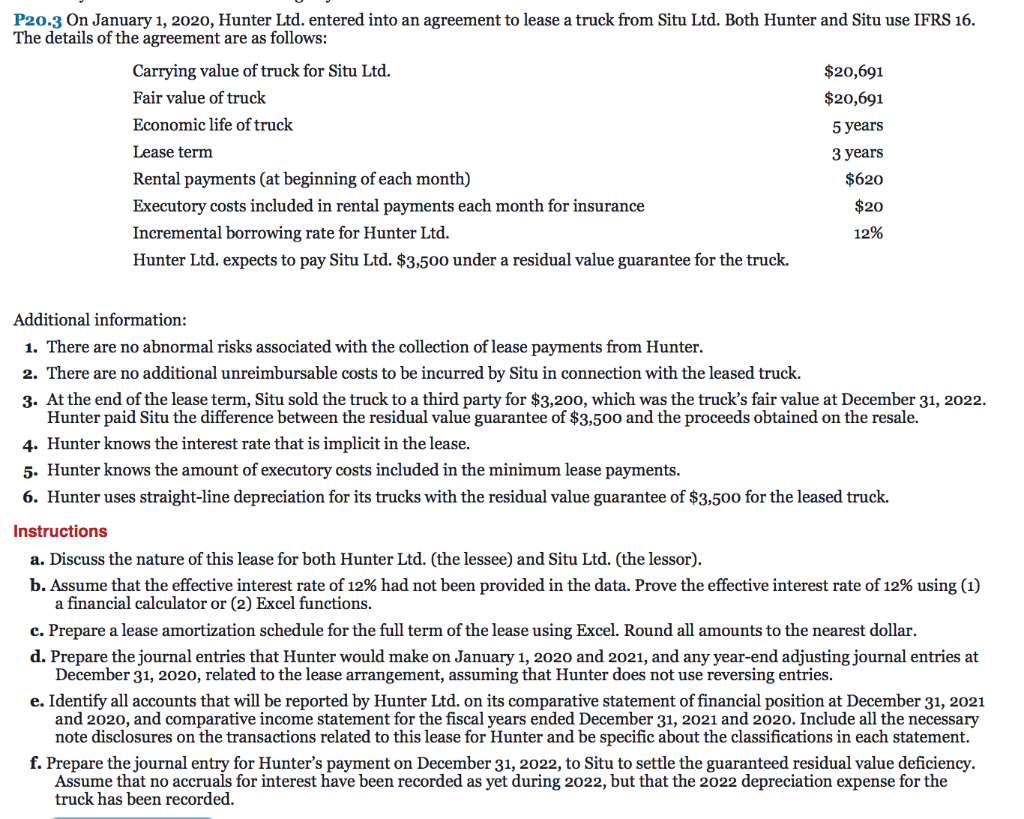

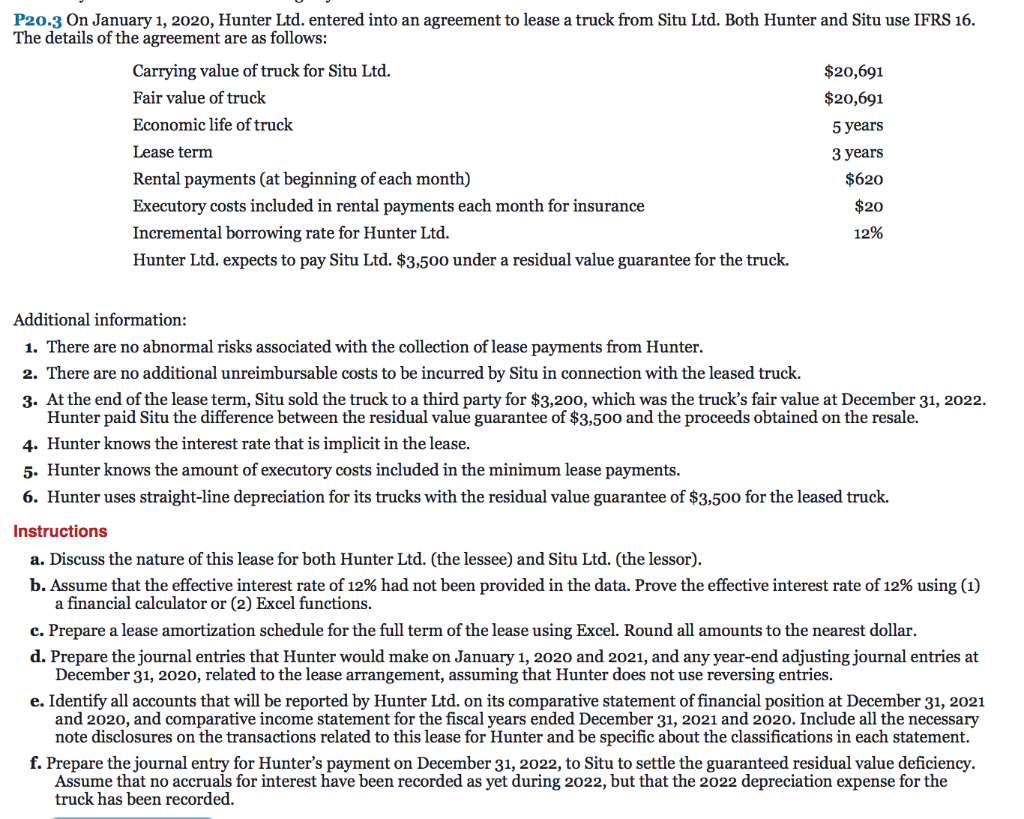

P20.3 On January 1, 2020, Hunter Ltd. entered into an agreement to lease a truck from Situ Ltd. Both Hunter and Situ use IFRS 16. The details of the agreement are as follows: Carrying value of truck for Situ Ltd. $20,691 Fair value of truck $20,691 Economic life of truck 5 years Lease term 3 years Rental payments (at beginning of each month) $620 Executory costs included in rental payments each month for insurance $20 Incremental borrowing rate for Hunter Ltd. 12% Hunter Ltd. expects to pay Situ Ltd. $3,500 under a residual value guarantee for the truck. Additional information: 1. There are no abnormal risks associated with the collection of lease payments from Hunter. 2. There are no additional unreimbursable costs to be incurred by Situ in connection with the leased truck. 3. At the end of the lease term, Situ sold the truck to a third party for $3,200, which was the truck's fair value at December 31, 2022. Hunter paid Situ the difference between the residual value guarantee of $3,500 and the proceeds obtained on the resale. 4. Hunter knows the interest rate that is implicit in the lease. 5. Hunter knows the amount of executory costs included in the minimum lease payments. 6. Hunter uses straight-line depreciation for its trucks with the residual value guarantee of $3,500 for the leased truck. Instructions a. Discuss the nature of this lease for both Hunter Ltd. (the lessee) and Situ Ltd. (the lessor). b. Assume that the effective interest rate of 12% had not been provided in the data. Prove the effective interest rate of 12% using (1) a financial calculator or (2) Excel functions. c. Prepare a lease amortization schedule for the full term of the lease using Excel. Round all amounts to the nearest dollar. d. Prepare the journal entries that Hunter would make on January 1, 2020 and 2021, and any year-end adjusting journal entries at December 31, 2020, related to the lease arrangement, assuming that Hunter does not use reversing entries. e. Identify all accounts that will be reported by Hunter Ltd. on its comparative statement of financial position at December 31, 2021 and 2020, and comparative income statement for the fiscal years ended December 31, 2021 and 2020. Include all the necessary note disclosures on the transactions related to this lease for Hunter and be specific about the classifications in each statement. f. Prepare the journal entry for Hunter's payment on December 31, 2022, to Situ to settle the guaranteed residual value deficiency. Assume that no accruals for interest have been recorded as yet during 2022, but that the 2022 depreciation expense for the truck has been recorded. P20.3 On January 1, 2020, Hunter Ltd. entered into an agreement to lease a truck from Situ Ltd. Both Hunter and Situ use IFRS 16. The details of the agreement are as follows: Carrying value of truck for Situ Ltd. $20,691 Fair value of truck $20,691 Economic life of truck 5 years Lease term 3 years Rental payments (at beginning of each month) $620 Executory costs included in rental payments each month for insurance $20 Incremental borrowing rate for Hunter Ltd. 12% Hunter Ltd. expects to pay Situ Ltd. $3,500 under a residual value guarantee for the truck. Additional information: 1. There are no abnormal risks associated with the collection of lease payments from Hunter. 2. There are no additional unreimbursable costs to be incurred by Situ in connection with the leased truck. 3. At the end of the lease term, Situ sold the truck to a third party for $3,200, which was the truck's fair value at December 31, 2022. Hunter paid Situ the difference between the residual value guarantee of $3,500 and the proceeds obtained on the resale. 4. Hunter knows the interest rate that is implicit in the lease. 5. Hunter knows the amount of executory costs included in the minimum lease payments. 6. Hunter uses straight-line depreciation for its trucks with the residual value guarantee of $3,500 for the leased truck. Instructions a. Discuss the nature of this lease for both Hunter Ltd. (the lessee) and Situ Ltd. (the lessor). b. Assume that the effective interest rate of 12% had not been provided in the data. Prove the effective interest rate of 12% using (1) a financial calculator or (2) Excel functions. c. Prepare a lease amortization schedule for the full term of the lease using Excel. Round all amounts to the nearest dollar. d. Prepare the journal entries that Hunter would make on January 1, 2020 and 2021, and any year-end adjusting journal entries at December 31, 2020, related to the lease arrangement, assuming that Hunter does not use reversing entries. e. Identify all accounts that will be reported by Hunter Ltd. on its comparative statement of financial position at December 31, 2021 and 2020, and comparative income statement for the fiscal years ended December 31, 2021 and 2020. Include all the necessary note disclosures on the transactions related to this lease for Hunter and be specific about the classifications in each statement. f. Prepare the journal entry for Hunter's payment on December 31, 2022, to Situ to settle the guaranteed residual value deficiency. Assume that no accruals for interest have been recorded as yet during 2022, but that the 2022 depreciation expense for the truck has been recorded