dollars under each of the alternative courses of action. (Round all ratios to nearest full percent) Which course of action do you recommend? (a) FYI Sales were 51,800,000 and variable expenses were 5f, 170 000, wwch means contnbutiors margin was $630 000 and CM rato was 35 % (b-1) FY The effect of ths alternative is to norease the sellng price pey unt to 537 50 (530 X 125 % ) (b-2) FYI The effects of this altermative are to chage tolal foxed costs to $660,000 (5840 000- $180 000) and to change the contribution margn fo 30 ((51.800 000 $1,170000-$90 0001- $1.800 000) D 31 FY The effects of tus allemative are (1) vaiable and foxed cost of goods sold becone 5675 000 each (2) total variable costs beoome 5915 000 (5675,000+5125, 000+ 5115.000), and (3) total fored costs are $1 095 000 ($675 000+ $355 000 $65 000)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started