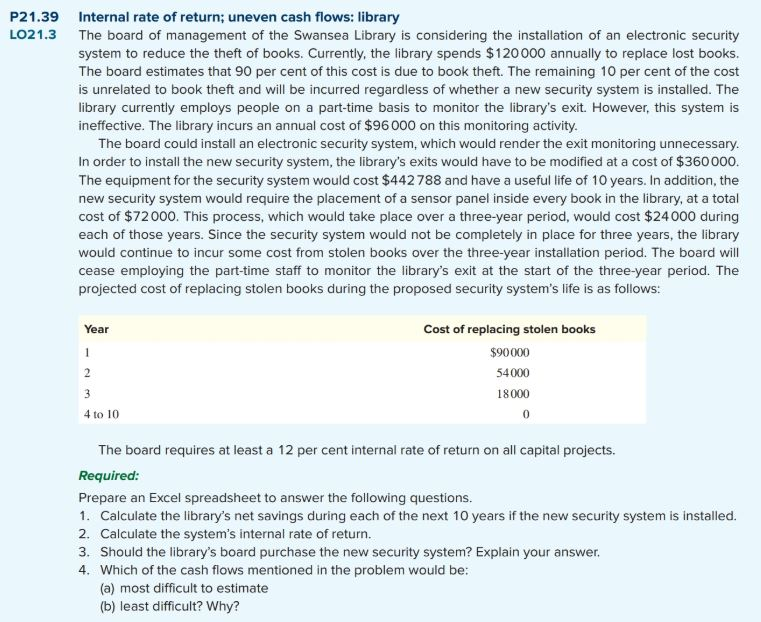

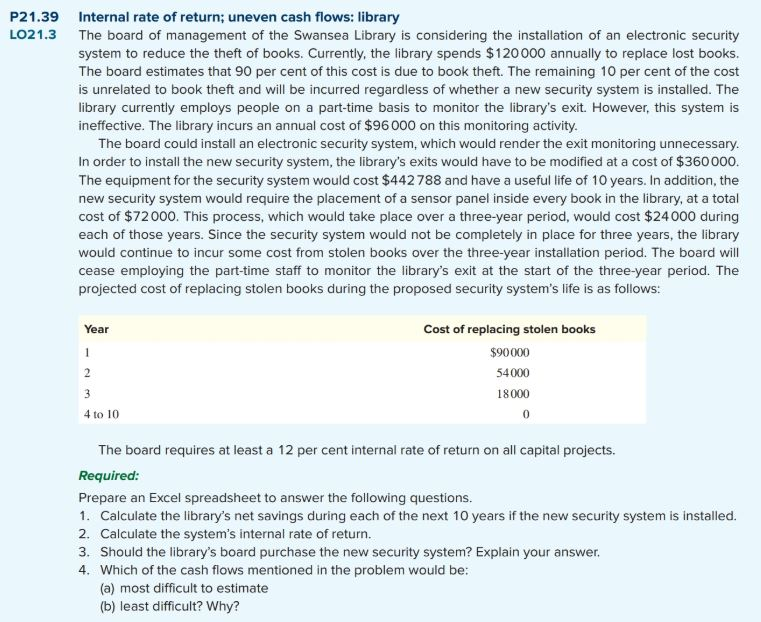

P21.39 Internal rate of return; uneven cash flows: library LO21.3 The board of management of the Swansea Library is considering the installation of an electronic security system to reduce the theft of books. Currently, the library spends $120 000 annually to replace lost books. The board estimates that 90 per cent of this cost is due to book theft. The remaining 10 per cent of the cost is unrelated to book theft and will be incurred regardless of whether a new security system is installed. The library currently employs people on a part-time basis to monitor the library's exit. However, this system is ineffective. The library incurs an annual cost of $96 000 on this monitoring activity. The board could install an electronic security system, which would render the exit monitoring unnecessary. In order to install the new security system, the library's exits would have to be modified at a cost of $360 000. The equipment for the security system would cost $442788 and have a useful life of 10 years. In addition, the new security system would require the placement of a sensor panel inside every book in the library, at a total cost of $72000. This process, which would take place over a three-year period, would cost $24000 during each of those years. Since the security system would not be completely in place for three years, the library would continue to incur some cost from stolen books over the three-year installation period. The board will cease employing the part-time staff to monitor the library's exit at the start of the three-year period. The projected cost of replacing stolen books during the proposed security system's life is as follows: Year 2 Cost of replacing stolen books $90000 54000 18000 0 3 4 to 10 The board requires at least a 12 per cent internal rate of return on all capital projects. Required: Prepare an Excel spreadsheet to answer the following questions. 1. Calculate the library's net savings during each of the next 10 years if the new security system is installed. 2. Calculate the system's internal rate of return. 3. Should the library's board purchase the new security system? Explain your answer. 4. Which of the cash flows mentioned in the problem would be: (a) most difficult to estimate (b) least difficult? Why