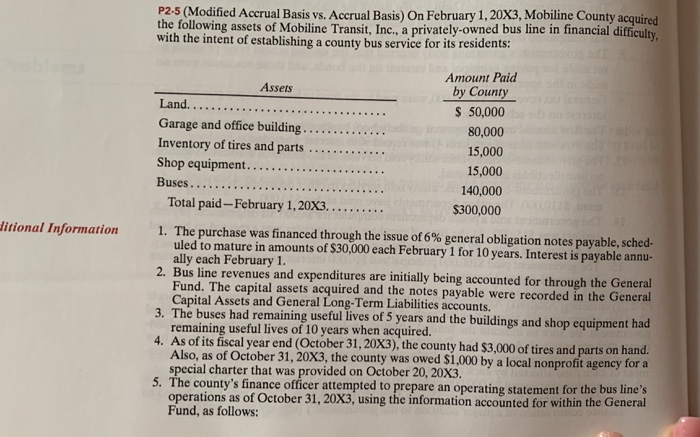

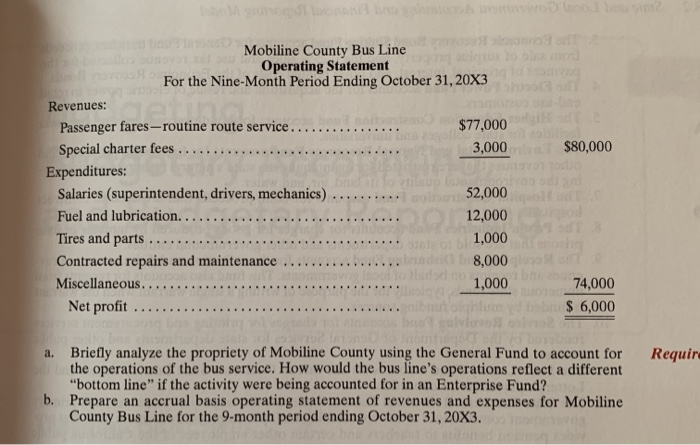

P2-5 (Modified Accrual Basis vs. Accrual Basis) On February 1, 20X3, Mobiline County acquired the following assets of Mobiline Transit. Inc., a privately-owned bus line in financial difficulty with the intent of establishing a county bus service for its residents: Assets Land.............................. Garage and office building......... Inventory of tires and parts ........ Shop equipment...................... Buses............................ Total paid - February 1, 20X3...... Amount Paid by County $ 50,000 80,000 15,000 15,000 140,000 $300,000 ditional Information 1. The purchase was financed through the issue of 6% general obligation notes payable, sched- uled to mature in amounts of $30,000 each February 1 for 10 years. Interest is payable annu- ally each February 1. 2. Bus line revenues and expenditures are initially being accounted for through the General Fund. The capital assets acquired and the notes payable were recorded in the General Capital Assets and General Long-Term Liabilities accounts. 3. The buses had remaining useful lives of 5 years and the buildings and shop equipment had remaining useful lives of 10 years when acquired. 4. As of its fiscal year end (October 31, 20X3), the county had $3,000 of tires and parts on hand. Also, as of October 31, 20X3, the county was owed $1,000 by a local nonprofit agency for a special charter that was provided on October 20, 20X3. 5. The county's finance officer attempted to prepare an operating statement for the bus line's operations as of October 31, 20X3, using the information accounted for within the General Fund, as follows: $80,000 Mobiline County Bus Line Mobiline Operating Statement For the Nine-Month Period Ending October 31, 20X3 Revenues: Passenger fares-routine route service.............. $77,000 Special charter fees .... 3,000 Expenditures: Salaries (superintendent, drivers, mechanics) 52,000 Fuel and lubrication........ 12,000 Tires and parts ............ 1,000 Contracted repairs and maintenance .... 8,000 Miscellaneous........... 1,000 Net profit ................. 74,000 $ 6,000 Requir a. Briefly analyze the propriety of Mobiline County using the General Fund to account for the operations of the bus service. How would the bus line's operations reflect a different "bottom line" if the activity were being accounted for in an Enterprise Fund? b. Prepare an accrual basis operating statement of revenues and expenses for Mobiline County Bus Line for the 9-month period ending October 31, 20X3