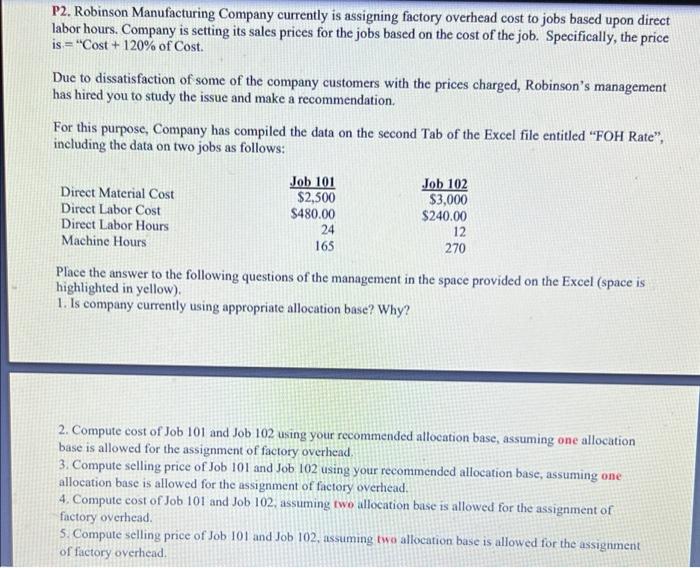

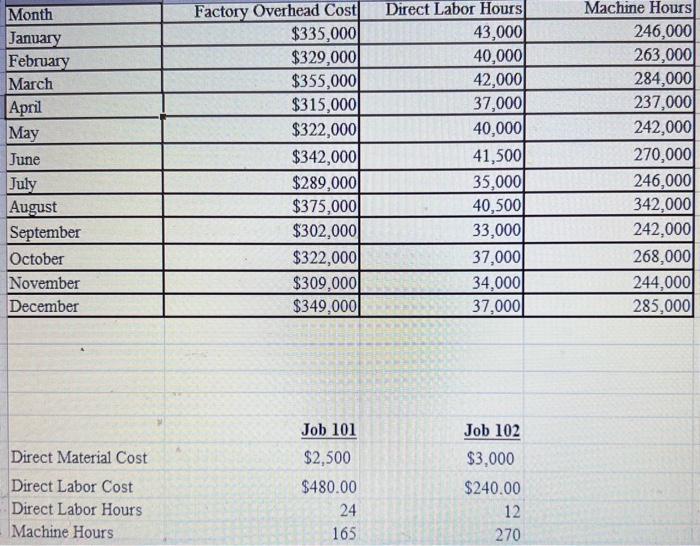

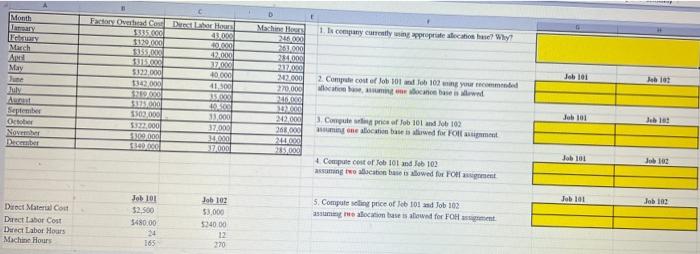

P2. Robinson Manufacturing Company currently is assigning factory overhead cost to jobs based upon direct labor hours. Company is setting its sales prices for the jobs based on the cost of the job. Specifically, the price is "Cost + 120% of Cost. Due to dissatisfaction of some of the company customers with the prices charged, Robinson's management has hired you to study the issue and make a recommendation. For this purpose, Company has compiled the data on the second Tab of the Excel file entitled "FOH Rate", including the data on two jobs as follows: Job 102 Direct Material Cost Direct Labor Cost Job 101 $2,500 $3,000 $480.00 $240.00 Direct Labor Hours 12 24 165 Machine Hours 270 Place the answer to the following questions of the management in the space provided on the Excel (space is highlighted in yellow). 1. Is company currently using appropriate allocation base? Why? 2. Compute cost of Job 101 and Job 102 using your recommended allocation base, assuming one allocation base is allowed for the assignment of factory overhead. 3. Compute selling price of Job 101 and Job 102 using your recommended allocation base, assuming one allocation base is allowed for the assignment of factory overhead. 4. Compute cost of Job 101 and Job 102, assuming two allocation base is allowed for the assignment of factory overhead. 5. Compute selling price of Job 101 and Job 102, assuming two allocation base is allowed for the assignment of factory overhead. Month January February March April May June July August September October November December Direct Material Cost Direct Labor Cost Direct Labor Hours Machine Hours Factory Overhead Cost $335,000 $329,000 $355,000 $315,000 $322,000 $342,000 $289,000 $375,000 $302,000 $322,000 $309,000 $349,000 Job 101 $2,500 $480.00 24 165 Direct Labor Hours 43,000 40,000 42,000 37,000 40,000 41,500 35,000 40,500 33,000 37,000 34,000 37,000 Job 102 $3,000 $240.00 12 270 Machine Hours 246,000 263,000 284,000 237,000 242,000 270,000 246,000 342,000 242,000 268,000 244,000 285,000 Month January February March Apol May June July Aunut September October November December Direct Material Cost Direct Labor Cost Direct Labor Hours Machine Hours Factory Overhead Con Direct Labor Hours $335.000 43.000 $129.000 40.000 $355.000 42.000 $315.000 37.000 $322.000 40,000 1342,000 41,300 $249.000 35.000 $375.000 40.500 $300,000 31,000 $322,000 37,000 $109,000 34.000 1349.000 37.000 Job 101 $2,500 Job 102 $3,000 $240.00 1480.00 24 12 165 270 Machine Hours 246.000 263.000 284.000 217.000 242.000 270.000 240.000 347.000 242.000 268,000 244.000 285,000 1. Is company currently using appropriate alocation hase? Why? 2. Compute cost of Job 101 and Job 102 aning your recommended allocation base, assuming one location base is allowed 3. Compute selling price of Job 101 and Job 102 assuming one allocation base is alwed for Foll assignment 4. Compute cost of Job 101 and Job 102 assuming two allocation base is allowed for FOR sigment 5. Compute selling price of Jeb 101 and Job 102 assuming me alocation base is allowed for FOH assignment Job 101 Job 101 Job 101 Job 101 Jeb 102 Jeb 101 Job 102 Job 102 P2. Robinson Manufacturing Company currently is assigning factory overhead cost to jobs based upon direct labor hours. Company is setting its sales prices for the jobs based on the cost of the job. Specifically, the price is "Cost + 120% of Cost. Due to dissatisfaction of some of the company customers with the prices charged, Robinson's management has hired you to study the issue and make a recommendation. For this purpose, Company has compiled the data on the second Tab of the Excel file entitled "FOH Rate", including the data on two jobs as follows: Job 102 Direct Material Cost Direct Labor Cost Job 101 $2,500 $3,000 $480.00 $240.00 Direct Labor Hours 12 24 165 Machine Hours 270 Place the answer to the following questions of the management in the space provided on the Excel (space is highlighted in yellow). 1. Is company currently using appropriate allocation base? Why? 2. Compute cost of Job 101 and Job 102 using your recommended allocation base, assuming one allocation base is allowed for the assignment of factory overhead. 3. Compute selling price of Job 101 and Job 102 using your recommended allocation base, assuming one allocation base is allowed for the assignment of factory overhead. 4. Compute cost of Job 101 and Job 102, assuming two allocation base is allowed for the assignment of factory overhead. 5. Compute selling price of Job 101 and Job 102, assuming two allocation base is allowed for the assignment of factory overhead. Month January February March April May June July August September October November December Direct Material Cost Direct Labor Cost Direct Labor Hours Machine Hours Factory Overhead Cost $335,000 $329,000 $355,000 $315,000 $322,000 $342,000 $289,000 $375,000 $302,000 $322,000 $309,000 $349,000 Job 101 $2,500 $480.00 24 165 Direct Labor Hours 43,000 40,000 42,000 37,000 40,000 41,500 35,000 40,500 33,000 37,000 34,000 37,000 Job 102 $3,000 $240.00 12 270 Machine Hours 246,000 263,000 284,000 237,000 242,000 270,000 246,000 342,000 242,000 268,000 244,000 285,000 Month January February March Apol May June July Aunut September October November December Direct Material Cost Direct Labor Cost Direct Labor Hours Machine Hours Factory Overhead Con Direct Labor Hours $335.000 43.000 $129.000 40.000 $355.000 42.000 $315.000 37.000 $322.000 40,000 1342,000 41,300 $249.000 35.000 $375.000 40.500 $300,000 31,000 $322,000 37,000 $109,000 34.000 1349.000 37.000 Job 101 $2,500 Job 102 $3,000 $240.00 1480.00 24 12 165 270 Machine Hours 246.000 263.000 284.000 217.000 242.000 270.000 240.000 347.000 242.000 268,000 244.000 285,000 1. Is company currently using appropriate alocation hase? Why? 2. Compute cost of Job 101 and Job 102 aning your recommended allocation base, assuming one location base is allowed 3. Compute selling price of Job 101 and Job 102 assuming one allocation base is alwed for Foll assignment 4. Compute cost of Job 101 and Job 102 assuming two allocation base is allowed for FOR sigment 5. Compute selling price of Jeb 101 and Job 102 assuming me alocation base is allowed for FOH assignment Job 101 Job 101 Job 101 Job 101 Jeb 102 Jeb 101 Job 102 Job 102