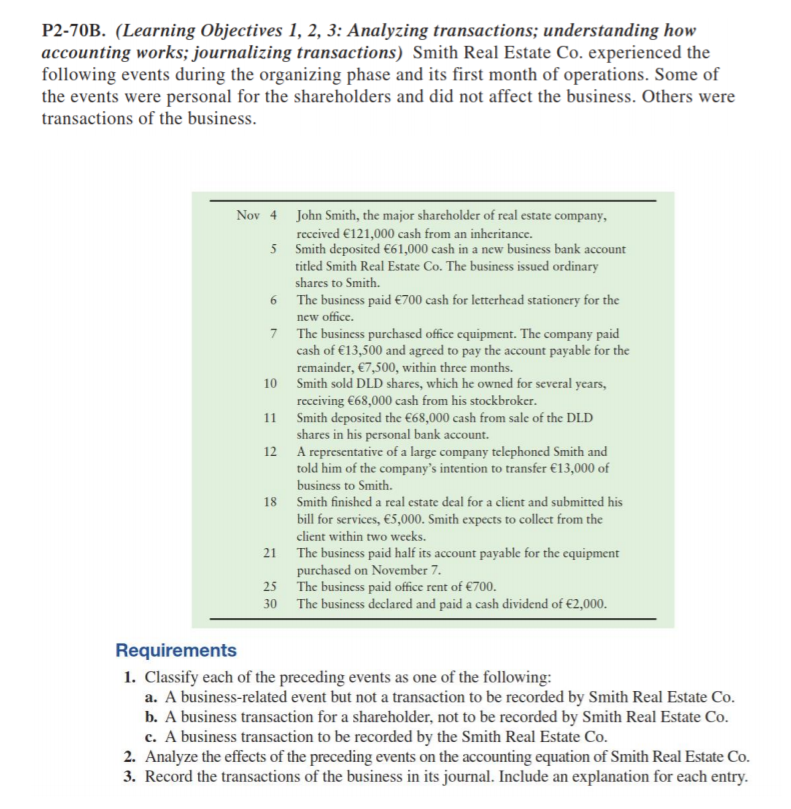

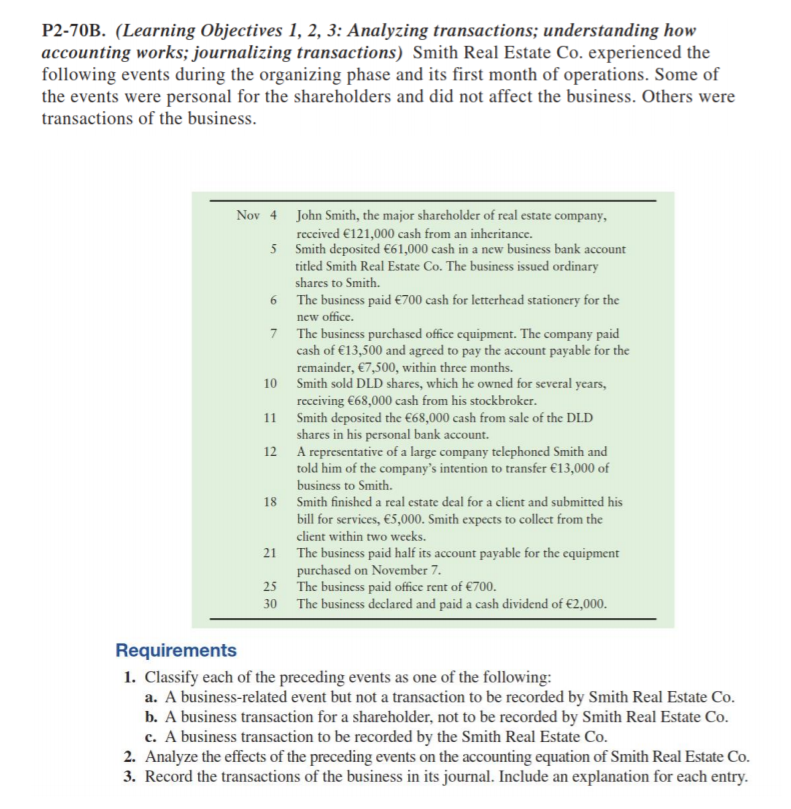

P2-70B. (Learning Objectives 1, 2, 3: Analyzing transactions; understanding how accounting works; journalizing transactions) Smith Real Estate Co. experienced the following events during the organizing phase and its first month of operations. Some of the events were personal for the shareholders and did not affect the business. Others were transactions of the business. Nov 4 John Smith, the major shareholder of real estate company, received 121,000 cash from an inheritance. 5 Smith deposited 61,000 cash in a new business bank account titled Smith Real Estate Co. The business issued ordinary shares to Smith 6 The business paid 700 cash for letterhead stationery for the new office. 7 The business purchased office equipment. The company paid cash of 13,500 and agreed to pay the account payable for the remainder, 7,500, within three months. 10 Smith sold DLD shares, which he owned for several years, receiving 68,000 cash from his stockbroker. 11 Smith deposited the 68,000 cash from sale of the DLD shares in his personal bank account. A representative of a large company telephoned Smith and told him of the company's intention to transfer 13,000 of business to Smith. Smith finished a real estate deal for a client and submitted his bill for services, 5,000. Smith expects to collect from the client within two weeks. The business paid half its account payable for the equipment purchased on November 7. The business paid office rent of 700. 30 The business declared and paid a cash dividend of 2,000. 12 18 21 25 Requirements 1. Classify each of the preceding events as one of the following: a. A business-related event but not a transaction to be recorded by Smith Real Estate Co. b. A business transaction for a shareholder, not to be recorded by Smith Real Estate Co. c. A business transaction to be recorded by the Smith Real Estate Co. 2. Analyze the effects of the preceding events on the accounting equation of Smith Real Estate Co. 3. Record the transactions of the business in its journal. Include an explanation for each entry. P2-70B. (Learning Objectives 1, 2, 3: Analyzing transactions; understanding how accounting works; journalizing transactions) Smith Real Estate Co. experienced the following events during the organizing phase and its first month of operations. Some of the events were personal for the shareholders and did not affect the business. Others were transactions of the business. Nov 4 John Smith, the major shareholder of real estate company, received 121,000 cash from an inheritance. 5 Smith deposited 61,000 cash in a new business bank account titled Smith Real Estate Co. The business issued ordinary shares to Smith 6 The business paid 700 cash for letterhead stationery for the new office. 7 The business purchased office equipment. The company paid cash of 13,500 and agreed to pay the account payable for the remainder, 7,500, within three months. 10 Smith sold DLD shares, which he owned for several years, receiving 68,000 cash from his stockbroker. 11 Smith deposited the 68,000 cash from sale of the DLD shares in his personal bank account. A representative of a large company telephoned Smith and told him of the company's intention to transfer 13,000 of business to Smith. Smith finished a real estate deal for a client and submitted his bill for services, 5,000. Smith expects to collect from the client within two weeks. The business paid half its account payable for the equipment purchased on November 7. The business paid office rent of 700. 30 The business declared and paid a cash dividend of 2,000. 12 18 21 25 Requirements 1. Classify each of the preceding events as one of the following: a. A business-related event but not a transaction to be recorded by Smith Real Estate Co. b. A business transaction for a shareholder, not to be recorded by Smith Real Estate Co. c. A business transaction to be recorded by the Smith Real Estate Co. 2. Analyze the effects of the preceding events on the accounting equation of Smith Real Estate Co. 3. Record the transactions of the business in its journal. Include an explanation for each entry