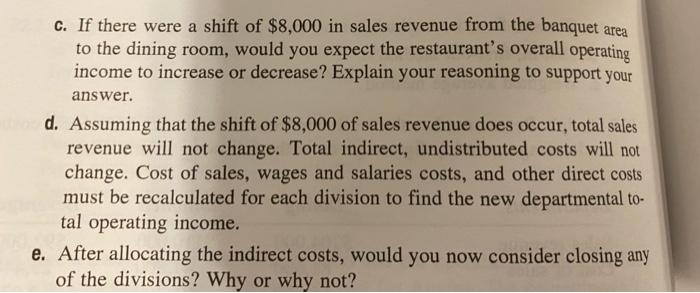

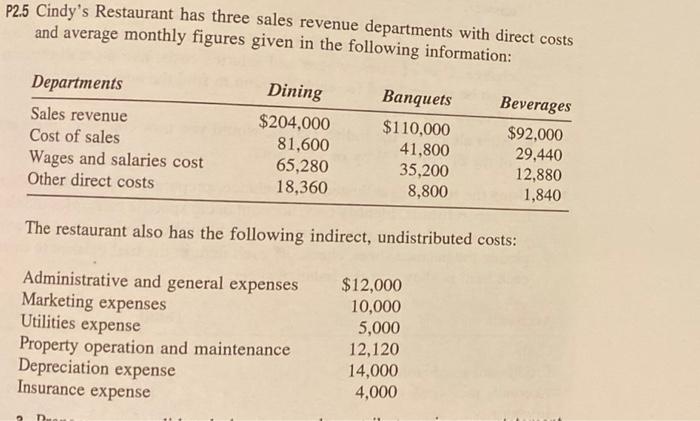

P2.6 With reference to the information provided for Cindy's Restaurant in Prob- lem 2.5 (round all percentage calculations to a whole percentage): for each of the three C. If there were a shift of $8,000 in sales revenue from the banquet area to the dining room, would you expect the restaurant's overall operating income to increase or decrease? Explain your reasoning to support your answer. d. Assuming that the shift of $8,000 of sales revenue does occur, total sales revenue will not change. Total indirect, undistributed costs will not change. Cost of sales, wages and salaries costs, and other direct costs must be recalculated for each division to find the new departmental to- tal operating income. e. After allocating the indirect costs, would you now consider closing any of the divisions? Why or why not? P2.5 Cindy's Restaurant has three sales revenue departments with direct costs and average monthly figures given in the following information: Departments Sales revenue Cost of sales Wages and salaries cost Other direct costs Dining $204,000 81,600 65,280 18,360 Banquets $110,000 41,800 35,200 8,800 Beverages $92,000 29,440 12,880 1,840 The restaurant also has the following indirect, undistributed costs: Administrative and general expenses Marketing expenses Utilities expense Property operation and maintenance Depreciation expense Insurance expense $12,000 10,000 5,000 12,120 14,000 4,000 P2.6 With reference to the information provided for Cindy's Restaurant in Prob- lem 2.5 (round all percentage calculations to a whole percentage): for each of the three C. If there were a shift of $8,000 in sales revenue from the banquet area to the dining room, would you expect the restaurant's overall operating income to increase or decrease? Explain your reasoning to support your answer. d. Assuming that the shift of $8,000 of sales revenue does occur, total sales revenue will not change. Total indirect, undistributed costs will not change. Cost of sales, wages and salaries costs, and other direct costs must be recalculated for each division to find the new departmental to- tal operating income. e. After allocating the indirect costs, would you now consider closing any of the divisions? Why or why not? P2.5 Cindy's Restaurant has three sales revenue departments with direct costs and average monthly figures given in the following information: Departments Sales revenue Cost of sales Wages and salaries cost Other direct costs Dining $204,000 81,600 65,280 18,360 Banquets $110,000 41,800 35,200 8,800 Beverages $92,000 29,440 12,880 1,840 The restaurant also has the following indirect, undistributed costs: Administrative and general expenses Marketing expenses Utilities expense Property operation and maintenance Depreciation expense Insurance expense $12,000 10,000 5,000 12,120 14,000 4,000