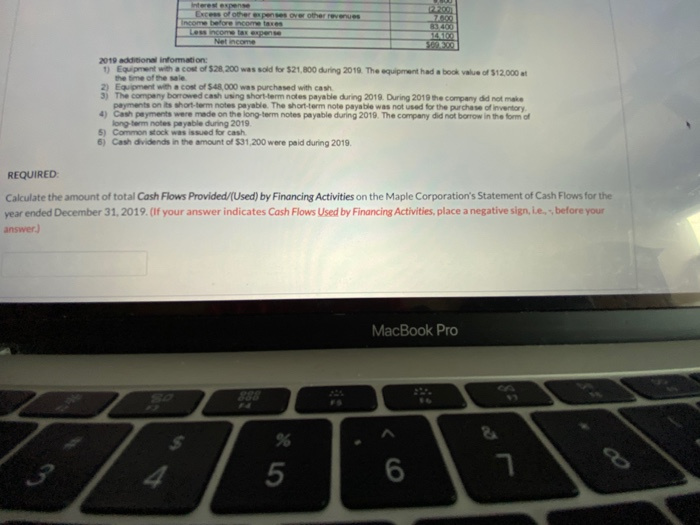

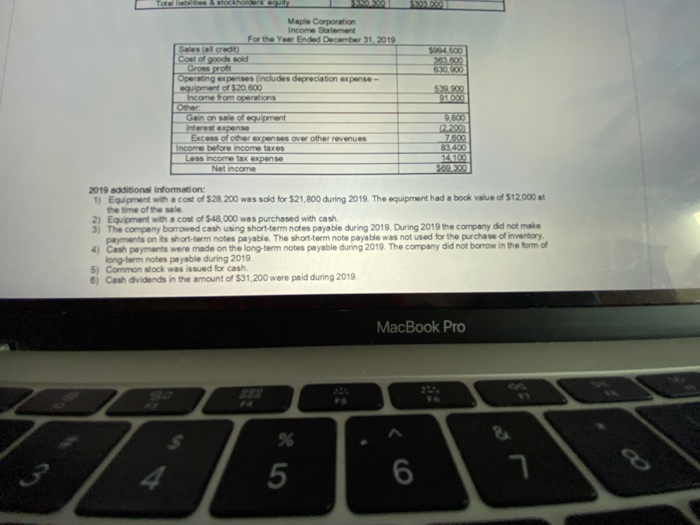

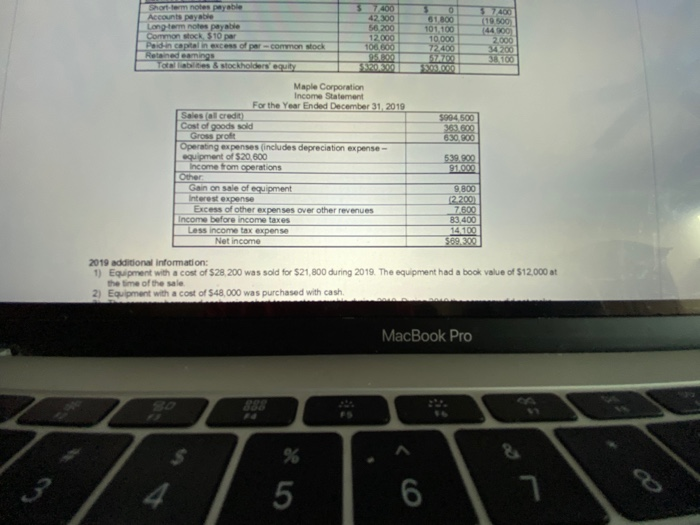

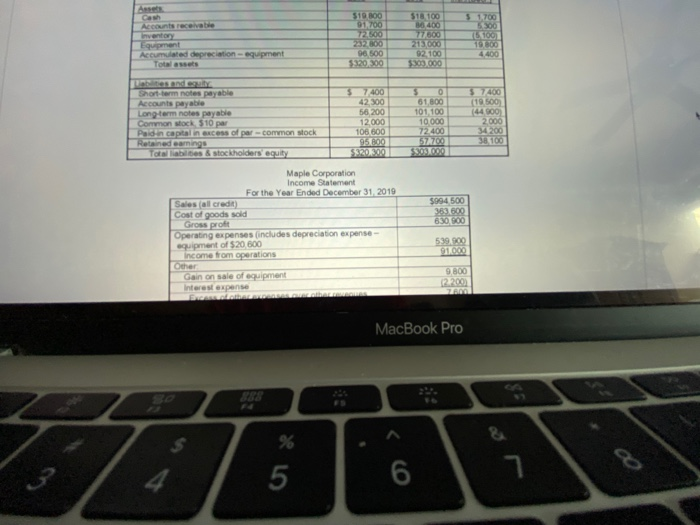

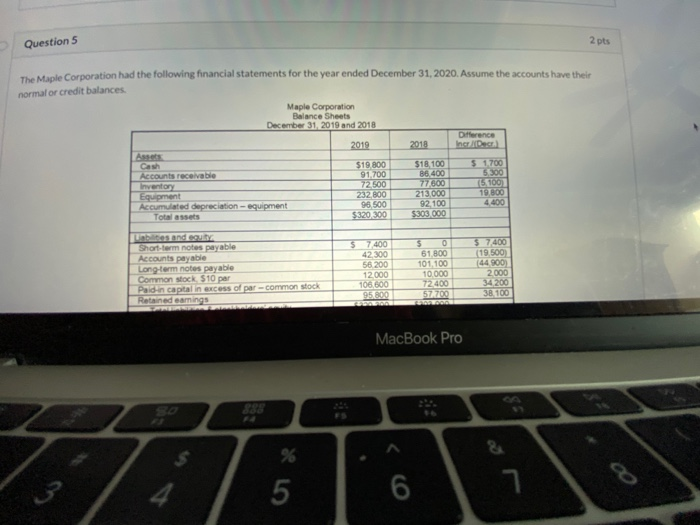

P200 Excess of other expenses over other revenues 0400 100 300 2019 additional information: 1) Equipment with a cost of $28,200 was sold for $21,800 during 2010. The equipment had a book value of $12.000 at the time of the sale 2) Equipment with a cost of $48.000 was purchased with cash 3) The company borrowed cash using short-term notes payable during 2019. During 2019 the company did not make payments on its short-term notes payable. The short-term note payable was not used for the purchase of inventory 4) Cash payments were made on the long-term notes payable during 2019. The company did not borrow in the form of long-term notes payable during 2019 5) Common stock was issued for cash 5) Cash dividends in the amount of $31,200 were paid during 2019. REQUIRED Calculate the amount of total Cash Flows Provided/(Used) by Financing Activities on the Maple Corporation's Statement of Cash Flows for the year ended December 31, 2019. (If your answer indicates Cash Flows Used by Financing Activities, place a negative sign, le, before your answer.) MacBook Pro 6 Totabilities & stockholders equity 312000 5004 500 Maple Corporation Income Statement For the Year Ended December 31, 2019 Sales (all credit Cost of goods sold Gross proft Operating expenses includes depreciation expense- equipment of $20 500 Income from operations 539.900 One 800 Gain on sale of equipment Interest expense Excess of other expenses over other reven Income before income taxes Less income tax expense Net income 7600 337400 14100 569.300 2019 additional information: 1) Equipment with a cost of $28, 200 was sold for $21,800 during 2019. The equipment had a book value of $12.000 at the time of the sale 2) Equipment with a cost of $48,000 was purchased with cash 3) The company borrowed cash using short-term notes payable during 2019. During 2019 the company did not make payments on its short-term notes payable. The short-term note payable was not used for the purchase of inventory 4) Cash payments were made on the long-term notes payable during 2019. The company did not borrow in the form of long-term notes payable during 2019 5) Common stock was issued for cash 5) Cash dividends in the amount of $31,200 were paid during 2019 MacBook Pro 6 7200 $77400 (191500 Accounts payable Long-term notes payable Common stock 510 par Paid in capital in excess of par 42300 56.200 12000 100 g 93000 512800 101.100 10.000 72400 5700 common stock TOET Stockholders City $804 500 369600 630,000 Maple Corporation Income Statement For the Year Ended December 31, 2019 Sales (all credit) Cost of goods sold Gross profit Operating expenses (includes depreciation expense- equipment of $20,600 income from operations Other Gain on sale of equipment Interest expense Excess of other expenses over other revenues Income before income taxes Less income tax expense Net Income 539.000 91.000 9800 12.2001 7800 83.400 14 100 $69.300 2019 additional Information: 1) Equipment with a cost of $28,200 was sold for $21,800 during 2019. The equipment had a book value of $12.000 at the time of the sale 2) Equipment with a cost of $48,000 was purchased with cash. MacBook Pro 510 800 1700 72500 232 8001 96 500 5320300 516100 400 7715001 2150 (54100 101800 Accumulated depreciation equipment 92.100 $ 31000 U $ 77400 (191500) stand Short-term notes payable Accounts payab Long-term notes payable Common stock 510 par Paid in capital in excess of par common stock Retained earnings Tot s & stockholderseguit $ 7400 42300 56 200 12 000 106.600 95 100 S86021 2.000 51.800 101,100 10000 727400 57700 309000 100 $994 500 63.600 6907300 Maple Corporation Income Statement For the Year Ended December 31, 2019 Sales (all credit) Cost of goods sold Gross profit Operating expenses includes depreciation expense- equipment of $20.600 income from operations Other Gain on sale of equipment Interest expense 539.900 91.000 9,800 2.2001 MacBook Pro Question 5 2 pts The Maple Corporation had the following financial statements for the year ended December 31, 2020. Assume the accounts have their normal or credit balances Maple Corporation Balance Sheets December 31, 2019 and 2018 2019 2018 Difference IncrDC $19 800 912700 72.500 2327800 96.500 $320.300 518 100 400 000 213 000 92.100 $103.000 equipment Accumulated preciation Total assets Short-term notes payable Accounts payable Long term notos payable Common stock $10 par Paid in capital in excess of par $ 7400 42300 56. 200 12000 106,600 61.800 101 100 10.000 72400 202 $ 7400 (19.500) (44900 2000 34200 38.100 common stock DOPO MacBook Pro