Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P21.1B (LO 2,4) (Lessee Entries, Finance Lease) The following facts pertain to a non-cancelable lease agreement between Jupiter Leasing Company and Siskiwit Company, a

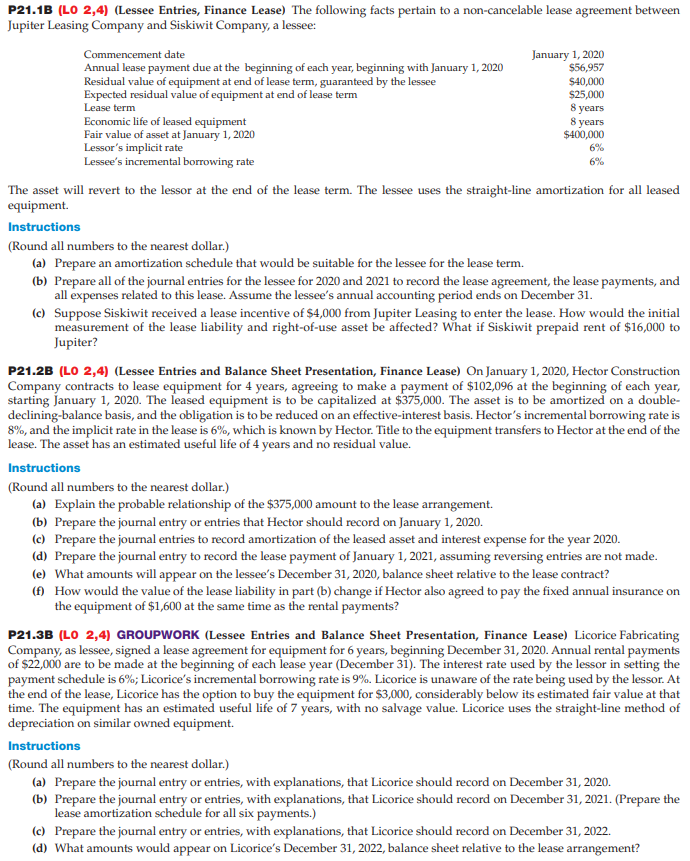

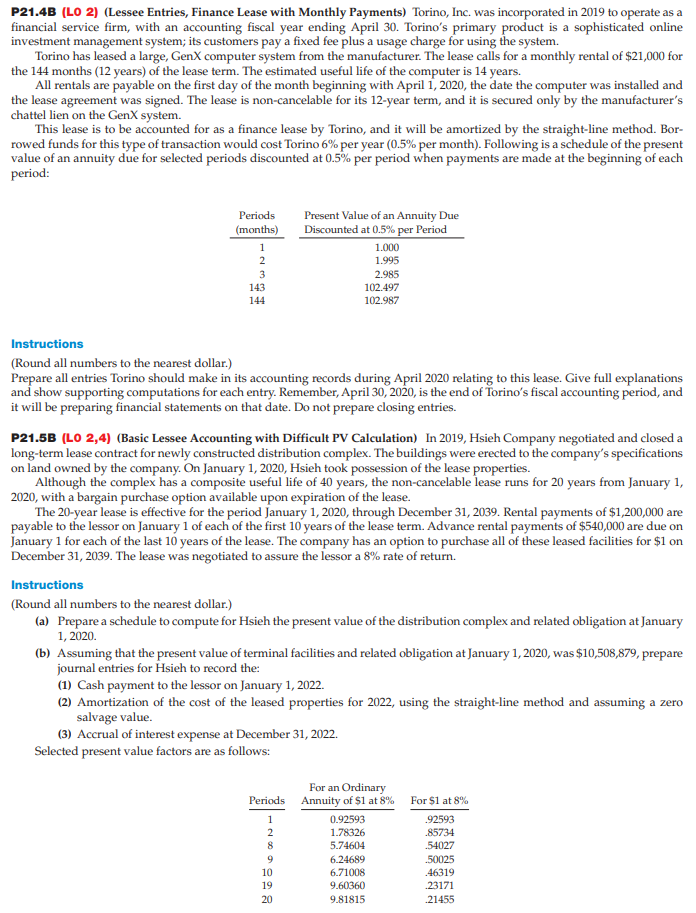

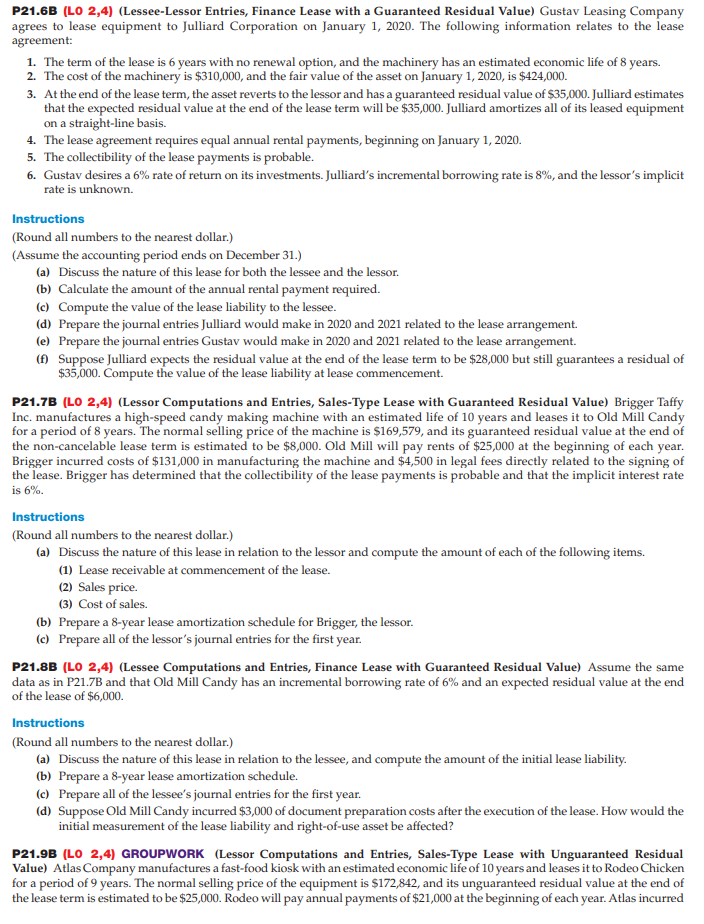

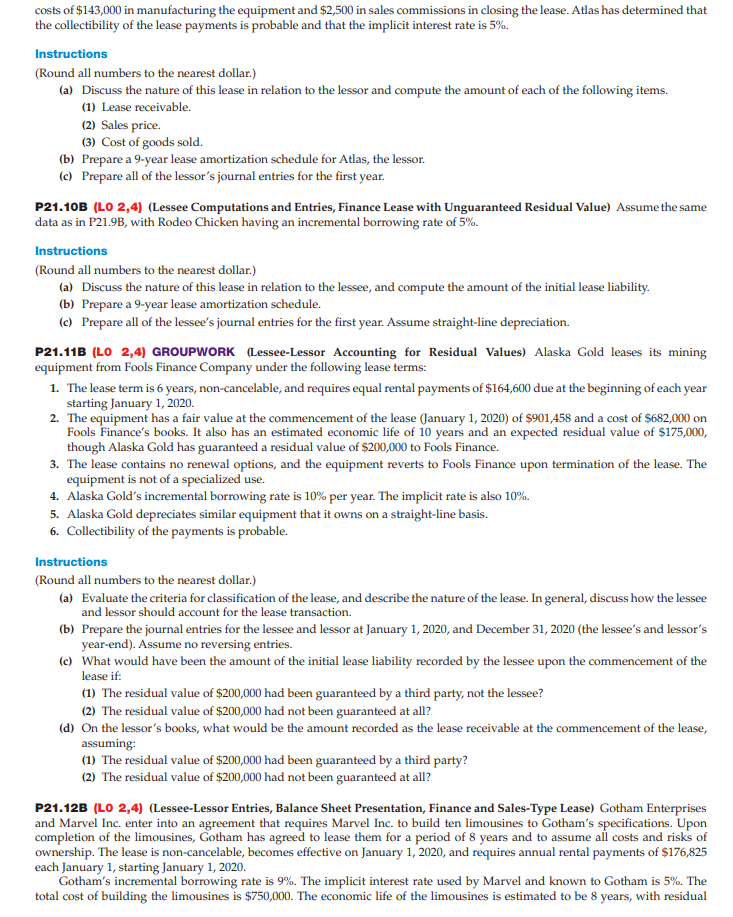

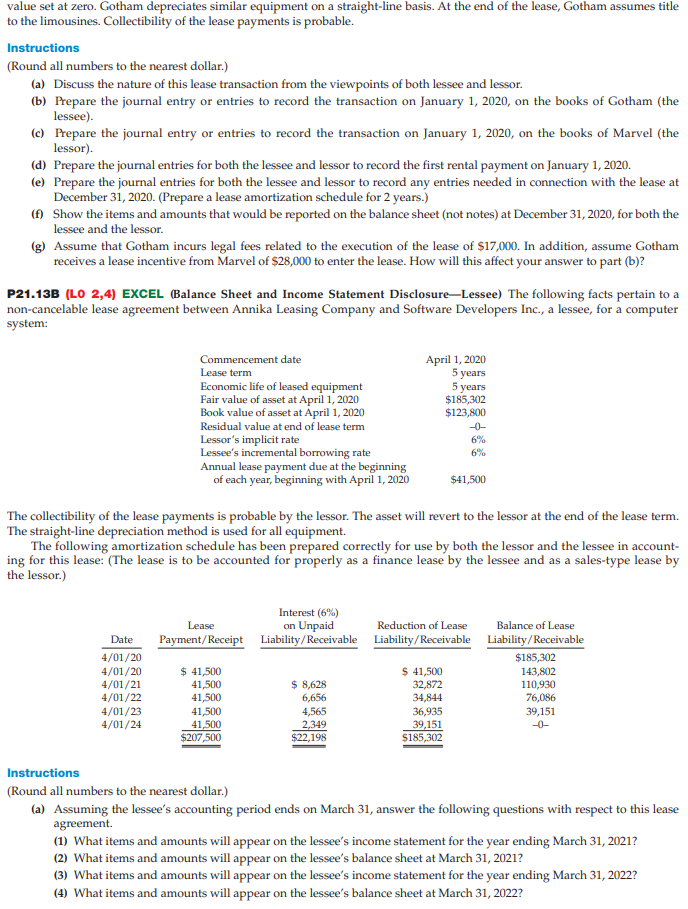

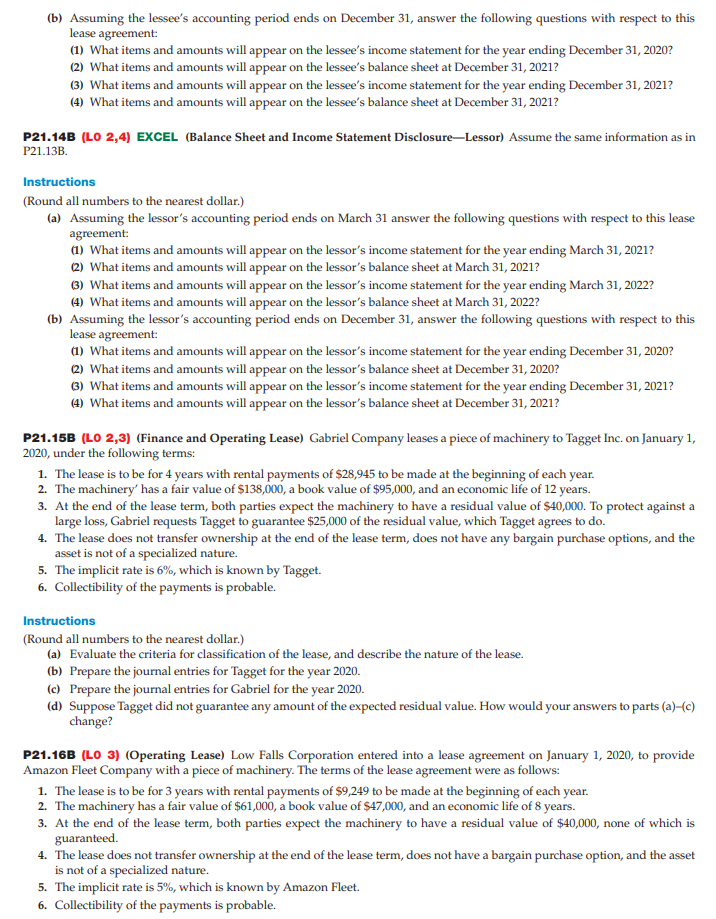

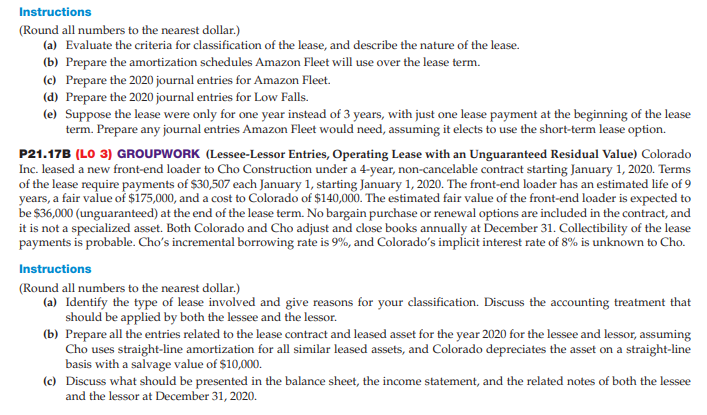

P21.1B (LO 2,4) (Lessee Entries, Finance Lease) The following facts pertain to a non-cancelable lease agreement between Jupiter Leasing Company and Siskiwit Company, a lessee: Commencement date Annual lease payment due at the beginning of each year, beginning with January 1, 2020 Residual value of equipment at end of lease term, guaranteed by the lessee Expected residual value of equipment at end of lease term Lease term Economic life of leased equipment Fair value of asset at January 1, 2020 Lessor's implicit rate Lessee's incremental borrowing rate January 1, 2020 $56,957 $40,000 $25,000 8 years 8 years $400,000 6% The asset will revert to the lessor at the end of the lease term. The lessee uses the straight-line amortization for all leased equipment. Instructions (Round all numbers to the nearest dollar.) (a) Prepare an amortization schedule that would be suitable for the lessee for the lease term. (b) Prepare all of the journal entries for the lessee for 2020 and 2021 to record the lease agreement, the lease payments, and all expenses related to this lease. Assume the lessee's annual accounting period ends on December 31. (c) Suppose Siskiwit received a lease incentive of $4,000 from Jupiter Leasing to enter the lease. How would the initial measurement of the lease liability and right-of-use asset be affected? What if Siskiwit prepaid rent of $16,000 to Jupiter? P21.2B (LO 2,4) (Lessee Entries and Balance Sheet Presentation, Finance Lease) On January 1, 2020, Hector Construction Company contracts to lease equipment for 4 years, agreeing to make a payment of $102,096 at the beginning of each year, starting January 1, 2020. The leased equipment is to be capitalized at $375,000. The asset is to be amortized on a double- declining-balance basis, and the obligation is to be reduced on an effective-interest basis. Hector's incremental borrowing rate is 8%, and the implicit rate in the lease is 6%, which is known by Hector. Title to the equipment transfers to Hector at the end of the lease. The asset has an estimated useful life of 4 years and no residual value. Instructions (Round all numbers to the nearest dollar.) (a) Explain the probable relationship of the $375,000 amount to the lease arrangement. (b) Prepare the journal entry or entries that Hector should record on January 1, 2020. (c) Prepare the journal entries to record amortization of the leased asset and interest expense for the year 2020. (d) Prepare the journal entry to record the lease payment of January 1, 2021, assuming reversing entries are not made. (e) What amounts will appear on the lessee's December 31, 2020, balance sheet relative to the lease contract? (f) How would the value of the lease liability in part (b) change if Hector also agreed to pay the fixed annual insurance on the equipment of $1,600 at the same time as the rental payments? P21.3B (LO 2,4) GROUPWORK (Lessee Entries and Balance Sheet Presentation, Finance Lease) Licorice Fabricating Company, as lessee, signed a lease agreement for equipment for 6 years, beginning December 31, 2020. Annual rental payments of $22,000 are to be made at the beginning of each lease year (December 31). The interest rate used by the lessor in setting the payment schedule is 6%; Licorice's incremental borrowing rate is 9%. Licorice is unaware of the rate being used by the lessor. At the end of the lease, Licorice has the option to buy the equipment for $3,000, considerably below its estimated fair value at that time. The equipment has an estimated useful life of 7 years, with no salvage value. Licorice uses the straight-line method of depreciation on similar owned equipment. Instructions (Round all numbers to the nearest dollar.) (a) Prepare the journal entry or entries, with explanations, that Licorice should record on December 31, 2020. (b) Prepare the journal entry or entries, with explanations, that Licorice should record on December 31, 2021. (Prepare the lease amortization schedule for all six payments.) (c) Prepare the journal entry or entries, with explanations, that Licorice should record on December 31, 2022. (d) What amounts would appear on Licorice's December 31, 2022, balance sheet relative to the lease arrangement? P21.4B (LO 2) (Lessee Entries, Finance Lease with Monthly Payments) Torino, Inc. was incorporated in 2019 to operate as a financial service firm, with an accounting fiscal year ending April 30. Torino's primary product is a sophisticated online investment management system; its customers pay a fixed fee plus a usage charge for using the system. Torino has leased a large, GenX computer system from the manufacturer. The lease calls for a monthly rental of $21,000 for the 144 months (12 years) of the lease term. The estimated useful life of the computer is 14 years. All rentals are payable on the first day of the month beginning with April 1, 2020, the date the computer was installed and the lease agreement was signed. The lease is non-cancelable for its 12-year term, and it is secured only by the manufacturer's chattel lien on the GenX system. This lease is to be accounted for as a finance lease by Torino, and it will be amortized by the straight-line method. Bor- rowed funds for this type of transaction would cost Torino 6% per year (0.5% per month). Following is a schedule of the present value of an annuity due for selected periods discounted at 0.5% per period when payments are made at the beginning of each period: Periods (months) 1 2 3 143 144 Instructions (Round all numbers to the nearest dollar.) Prepare all entries Torino should make in its accounting records during April 2020 relating to this lease. Give full explanations and show supporting computations for each entry. Remember, April 30, 2020, is the end of Torino's fiscal accounting period, and it will be preparing financial statements on that date. Do not prepare closing entries. Present Value of an Annuity Due Discounted at 0.5% per Period P21.5B (LO 2,4) (Basic Lessee Accounting with Difficult PV Calculation) In 2019, Hsieh Company negotiated and closed a long-term lease contract for newly constructed distribution complex. The buildings were erected to the company's specifications on land owned by the company. On January 1, 2020, Hsieh took possession of the lease properties. Although the complex has a composite useful life of 40 years, the non-cancelable lease runs for 20 years from January 1, 2020, with a bargain purchase option available upon expiration of the lease. The 20-year lease is effective for the period January 1, 2020, through December 31, 2039. Rental payments of $1,200,000 are payable to the lessor on January 1 of each of the first 10 years of the lease term. Advance rental payments of $540,000 are due on January 1 for each of the last 10 years of the lease. The company has an option to purchase all of these leased facilities for $1 on December 31, 2039. The lease was negotiated to assure the lessor a 8% rate of return. 1.000 1.995 2.985 102.497 102.987 Instructions (Round all numbers to the nearest dollar.) (a) Prepare a schedule to compute for Hsieh the present value of the distribution complex and related obligation at January 1, 2020. (b) Assuming that the present value of terminal facilities and related obligation at January 1, 2020, was $10,508,879, prepare journal entries for Hsieh to record the: Periods 1 2 (1) Cash payment to the lessor on January 1, 2022. (2) Amortization of the cost of the leased properties for 2022, using the straight-line method and assuming a zero salvage value. (3) Accrual of interest expense at December 31, 2022. Selected present value factors are as follows: 8 9 10 19 20 For an Ordinary Annuity of $1 at 8% 0.92593 1.78326 5.74604 6.24689 6.71008 9.60360 9.81815 For $1 at 8% 92593 .85734 54027 50025 46319 .23171 21455 P21.6B (LO 2,4) (Lessee-Lessor Entries, Finance Lease with a Guaranteed Residual Value) Gustav Leasing Company agrees to lease equipment to Julliard Corporation on January 1, 2020. The following information relates to the lease agreement: 1. The term of the lease is 6 years with no renewal option, and the machinery has an estimated economic life of 8 years. 2. The cost of the machinery is $310,000, and the fair value of the asset on January 1, 2020, is $424,000. 3. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $35,000. Julliard estimates that the expected residual value at the end of the lease term will be $35,000. Julliard amortizes all of its leased equipment on a straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2020. 5. The collectibility of the lease payments is probable. 6. Gustav desires a 6% rate of return on its investments. Julliard's incremental borrowing rate is 8%, and the lessor's implicit rate is unknown. Instructions (Round all numbers to the nearest dollar.) (Assume the accounting period ends on December 31.) (a) Discuss the nature of this lease for both the lessee and the lessor. (b) Calculate the amount of the annual rental payment required. (c) Compute the value of the lease liability to the lessee. (d) Prepare the journal entries Julliard would make in 2020 and 2021 related to the lease arrangement. (e) Prepare the journal entries Gustav would make in 2020 and 2021 related to the lease arrangement. (f) Suppose Julliard expects the residual value at the end of the lease term to be $28,000 but still guarantees a residual of $35,000. Compute the value of the lease liability at lease commencement. P21.7B (LO 2,4) (Lessor Computations and Entries, Sales-Type Lease with Guaranteed Residual Value) Brigger Taffy Inc. manufactures a high-speed candy making machine with an estimated life of 10 years and leases it to Old Mill Candy for a period of 8 years. The normal selling price of the machine is $169,579, and its guaranteed residual value at the end of the non-cancelable lease term is estimated to be $8,000. Old Mill will pay rents of $25,000 at the beginning of each year. Brigger incurred costs of $131,000 in manufacturing the machine and $4,500 in legal fees directly related to the signing of the lease. Brigger has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 6%. Instructions (Round all numbers to the nearest dollar.) (a) Discuss the nature of this lease in relation to the lessor and compute the amount of each of the following items. (1) Lease receivable at commencement of the lease. (2) Sales price. (3) Cost of sales. (b) Prepare a 8-year lease amortization schedule for Brigger, the lessor. (c) Prepare all of the lessor's journal entries for the first year. P21.8B (LO 2,4) (Lessee Computations and Entries, Finance Lease with Guaranteed Residual Value) Assume the same data as in P21.7B and that Old Mill Candy has an incremental borrowing rate of 6% and an expected residual value at the end of the lease of $6,000. Instructions (Round all numbers to the nearest dollar.) (a) Discuss the nature of this lease in relation to the lessee, and compute the amount of the initial lease liability. (b) Prepare a 8-year lease amortization schedule. (c) Prepare all of the lessee's journal entries for the first year. (d) Suppose Old Mill Candy incurred $3,000 of document preparation costs after the execution of the lease. How would the initial measurement of the lease liability and right-of-use asset be affected? P21.9B (LO 2,4) GROUPWORK (Lessor Computations and Entries, Sales-Type Lease with Unguaranteed Residual Value) Atlas Company manufactures a fast-food kiosk with an estimated economic life of 10 years and leases it to Rodeo Chicken for a period of 9 years. The normal selling price of the equipment is $172,842, and its unguaranteed residual value at the end of the lease term is estimated to be $25,000. Rodeo will pay annual payments of $21,000 at the beginning of each year. Atlas incurred costs of $143,000 in manufacturing the equipment and $2,500 in sales commissions in closing the lease. Atlas has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%. Instructions (Round all numbers to the nearest dollar.) (a) Discuss the nature of this lease in relation to the lessor and compute the amount of each of the following items. (1) Lease receivable. (2) Sales price. (3) Cost of goods sold. (b) Prepare a 9-year lease amortization schedule for Atlas, the lessor. (c) Prepare all of the lessor's journal entries for the first year. P21.10B (LO 2,4) (Lessee Computations and Entries, Finance Lease with Unguaranteed Residual Value) Assume the same data as in P21.9B, with Rodeo Chicken having an incremental borrowing rate of 5%. Instructions (Round all numbers to the nearest dollar.) (a) Discuss the nature of this lease in relation to the lessee, and compute the amount of the initial lease liability. (b) Prepare a 9-year lease amortization schedule. (c) Prepare all of the lessee's journal entries for the first year. Assume straight-line depreciation. P21.11B (LO 2,4) GROUPWORK (Lessee-Lessor Accounting for Residual Values) Alaska Gold leases its mining equipment from Fools Finance Company under the following lease terms: 1. The lease term is 6 years, non-cancelable, and requires equal rental payments of $164,600 due at the beginning of each year starting January 1, 2020. 2. The equipment has a fair value at the commencement of the lease (January 1, 2020) of $901,458 and a cost of $682,000 on Fools Finance's books. It also has an estimated economic life of 10 years and an expected residual value of $175,000, though Alaska Gold has guaranteed a residual value of $200,000 to Fools Finance. 3. The lease contains no renewal options, and the equipment reverts to Fools Finance upon termination of the lease. The equipment is not of a specialized use. 4. Alaska Gold's incremental borrowing rate is 10% per year. The implicit rate is also 10%. 5. Alaska Gold depreciates similar equipment that it owns on a straight-line basis. 6. Collectibility of the payments is probable. Instructions (Round all numbers to the nearest dollar.) (a) Evaluate the criteria for classification of the lease, and describe the nature of the lease. In general, discuss how the lessee and lessor should account for the lease transaction. (b) Prepare the journal entries for the lessee and lessor at January 1, 2020, and December 31, 2020 (the lessee's and lessor's year-end). Assume no reversing entries. (c) What would have been the amount of the initial lease liability recorded by the lessee upon the commencement of the lease if: (1) The residual value of $200,000 had been guaranteed by a third party, not the lessee? (2) The residual value of $200,000 had not been guaranteed at all? (d) On the lessor's books, what would be the amount recorded as the lease receivable at the commencement of the lease, assuming: (1) The residual value of $200,000 had been guaranteed by a third party? (2) The residual value of $200,000 had not been guaranteed at all? P21.12B (LO 2,4) (Lessee-Lessor Entries, Balance Sheet Presentation, Finance and Sales-Type Lease) Gotham Enterprises and Marvel Inc. enter into an agreement that requires Marvel Inc. to build ten limousines to Gotham's specifications. Upon completion of the limousines, Gotham has agreed to lease them for a period of 8 years and to assume all costs and risks of ownership. The lease is non-cancelable, becomes effective on January 1, 2020, and requires annual rental payments of $176,825 each January 1, starting January 1, 2020. Gotham's incremental borrowing rate is 9%. The implicit interest rate used by Marvel and known to Gotham is 5%. The total cost of building the limousines is $750,000. The economic life of the limousines is estimated to be 8 years, with residual value set at zero. Gotham depreciates similar equipment on a straight-line basis. At the end of the lease, Gotham assumes title to the limousines. Collectibility of the lease payments is probable. Instructions (Round all numbers to the nearest dollar.) (a) Discuss the nature of this lease transaction from the viewpoints of both lessee and lessor. (b) Prepare the journal entry or entries to record the transaction on January 1, 2020, on the books of Gotham (the lessee). (c) Prepare the journal entry or entries to record the transaction on January 1, 2020, on the books of Marvel (the lessor). (d) Prepare the journal entries for both the lessee and lessor to record the first rental payment on January 1, 2020. (e) Prepare the journal entries for both the lessee and lessor to record any entries needed in connection with the lease at December 31, 2020. (Prepare a lease amortization schedule for 2 years.) (f) Show the items and amounts that would be reported on the balance sheet (not notes) at December 31, 2020, for both the lessee and the lessor. (g) Assume that Gotham incurs legal fees related to the execution of the lease of $17,000. In addition, assume Gotham receives a lease incentive from Marvel of $28,000 to enter the lease. How will this affect your answer to part (b)? P21.13B (LO 2,4) EXCEL (Balance Sheet and Income Statement Disclosure-Lessee) The following facts pertain to a non-cancelable lease agreement between Annika Leasing Company and Software Developers Inc., a lessee, for a computer system: Date 4/01/20 4/01/20 4/01/21 Commencement date Lease term 4/01/22 4/01/23 4/01/24 Economic life of leased equipment Fair value of asset at April 1, 2020 Book value of asset at April 1, 2020 Residual value at end of lease term Lessor's implicit rate Lessee's incremental borrowing rate Annual lease payment due at the beginning of each year, beginning with April 1, 2020 The collectibility of the lease payments is probable by the lessor. The asset will revert to the lessor at the end of the lease term. The straight-line depreciation method is used for all equipment. The following amortization schedule has been prepared correctly for use by both the lessor and the lessee in account- ing for this lease: (The lease is to be accounted for properly as a finance lease by the lessee and as a sales-type lease by the lessor.) Lease Payment/Receipt $ 41,500 41,500 41,500 41,500 41,500 $207,500 Interest (6%) on Unpaid Liability/Receivable $ 8,628 6,656 April 1, 2020 5 years 5 years $185,302 $123,800 4,565 2,349 $22,198 -0- 6% 6% $41,500 $ 41,500 32,872 34,844 36,935 39,151 $185,302 Reduction of Lease Liability/Receivable Balance of Lease Liability/Receivable $185,302 143,802 110,930 76,086 39,151 -0- Instructions (Round all numbers to the nearest dollar.) (a) Assuming the lessee's accounting period ends on March 31, answer the following questions with respect to this lease agreement. (1) What items and amounts will appear on the lessee's income statement for the year ending March 31, 2021? (2) What items and amounts will appear on the lessee's balance sheet at March 31, 2021? (3) What items and amounts will appear on the lessee's income statement for the year ending March 31, 2022? (4) What items and amounts will appear on the lessee's balance sheet at March 31, 2022? (b) Assuming the lessee's accounting period ends on December 31, answer the following questions with respect to this lease agreement: (1) What items and amounts will appear on the lessee's income statement for the year ending December 31, 2020? (2) What items and amounts will appear on the lessee's balance sheet at December 31, 2021? (3) What items and amounts will appear on the lessee's income statement for the year ending December 31, 2021? (4) What items and amounts will appear on the lessee's balance sheet at December 31, 2021? P21.14B (LO 2,4) EXCEL (Balance Sheet and Income Statement Disclosure-Lessor) Assume the same information as in P21.13B. Instructions (Round all numbers to the nearest dollar.) (a) Assuming the lessor's accounting period ends on March 31 answer the following questions with respect to this lease agreement: (1) What items and amounts will appear on the lessor's income statement for the year ending March 31, 2021? (2) What items and amounts will appear on the lessor's balance sheet at March 31, 2021? (3) What items and amounts will appear on the lessor's income statement for the year ending March 31, 2022? (4) What items and amounts will appear on the lessor's balance sheet at March 31, 2022? (b) Assuming the lessor's accounting period ends on December 31, answer the following questions with respect to this lease agreement: (1) What items and amounts will appear on the lessor's income statement for the year ending December 31, 2020? (2) What items and amounts will appear on the lessor's balance sheet at December 31, 2020? (3) What items and amounts will appear on the lessor's income statement for the year ending December 31, 2021? (4) What items and amounts will appear on the lessor's balance sheet at December 31, 2021? P21.15B (LO 2,3) (Finance and Operating Lease) Gabriel Company leases a piece of machinery to Tagget Inc. on January 1, 2020, under the following terms: 1. The lease is to be for 4 years with rental payments of $28,945 to be made at the beginning of each year. 2. The machinery' has a fair value of $138,000, a book value of $95,000, and an economic life of 12 years. 3. At the end of the lease term, both parties expect the machinery to have a residual value of $40,000. To protect against a large loss, Gabriel requests Tagget to guarantee $25,000 of the residual value, which Tagget agrees to do. 4. The lease does not transfer ownership at the end of the lease term, does not have any bargain purchase options, and the asset is not of a specialized nature. 5. The implicit rate is 6%, which is known by Tagget. 6. Collectibility of the payments is probable. Instructions (Round all numbers to the nearest dollar.) (a) Evaluate the criteria for classification of the lease, and describe the nature of the lease. (b) Prepare the journal entries for Tagget for the year 2020. (c) Prepare the journal entries for Gabriel for the year 2020. (d) Suppose Tagget did not guarantee any amount of the expected residual value. How would your answers to parts (a)-(c) change? P21.16B (LO 3) (Operating Lease) Low Falls Corporation entered into a lease agreement on January 1, 2020, to provide Amazon Fleet Company with a piece of machinery. The terms of the lease agreement were as follows: 1. The lease is to be for 3 years with rental payments of $9,249 to be made at the beginning of each year. 2. The machinery has a fair value of $61,000, a book value of $47,000, and an economic life of 8 years. 3. At the end of the lease term, both parties expect the machinery to have a residual value of $40,000, none of which is guaranteed. 4. The lease does not transfer ownership at the end of the lease term, does not have a bargain purchase option, and the asset is not of a specialized nature. 5. The implicit rate is 5%, which is known by Amazon Fleet. 6. Collectibility of the payments is probable. Instructions (Round all numbers to the nearest dollar.) (a) Evaluate the criteria for classification of the lease, and describe the nature of the lease. (b) Prepare the amortization schedules Amazon Fleet will use over the lease term. (c) Prepare the 2020 journal entries for Amazon Fleet. (d) Prepare the 2020 journal entries for Low Falls. (e) Suppose the lease were only for one year instead of 3 years, with just one lease payment at the beginning of the lease term. Prepare any journal entries Amazon Fleet would need, assuming it elects to use the short-term lease option. P21.17B (LO 3) GROUPWORK (Lessee-Lessor Entries, Operating Lease with an Unguaranteed Residual Value) Colorado Inc. leased a new front-end loader to Cho Construction under a 4-year, non-cancelable contract starting January 1, 2020. Terms of the lease require payments of $30,507 each January 1, starting January 1, 2020. The front-end loader has an estimated life of 9 years, a fair value of $175,000, and a cost to Colorado of $140,000. The estimated fair value of the front-end loader is expected to be $36,000 (unguaranteed) at the end of the lease term. No bargain purchase or renewal options are included in the contract, and it is not a specialized asset. Both Colorado and Cho adjust and close books annually at December 31. Collectibility of the lease payments is probable. Cho's incremental borrowing rate is 9%, and Colorado's implicit interest rate of 8% is unknown to Cho. Instructions (Round all numbers to the nearest dollar.) (a) Identify the type of lease involved and give reasons for your classification. Discuss the accounting treatment that should be applied by both the lessee and the lessor. (b) Prepare all the entries related to the lease contract and leased asset for the year 2020 for the lessee and lessor, assuming Cho uses straight-line amortization for all similar leased assets, and Colorado depreciates the asset on a straight-line basis with a salvage value of $10,000. (c) Discuss what should be presented in the balance sheet, the income statement, and the related notes of both the lessee and the lessor at December 31, 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer to a Date Annual Lease Payment BPO Interest on Li...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started