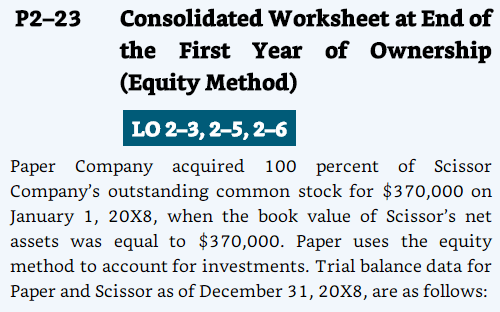

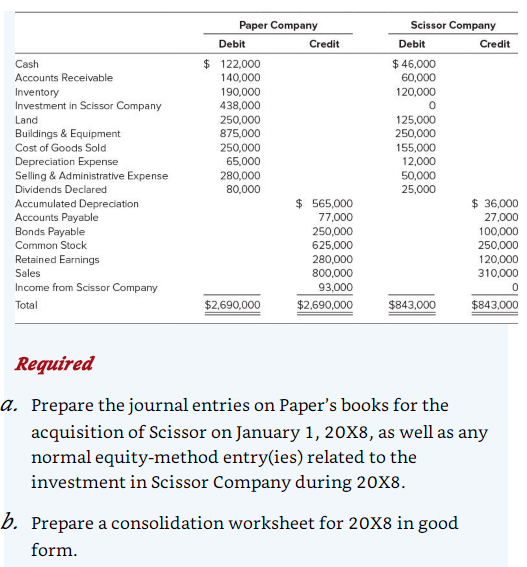

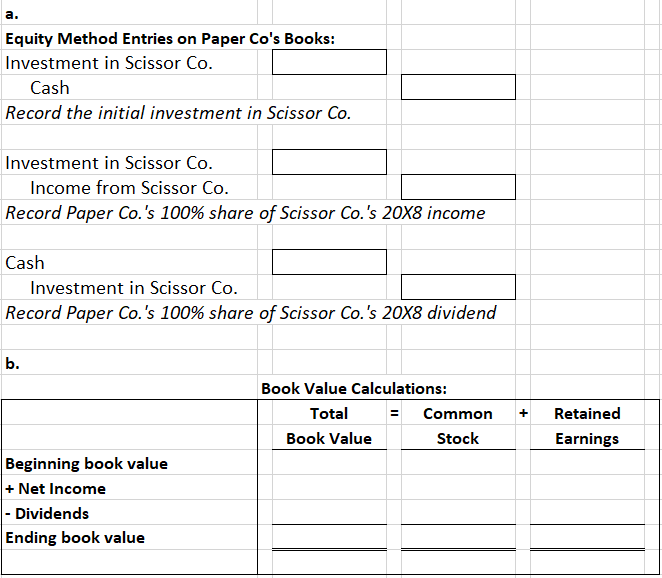

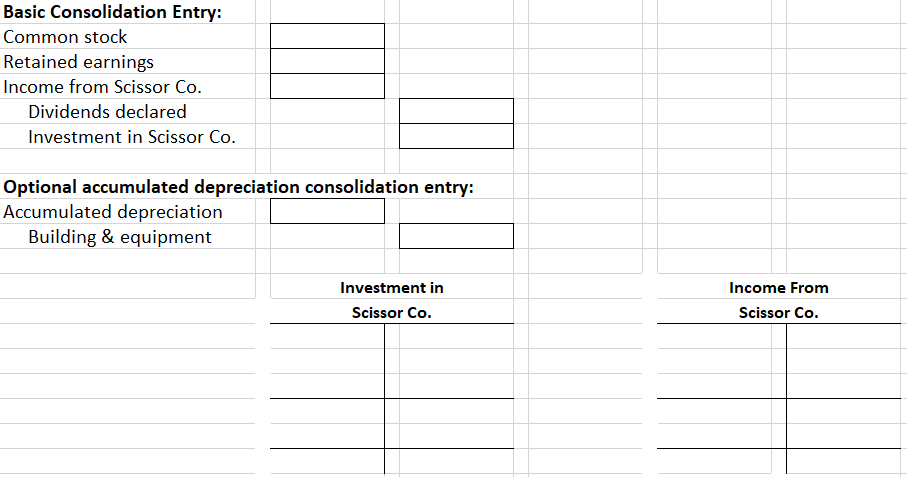

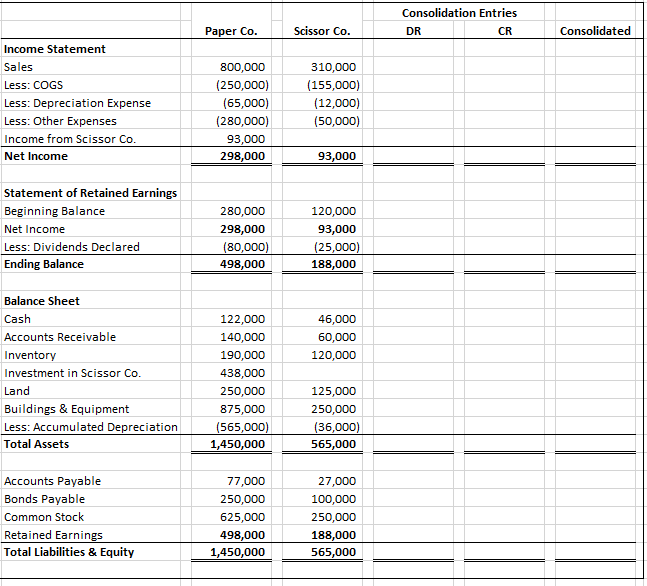

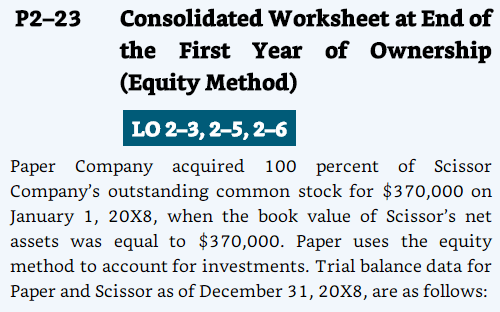

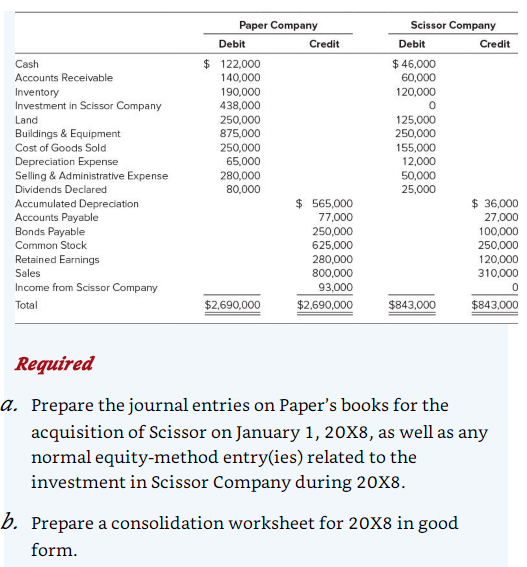

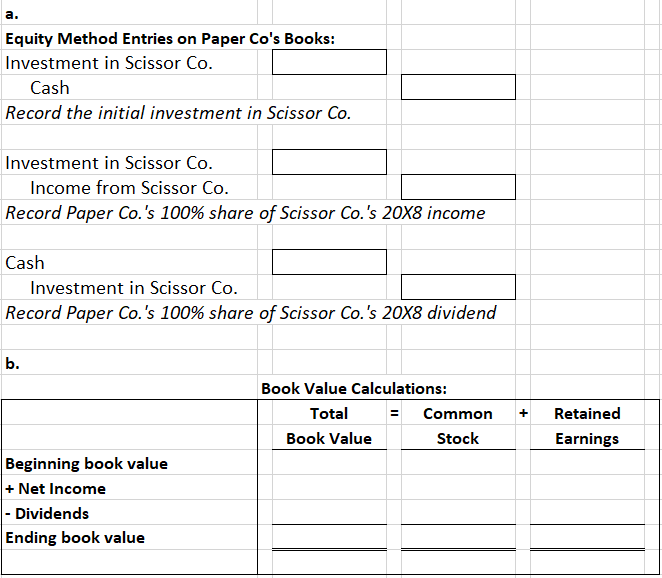

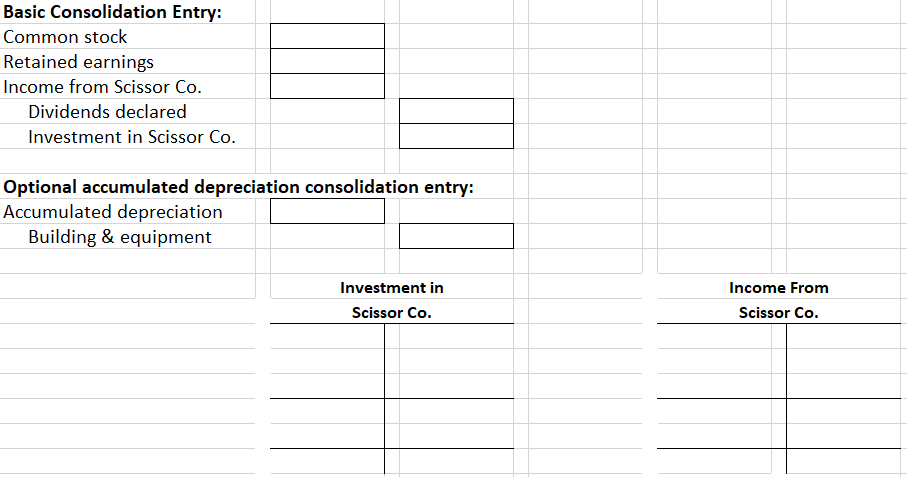

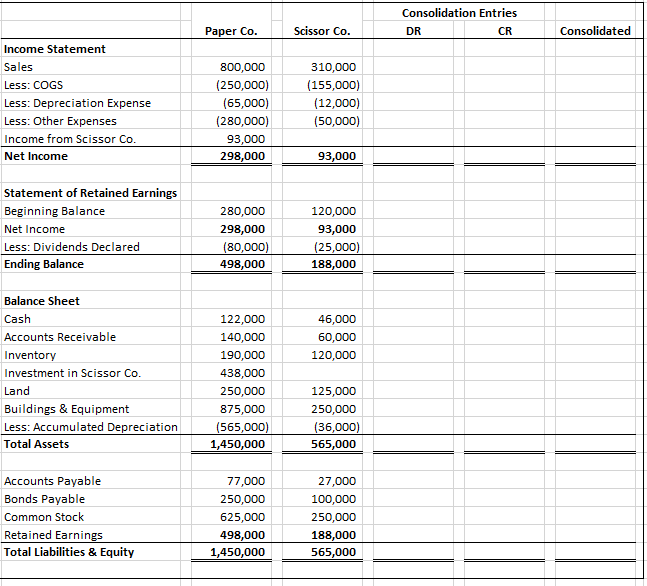

P2-23 Consolidated Worksheet at End of the First Year of Ownership (Equity Method) LO 2-3,2-5, 2-6 Paper Company acquired 100 percent of Scissor Company's outstanding common stock for $370,000 on January 1, 20X8, when the book value of Scissor's net assets was equal to $370,000. Paper uses the equity method to account for investments. Trial balance data for Paper and Scissor as of December 31, 20X8, are as follows: Paper Company Debit Credit Cash Accounts Receivable Inventory Investment in Scissor Company Land Buildings & Equipment Cost of Goods Sold Depreciation Expense Selling & Administrative Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Income from Scissor Company Total $ 122,000 140,000 190,000 438,000 250,000 875,000 250,000 65,000 280,000 80,000 Scissor Company Debit Credit $ 46,000 60,000 120,000 0 125,000 250,000 155,000 12.000 50,000 25,000 $ 36,000 27.000 100,000 250,000 120,000 310,000 0 $843,000 $843,000 $ 565,000 77,000 250,000 625,000 280,000 800,000 93,000 $2,690,000 $2,690,000 Required a. Prepare the journal entries on Paper's books for the acquisition of Scissor on January 1, 20X8, as well as any normal equity-method entry(ies) related to the investment in Scissor Company during 20X8. b. Prepare a consolidation worksheet for 20X8 in good form. a. Equity Method Entries on Paper Co's Books: Investment in Scissor Co. Cash Record the initial investment in Scissor Co. Investment in Scissor Co. Income from Scissor Co. Record Paper Co.'s 100% share of Scissor Co.'s 20X8 income Cash Investment in Scissor Co. Record Paper Co.'s 100% share of Scissor Co.'s 20x8 dividend b. Book Value Calculations: Total Common Book Value Stock + Retained Earnings Beginning book value + Net Income |- Dividends Ending book value Basic Consolidation Entry: Common stock Retained earnings Income from Scissor Co. Dividends declared Investment in Scissor Co. Optional accumulated depreciation consolidation entry: Accumulated depreciation Building & equipment Investment in Scissor Co. Income From Scissor Co. Consolidation Entries DR CR Paper Co. Scissor Co. Consolidated Income Statement Sales Less: COGS Less: Depreciation Expense Less: Other Expenses Income from Scissor Co. Net Income 800,000 (250,000) (65,000) (280,000) 93,000 298,000 310,000 (155,000) (12,000) (50,000) 93,000 Statement of Retained Earnings Beginning Balance Net Income Less: Dividends Declared Ending Balance 280,000 298,000 (80,000) 498,000 120,000 93,000 (25,000) 188,000 46,000 60,000 120,000 Balance Sheet Cash Accounts Receivable Inventory Investment in Scissor Co. Land Buildings & Equipment Less: Accumulated Depreciation Total Assets 122,000 140,000 190,000 438,000 250,000 875,000 (565,000) 1,450,000 125,000 250,000 (36,000) 565,000 Accounts Payable Bonds Payable Common Stock Retained Earnings Total Liabilities & Equity 77,000 250,000 625,000 498,000 1,450,000 27,000 100,000 250,000 188,000 565,000