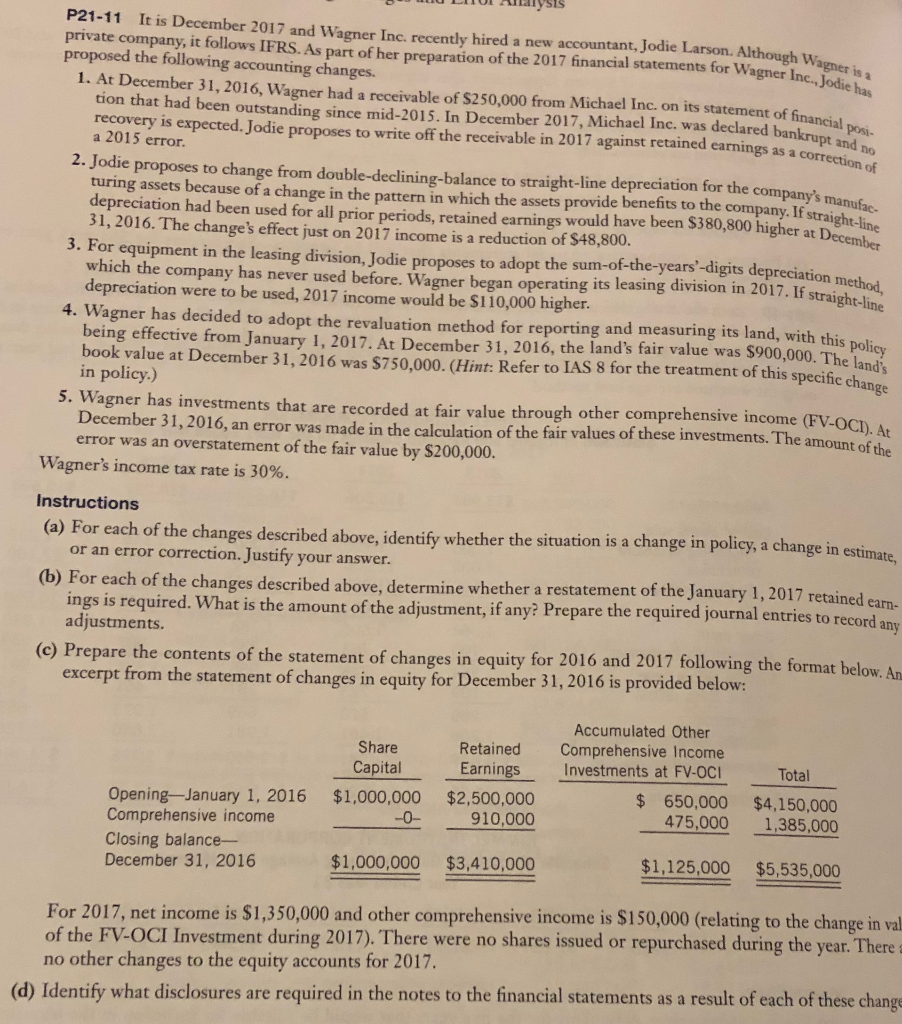

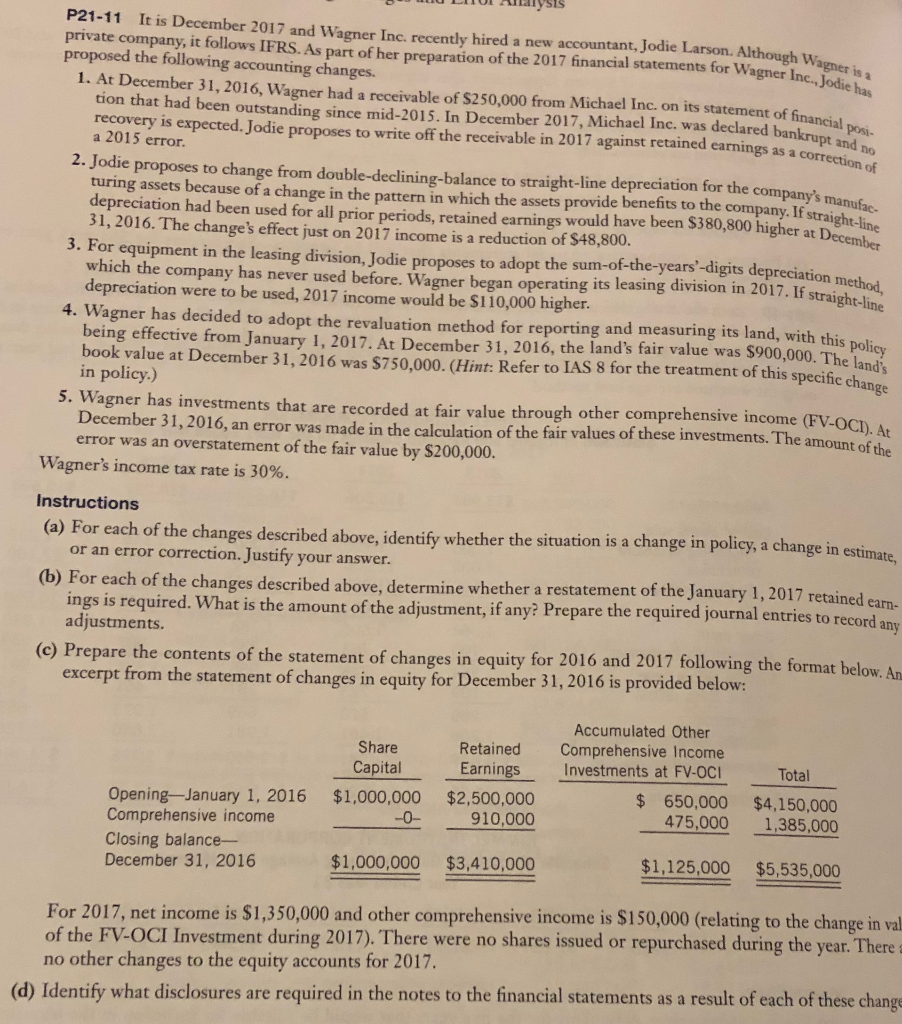

P21-11 It is December 2017 and Wagner Inc. recently hired a new accountant, Jodie Larson. Alth private company, it follows IFRS. As part of her proposed the following accounting changes. ough W preparation of the 2017 financial statements for Wagner Inc. agner is odie 1. At December 31, 2016, Wagner had a receivable of $250,000 from Michael Inc. on its statement of financis tion that had been outstanding since mid-2015. In December 2017, Michael Inc. was declared bankrupt recovery is expected. Jodie proposes to write off the receivable in 2017 against retained earnings as a correction posi- ho a 2015 error. 2. Jodie proposes to change from double-declining-balance to straight-line depreciation for the company's manu turing assets because of a change in the pattern in which the assets provide benefits to the company. If straight depreciation had been used for all prior periods, retained earnings would have been $380,800 higher at Decemhe 31, 2016. The change's effect just on 2017 income is a reduction of $48,800 3. For equipment in the leasing division, Jodie proposes to adopt the sum-of-the-years'-digits depreciation which the company has never used before. Wagner began operating its leasing division in 2017. If straight-Ii depreciation were to be used, 2017 income would be $110,000 higher 4. Wagner has decided to adopt the revaluation method for reporting and measuring its land, with this n being effective from January 1, 2017. At December 31, 2016, the land's fair value was $900,000. Th book value at December 31, 2016 was S750,000. (Hint: Refer to IAS 8 for the treatment of this specific chan in policy.) 5. Wagner has investments that are recorded at fair value through other comprehensive income (FV-OCI), Ar December 31,2016, an error was made in the calculation of the fair values of these investments. The amount of the error was an overstatement of the fair value by $200,000 Wagner's income tax rate is 30 Instructions a) For each of the changes deseribed above, identify whether the situation is a change in policy, a change in estimate or an error correction. Justify your answer. of the January 1, 2017 retained earn- adjustment, if any? Prepare the required journal entries to record an (b) For each of the changes described above, determine whether a restatement ings is required. What is the amount of the adjustments (c) Prepare the contents of the statement of changes in equity for 2016 and 2017 following the format ow: excerpt from the statement of changes in equity for December 31, 2016 is provided bel Accumulated Other Comprehensive Income Share Retained at FV-OCI 475,000 1385.000 $1,125,000 $5,535,000 Earnings Investments Total Capital Opening-January 1, 2016 $1,000,000 $%2,500,000 Comprehensive income Closing balance- December 31, 2016 $ 650,000 $4,150,000 0- 910,000 $1,000,000 $3,410,000 For 2017, net income is $1,350,000 and other comprehensive income is $150,000 (relating to the change in val of the FV-OCI Investment during 2017). There were no shares issued or repurchased during the year. There no other changes to the equity accounts for 2017. (d) Identify what disclosures are required in the notes to the financial statements as a result of each of these change