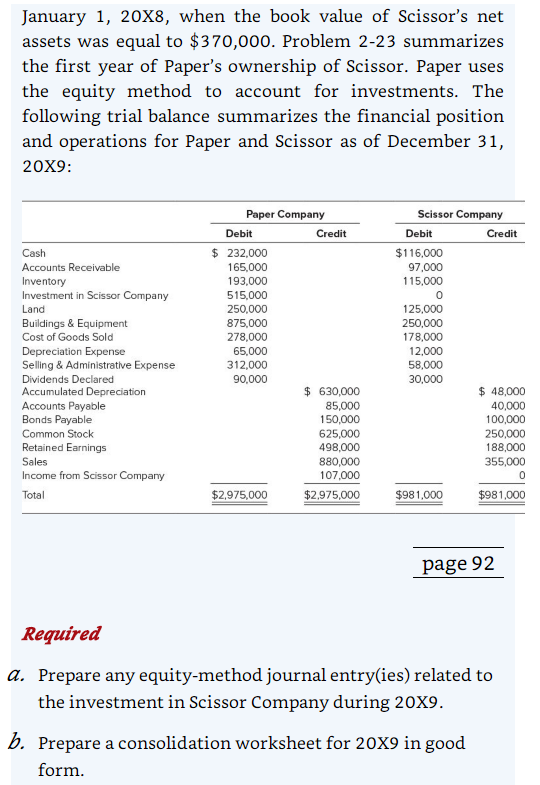

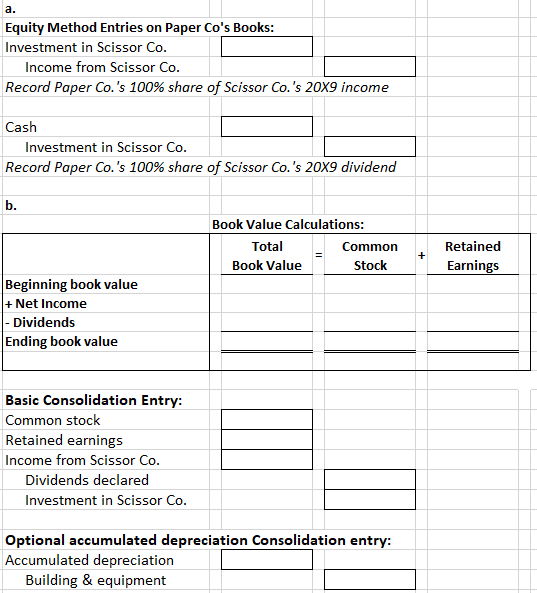

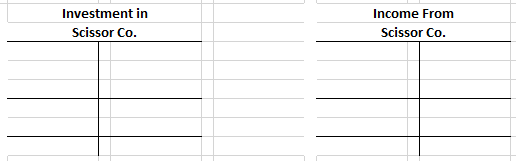

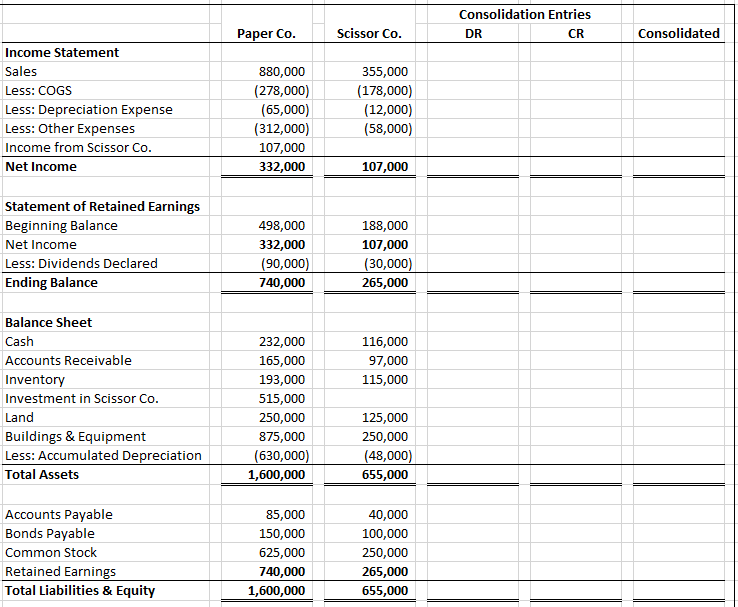

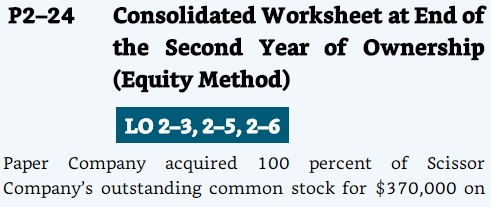

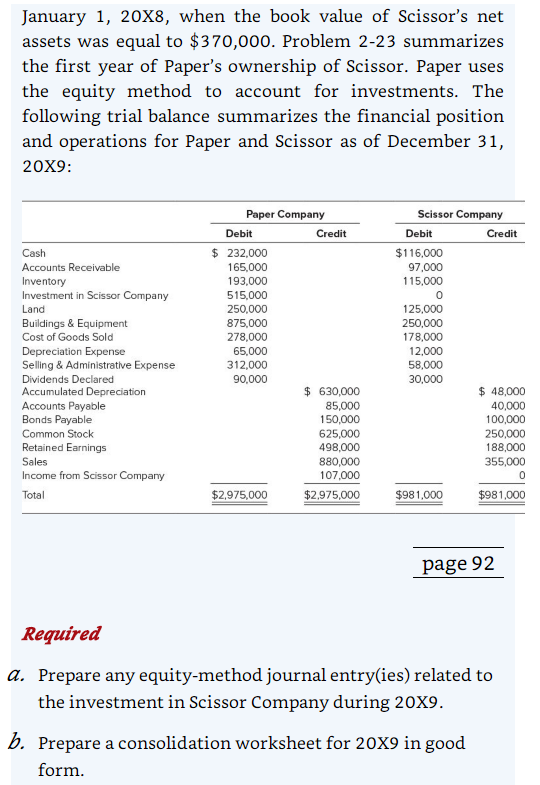

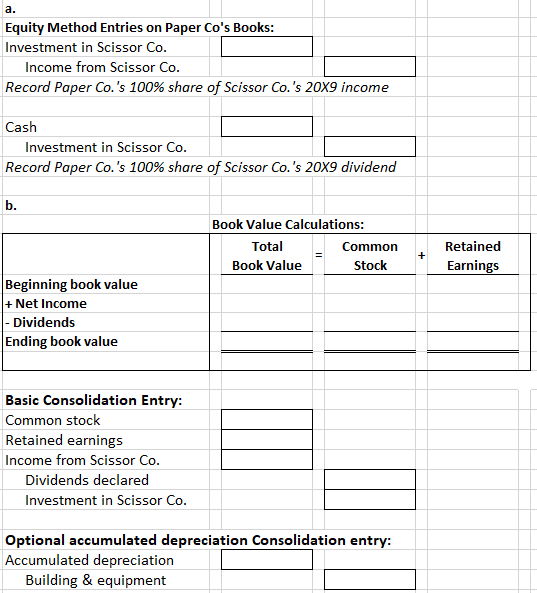

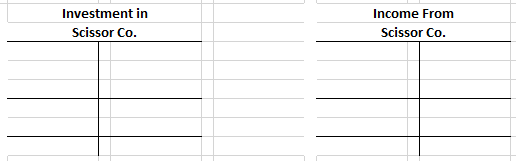

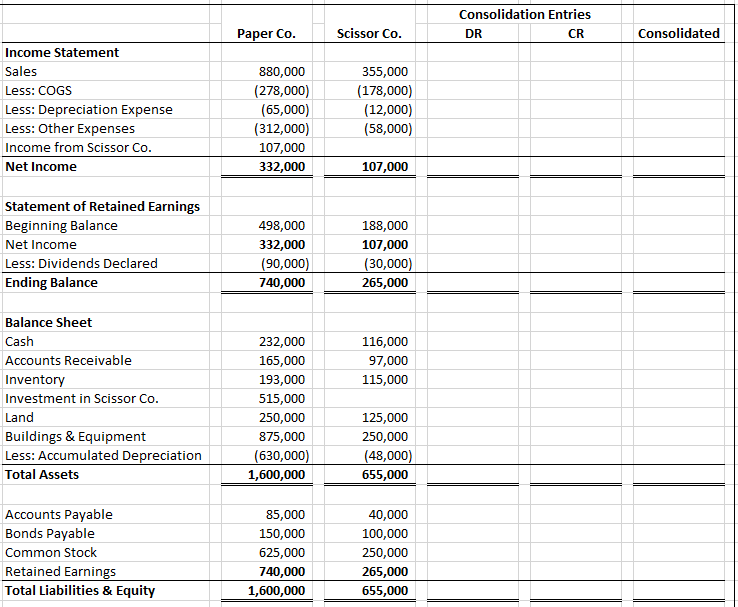

P2-24 Consolidated Worksheet at End of the Second Year of Ownership (Equity Method) LO 2-3,2-5, 2-6 Paper Company acquired 100 percent of Scissor Company's outstanding common stock for $370,000 on January 1, 20X8, when the book value of Scissor's net assets was equal to $370,000. Problem 2-23 summarizes the first year of Paper's ownership of Scissor. Paper uses the equity method to account for investments. The following trial balance summarizes the financial position and operations for Paper and Scissor as of December 31, 20X9: Cash Accounts Receivable Inventory Investment in Scissor Company Land Buildings & Equipment Cost of Goods Sold Depreciation Expense Selling & Administrative Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Income from Scissor Company Total Paper Company Debit Credit $ 232,000 165,000 193,000 515,000 250,000 875,000 278,000 65,000 312,000 90,000 $ 630,000 85,000 150,000 625,000 498,000 880,000 107.000 $2.975,000 $2.975,000 Scissor Company Debit Credit $116,000 97,000 115,000 o 125,000 250,000 178,000 12.000 58,000 30,000 $ 48,000 40,000 100,000 250,000 188,000 355,000 0 $981,000 $981,000 page 92 Required a. Prepare any equity-method journal entry(ies) related to the investment in Scissor Company during 20X9. b. Prepare a consolidation worksheet for 20x9 in good form. a. Equity Method Entries on Paper Co's Books: Investment in Scissor Co. Income from Scissor Co. Record Paper Co.'s 100% share of Scissor Co.'s 20x9 income Cash Investment in Scissor Co. Record Paper Co.'s 100% share of Scissor Co.'s 20x9 dividend b. Book Value Calculations: Total Common Book Value Stock + Retained Earnings Beginning book value + Net Income - Dividends Ending book value Basic Consolidation Entry: Common stock Retained earnings Income from Scissor Co. Dividends declared Investment in Scissor Co. Optional accumulated depreciation Consolidation entry: Accumulated depreciation Building & equipment Investment in Scissor Co. Income From Scissor Co. Consolidation Entries DR CR Paper Co. Scissor Co. Consolidated Income Statement Sales Less: COGS Less: Depreciation Expense Less: Other Expenses Income from Scissor Co. Net Income 880,000 (278,000) (65,000) (312,000) 107,000 332,000 355,000 (178,000) (12,000) (58,000) 107,000 Statement of Retained Earnings Beginning Balance Net Income Less: Dividends Declared Ending Balance 498,000 332,000 (90,000) 740,000 188,000 107,000 (30,000) 265,000 116,000 97,000 115,000 Balance Sheet Cash Accounts Receivable Inventory Investment in Scissor Co. Land Buildings & Equipment Less: Accumulated Depreciation Total Assets 232,000 165,000 193,000 515,000 250,000 875,000 (630,000) 1,600,000 125,000 250,000 (48,000) 655,000 Accounts Payable Bonds Payable Common Stock Retained Earnings Total Liabilities & Equity 85,000 150,000 625,000 740,000 1,600,000 40,000 100,000 250,000 265,000 655,000