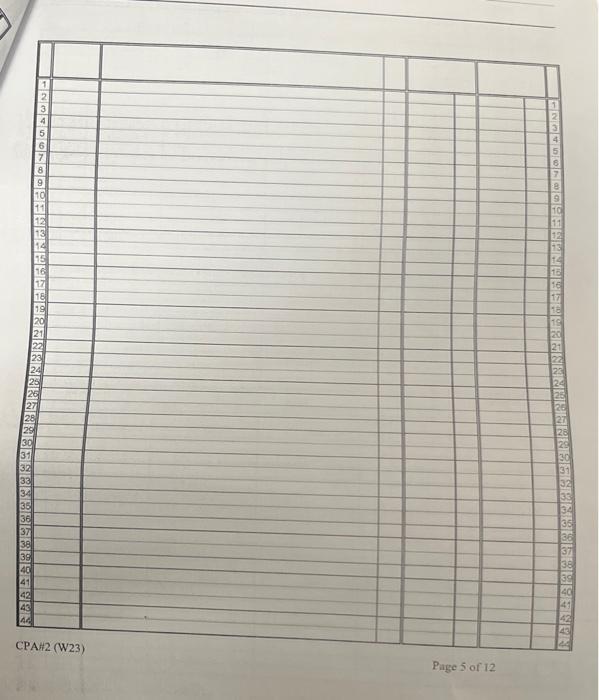

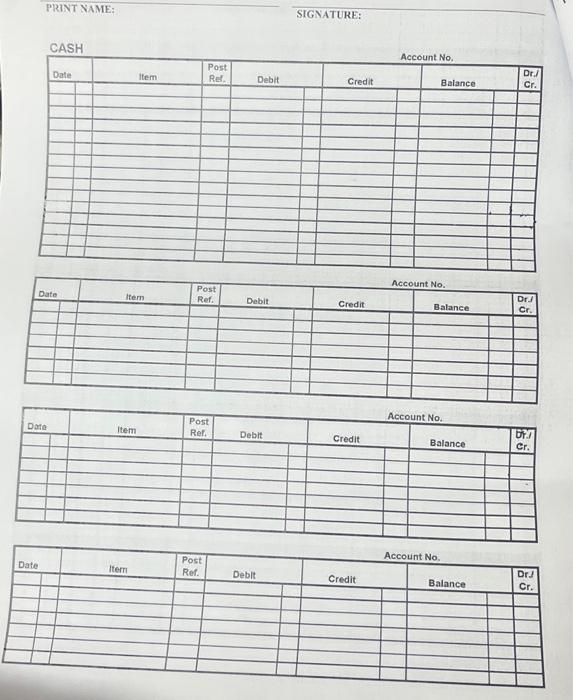

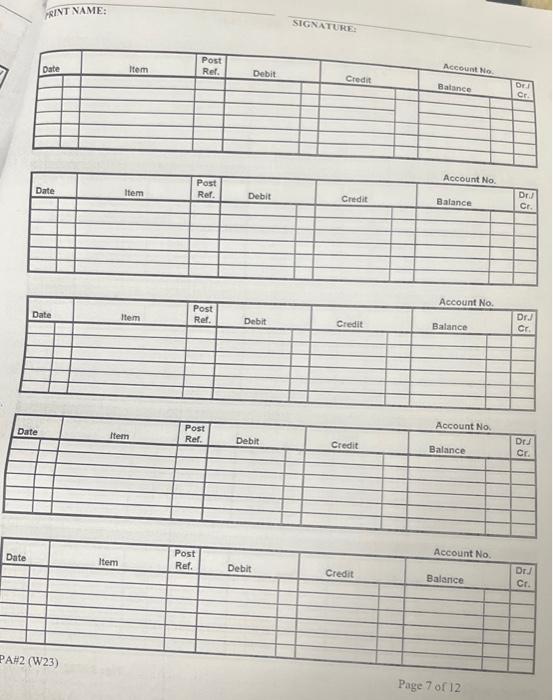

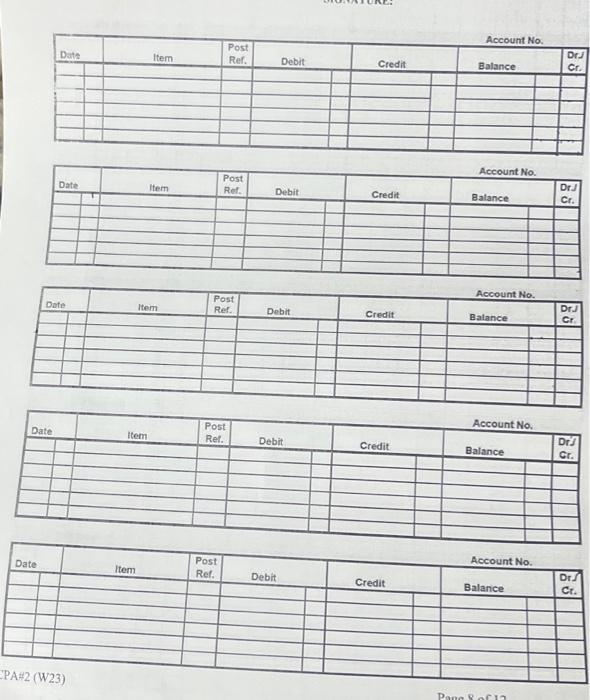

P2.5A ( LO2,3,4) AP Grete Rodewald formed a dog grooming and training business ealled. Grete Kanines on Septmber 1, 2024. After consulting with a friend who had taken introductory accounting, Grete created a chart of accounts for the business as follows: No. 101 Cash; No. 112 Accounts Receivable; No. 130 Prepaid Insurance; No. 151 Equipment; No. 201 Accounts Payable; No. 209 Unearned Revenue; No. 301 G. Rodewald, Capital; No. 306 G. Rodewald, Drawings; No. 400 Service Revenue; No. 610 Advertising Expense; No. 726 Rent Expense; and No. 737 Utilities Expense. During September, the following events and transactions occurred: Sept. Grete transferred $9,630 from her personal bank account to a bank account under the 1 company name Grete Kanines. 2 Signed a one-year rental agreement for $690 per month. Paid the first month's rent. 2 Paid $750 for a one-year insurance policy effective September 1, 2024 . 5 Purchased $2,640 of equipment on credit. 7 Paid $420 for advertising in several community newsletters in September. 13 Collected $500 cash for providing dog grooming services. 21 Attended a dog show and provided $800 of dog grooming services for one of the major kennel owners. The kennel owner will pay the amount owing within two weeks. 24 Collected $540 from the kennel owner for the services provided on September 21 . The kennel owner promised to pay the rest on October 2. 28 Paid $210 for utilities for the month of September. 29 Paid $1,470 of the amount owed from the September 5 equipment purchase. 30 Received $860 cash for dog training lessons that will start on October 10. 30 Collected $1,045 cash for providing dog grooming services. 30 Paid the owner, Grete Rodewald, $1,490 for her personal use. Instructions a. Journalize the transactions. b. Post the journal entries to the ledger accounts. (Use the ledger format provided in Ilustration 2.18.) c. Prepare a trial balance as at September 30, 2024 . Page 5 of 12 PRINT NAME: SIGNATURE: CASH Account No. \begin{tabular}{|l|l|l|l|l|l|l|l|l|} \hline Date & Item & Post Ref. & Deblt & Credit & Balance & Dr: Cr. \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline \end{tabular} IRINT NAME: \begin{tabular}{|l|l|l|l|l|l|l|l|l|l|l|} \hline \multicolumn{2}{|l|}{ Date } & \multicolumn{1}{|c|}{ Item } & Post Ref. & Debit & Credit \\ \hline & & & & & & & \multicolumn{1}{|c|}{ Account No. } \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline \end{tabular} Page 7 of 12 \begin{tabular}{|l|l|l|l|l|l|l|l|l|} \hline Date & Item & Post Ref. & \multicolumn{1}{|c|}{ Debit } & Credit & \multicolumn{2}{|c|}{ Account No. } \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline \end{tabular}