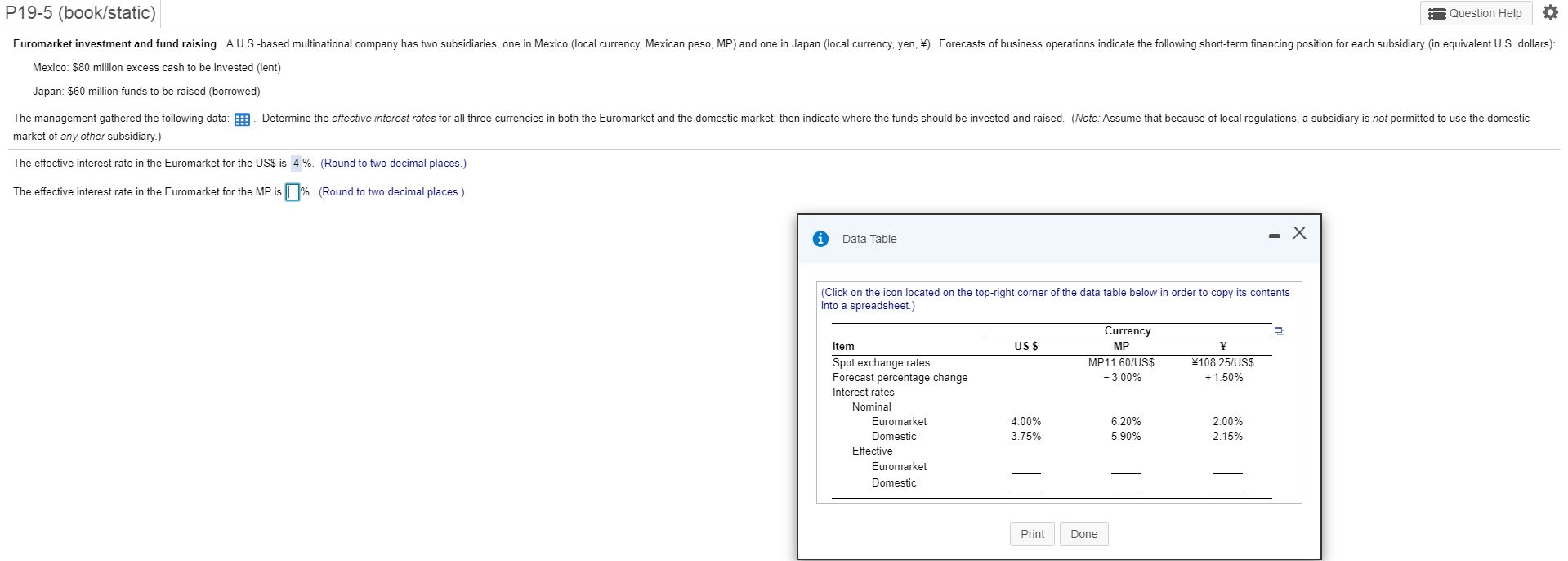

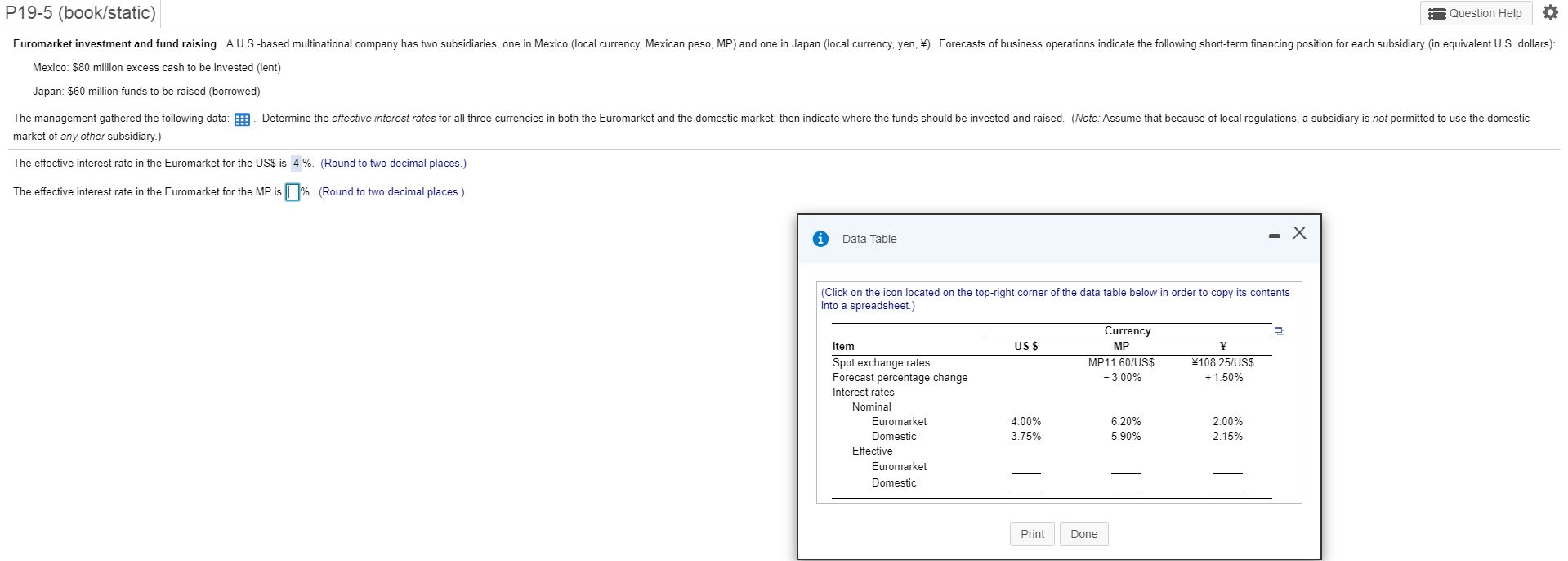

P19-5 (book/static) Question Help Euromarket investment and fund raising A U.S.-based multinational company has two subsidiaries, one in Mexico (local currency, Mexican peso, MP) and one in Japan (local currency, yen, W). Forecasts of business operations indicate the following short-term financing position for each subsidiary in equivalent U.S. dollars): Mexico: $80 million excess cash to be invested (lent) Japan: $60 million funds to be raised (borrowed) Determine the effective interest rates for all three currencies in both the Euromarket and the domestic market, then indicate where the funds should be invested and raised. (Note: Assume that because of local regulations, a subsidiary is not permitted to use the domestic The management gathered the following data: market of any other subsidiary.) The effective interest rate in the Euromarket for the US$ is 4 %. (Round to two decimal places.) The effective interest rate in the Euromarket for the MP is % (Round to two decimal places.) Data Table - X (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) - Item US$ Currency MP MP11.60/US$ - 3.00% 108.25/US$ + 1.50% Spot exchange rates Forecast percentage change Interest rates Nominal Euromarket Domestic Effective Euromarket Domestic 4.00% 3.75% 6.20% 5.90% 2.00% 2.15% Print Done P19-5 (book/static) Question Help Euromarket investment and fund raising A U.S.-based multinational company has two subsidiaries, one in Mexico (local currency, Mexican peso, MP) and one in Japan (local currency, yen, W). Forecasts of business operations indicate the following short-term financing position for each subsidiary in equivalent U.S. dollars): Mexico: $80 million excess cash to be invested (lent) Japan: $60 million funds to be raised (borrowed) Determine the effective interest rates for all three currencies in both the Euromarket and the domestic market, then indicate where the funds should be invested and raised. (Note: Assume that because of local regulations, a subsidiary is not permitted to use the domestic The management gathered the following data: market of any other subsidiary.) The effective interest rate in the Euromarket for the US$ is 4 %. (Round to two decimal places.) The effective interest rate in the Euromarket for the MP is % (Round to two decimal places.) Data Table - X (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) - Item US$ Currency MP MP11.60/US$ - 3.00% 108.25/US$ + 1.50% Spot exchange rates Forecast percentage change Interest rates Nominal Euromarket Domestic Effective Euromarket Domestic 4.00% 3.75% 6.20% 5.90% 2.00% 2.15% Print Done