Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P=(1+y) -N F Modified Duration M=-(dP/dy)/P Convecity C=(d 2 P/dy 2 )/P (4)(30 points) Consider the following two bonds Bond 1 has face value F-$20000

P=(1+y)-NF

Modified Duration M=-(dP/dy)/P

Convecity C=(d2P/dy2)/P

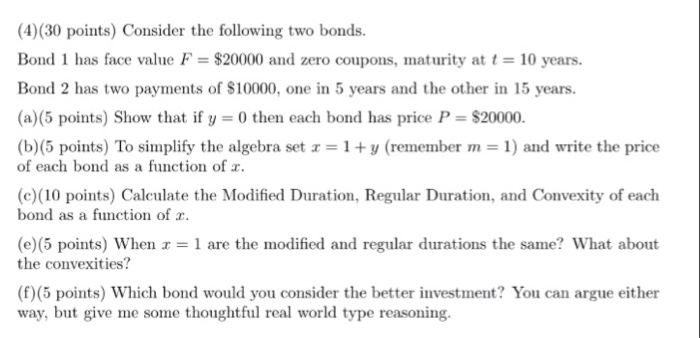

(4)(30 points) Consider the following two bonds Bond 1 has face value F-$20000 and zero coupons, miat urity at t = 10 years. Bond 2 has two payments of S10000, one in 5 years and the other in 15 years. (a)(5 points) Show that if y = 0 then each bond has price P = $20000. (b)(5 points) To simplify the algebra set x = 1 + y (rennember m = 1) and write the price of each bond as a function of r (c)(10 points) Calculate the Modified Duration, Regular Duration, and Convexity of each bond as a function of z (e) (5 points) when x = 1 are the modified and regular durations the same? What about the convexities? (f)(5 points) Which bond would you consider the better investment? You can argue either way, but give me some thoughtful real world type reasoningStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started