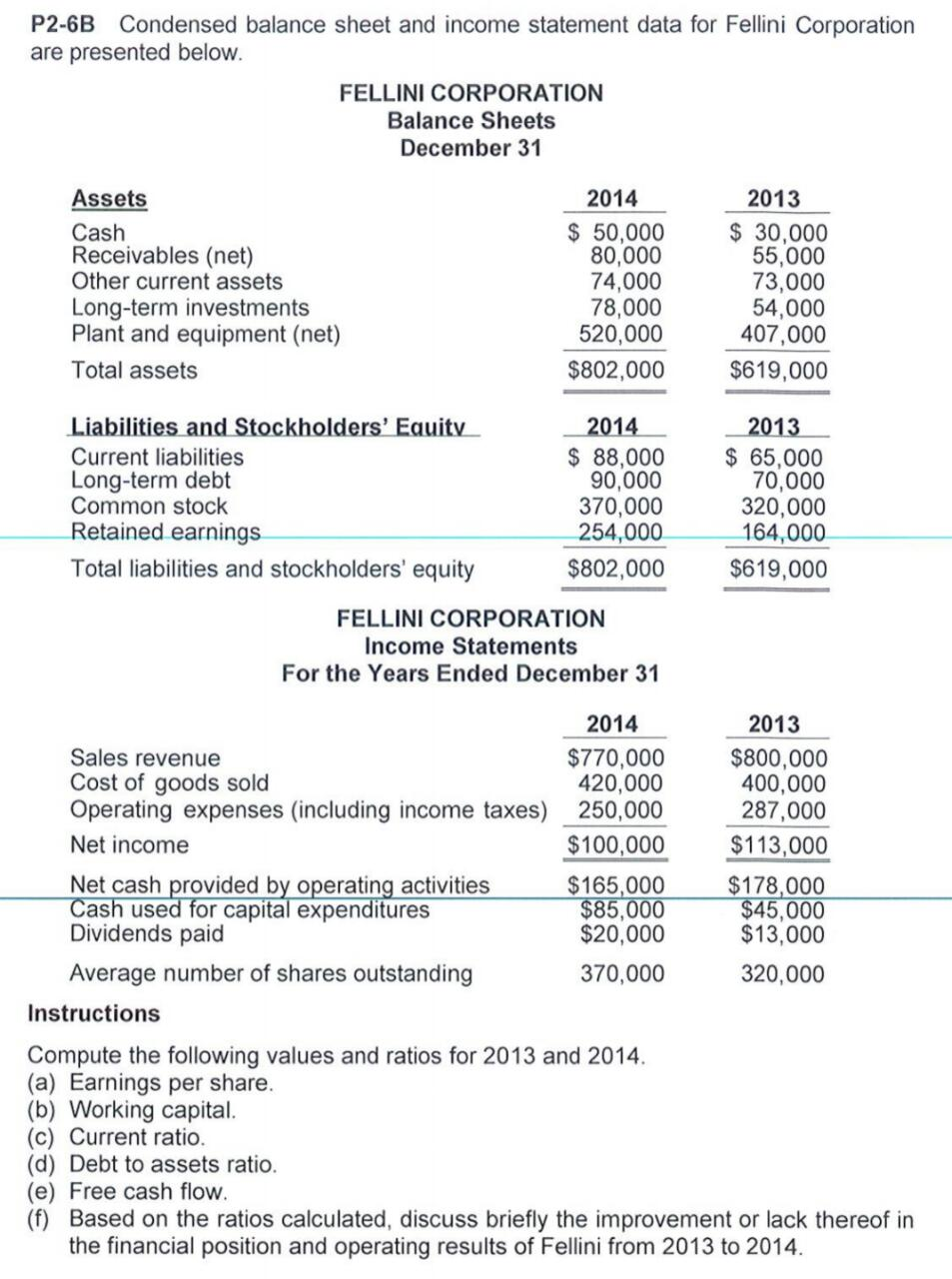

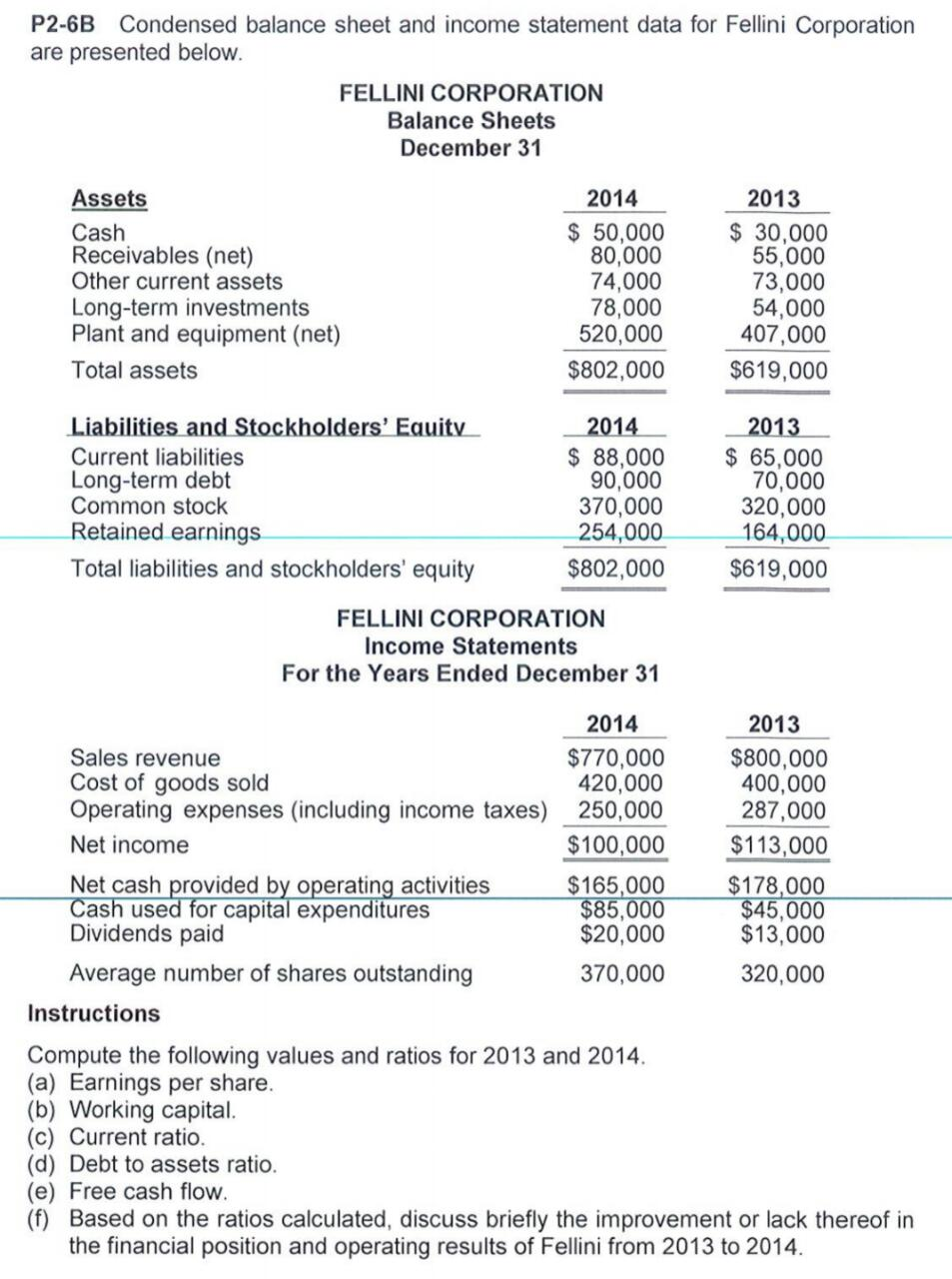

P2-6B Condensed balance sheet and income statement data for Fellini Corporation are presented below. FELLINI CORPORATION Balance Sheets December 31 Assets Cash Receivables (net) Other current assets Long-term investments Plant and equipment (net) Total assets 2014 $ 50,000 80,000 74,000 78,000 520,000 $802,000 2013 $ 30,000 55,000 73,000 54,000 407,000 $619,000 Liabilities and Stockholders' Equity Current liabilities Long-term debt Common stock Retained earnings Total liabilities and stockholders' equity 2014 $ 88,000 90,000 370,000 254,000 $802,000 2013 $ 65,000 70,000 320,000 164,000 $619,000 FELLINI CORPORATION Income Statements For the Years Ended December 31 Sales revenue Cost of goods sold Operating expenses (including income taxes) Net income 2014 $770,000 420,000 250,000 $100,000 2013 $800,000 400,000 287,000 $113,000 Net cash provided by operating activities $165,000 $178,000 Cash used for capital expenditures $85,000 $45,000 Dividends paid $20,000 $13,000 Average number of shares outstanding 370,000 320,000 Instructions Compute the following values and ratios for 2013 and 2014. (a) Earnings per share. (b) Working capital. (c) Current ratio. (d) Debt to assets ratio. (e) Free cash flow. (f) Based on the ratios calculated, discuss briefly the improvement or lack thereof in the financial position and operating results of Fellini from 2013 to 2014. P2-6B Condensed balance sheet and income statement data for Fellini Corporation are presented below. FELLINI CORPORATION Balance Sheets December 31 Assets Cash Receivables (net) Other current assets Long-term investments Plant and equipment (net) Total assets 2014 $ 50,000 80,000 74,000 78,000 520,000 $802,000 2013 $ 30,000 55,000 73,000 54,000 407,000 $619,000 Liabilities and Stockholders' Equity Current liabilities Long-term debt Common stock Retained earnings Total liabilities and stockholders' equity 2014 $ 88,000 90,000 370,000 254,000 $802,000 2013 $ 65,000 70,000 320,000 164,000 $619,000 FELLINI CORPORATION Income Statements For the Years Ended December 31 Sales revenue Cost of goods sold Operating expenses (including income taxes) Net income 2014 $770,000 420,000 250,000 $100,000 2013 $800,000 400,000 287,000 $113,000 Net cash provided by operating activities $165,000 $178,000 Cash used for capital expenditures $85,000 $45,000 Dividends paid $20,000 $13,000 Average number of shares outstanding 370,000 320,000 Instructions Compute the following values and ratios for 2013 and 2014. (a) Earnings per share. (b) Working capital. (c) Current ratio. (d) Debt to assets ratio. (e) Free cash flow. (f) Based on the ratios calculated, discuss briefly the improvement or lack thereof in the financial position and operating results of Fellini from 2013 to 2014