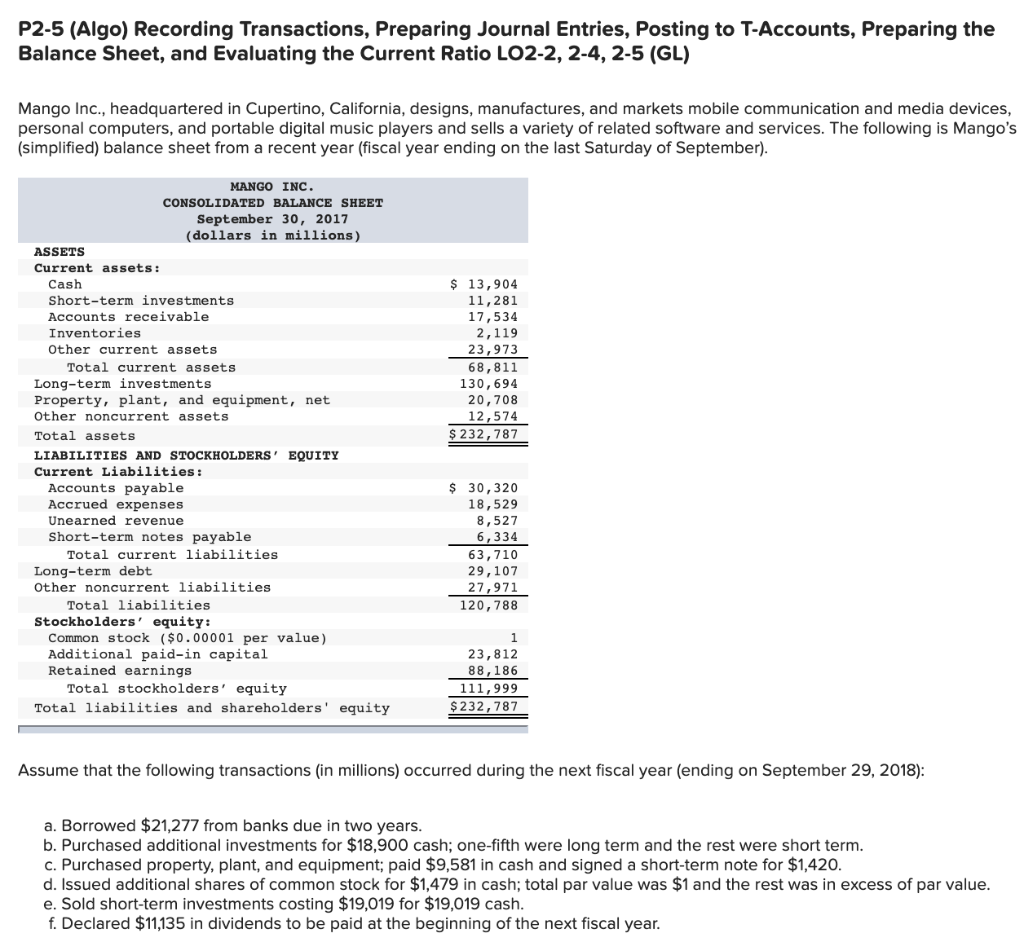

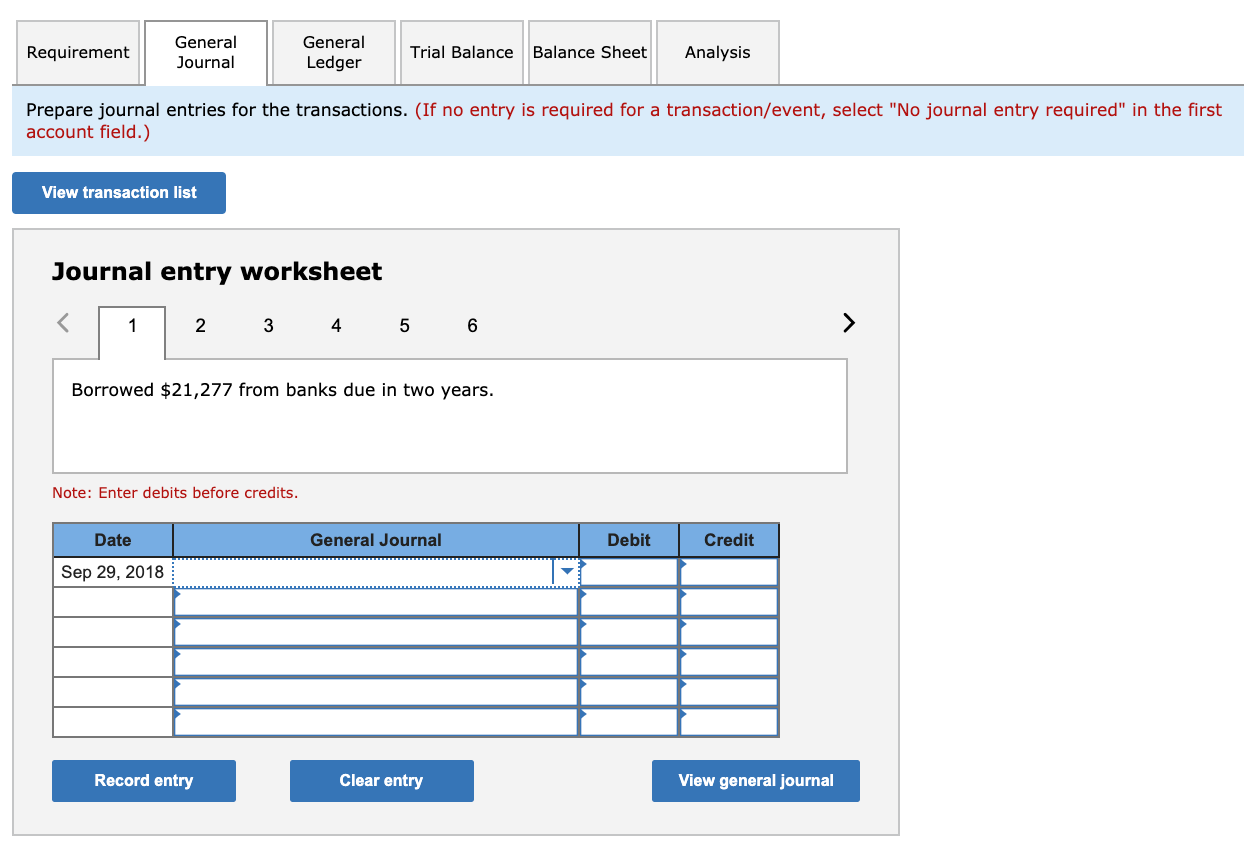

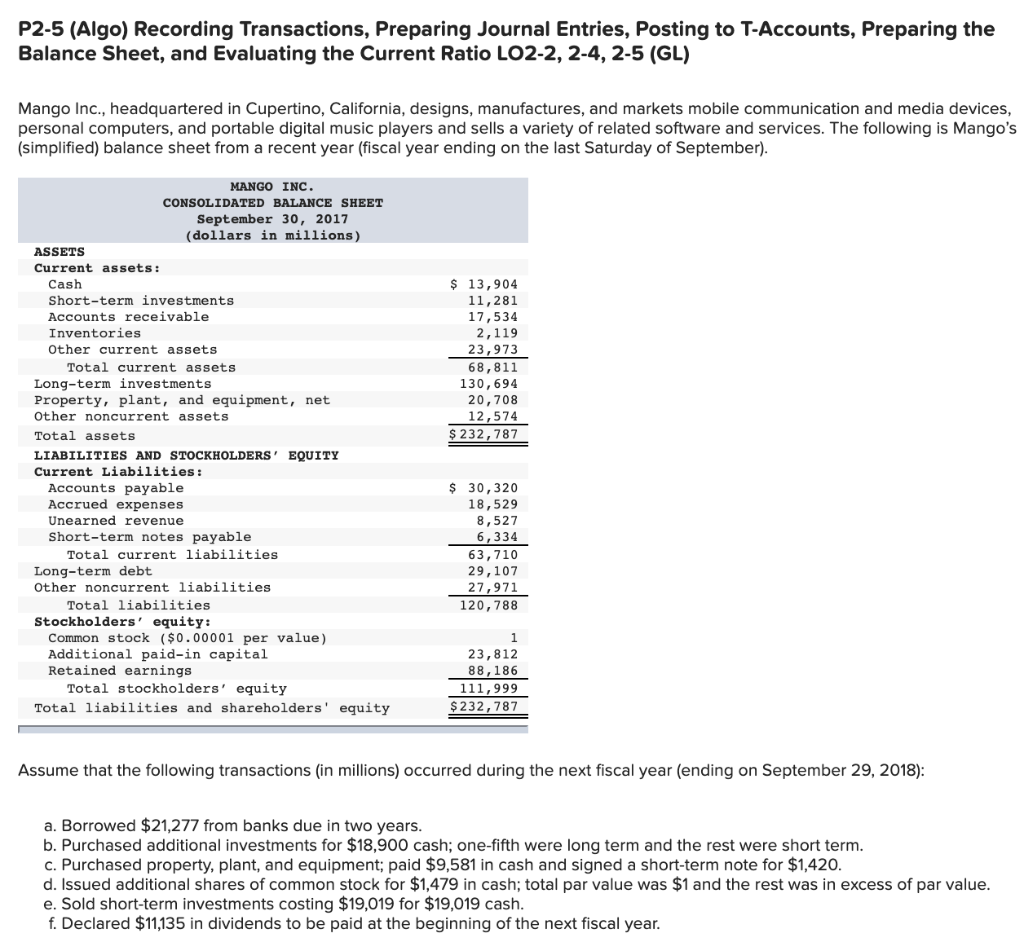

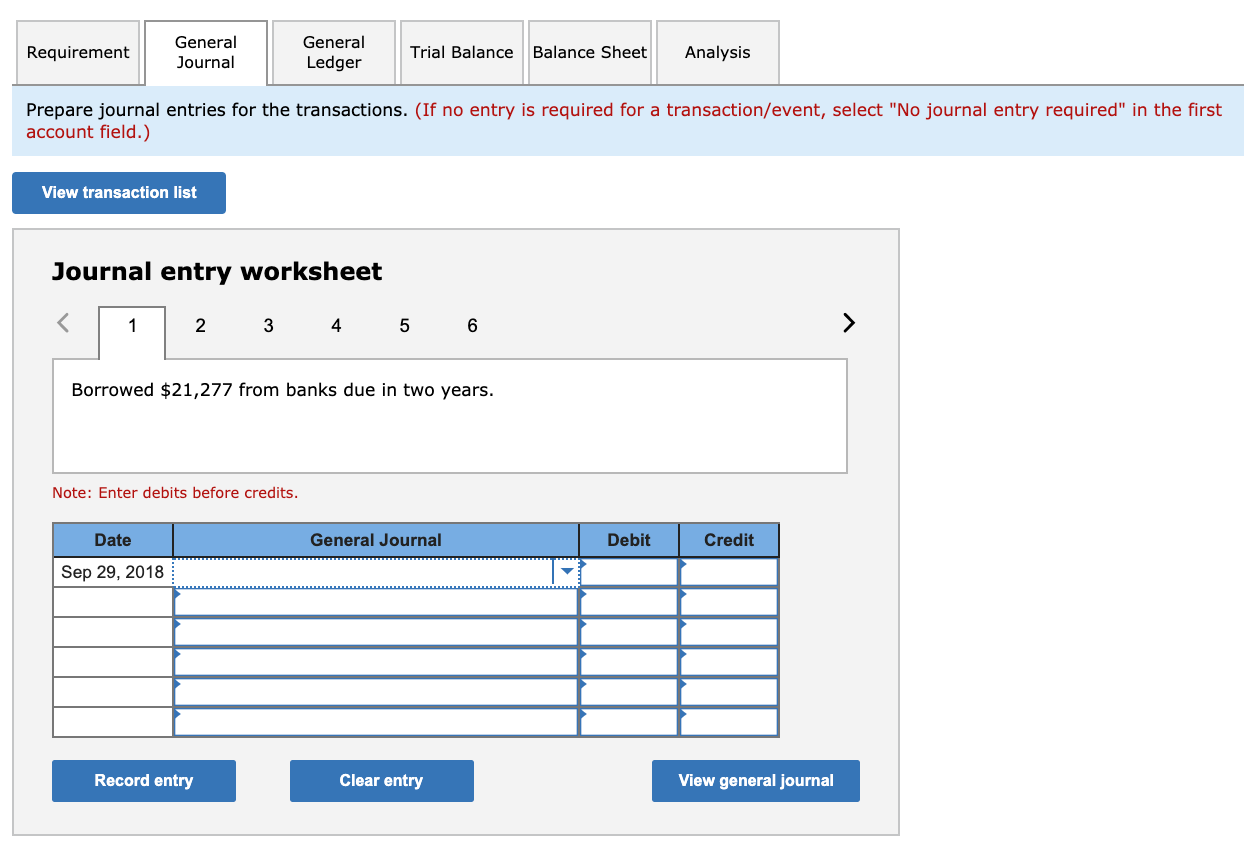

P2-5 (Algo) Recording Transactions, Preparing Journal Entries, Posting to T-Accounts, Preparing the Balance Sheet, and Evaluating the Current Ratio LO2-2, 2-4, 2-5 (GL) Mango Inc., headquartered in Cupertino, California, designs, manufactures, and markets mobile communication and media devices, personal computers, and portable digital music players and sells a variety of related software and services. The following is Mango's (simplified) balance sheet from a recent year (fiscal year ending on the last Saturday of September). $ 13,904 11,281 17,534 2,119 23,973 68,811 130,694 20,708 12,574 $ 232,787 MANGO INC. CONSOLIDATED BALANCE SHEET September 30, 2017 (dollars in millions) ASSETS Current assets: Cash Short-term investments Accounts receivable Inventories Other current assets Total current assets Long-term investments Property, plant, and equipment, net Other noncurrent assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts payable Accrued expenses Unearned revenue Short-term notes payable Total current liabilities Long-term debt Other noncurrent liabilities Total liabilities Stockholders' equity: Common stock ($0.00001 per value) Additional paid-in capital Retained earnings Total stockholders' equity Total liabilities and shareholders' equity $ 30,320 18,529 8,527 6,334 63,710 29,107 27,971 120,788 23,812 88,186 111,999 $ 232,787 Assume that the following transactions (in millions) occurred during the next fiscal year (ending on September 29, 2018): a. Borrowed $21,277 from banks due in two years. b. Purchased additional investments for $18,900 cash; one-fifth were long term and the rest were short term. c. Purchased property, plant, and equipment; paid $9,581 in cash and signed a short-term note for $1,420. d. Issued additional shares of common stock for $1,479 in cash; total par value was $1 and the rest was in excess of par value. e. Sold short-term investments costing $19,019 for $19,019 cash. f. Declared $11,135 in dividends to be paid at the beginning of the next fiscal year. Requirement General Journal General Ledger Trial Balance Balance Sheet Analysis Prepare journal entries for the transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 5 6 > Borrowed $21,277 from banks due in two years. Note: Enter debits before credits. Date General Journal Debit Credit Sep 29, 2018 Record entry Clear entry View general journal