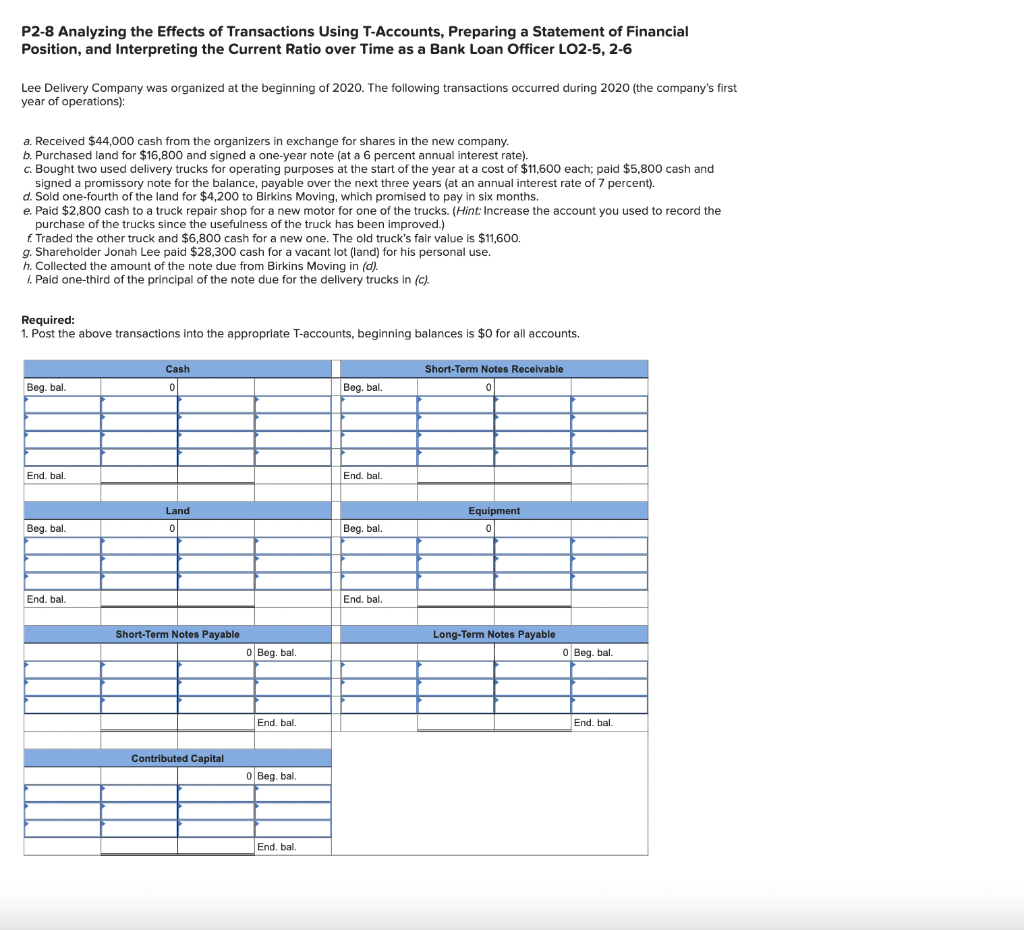

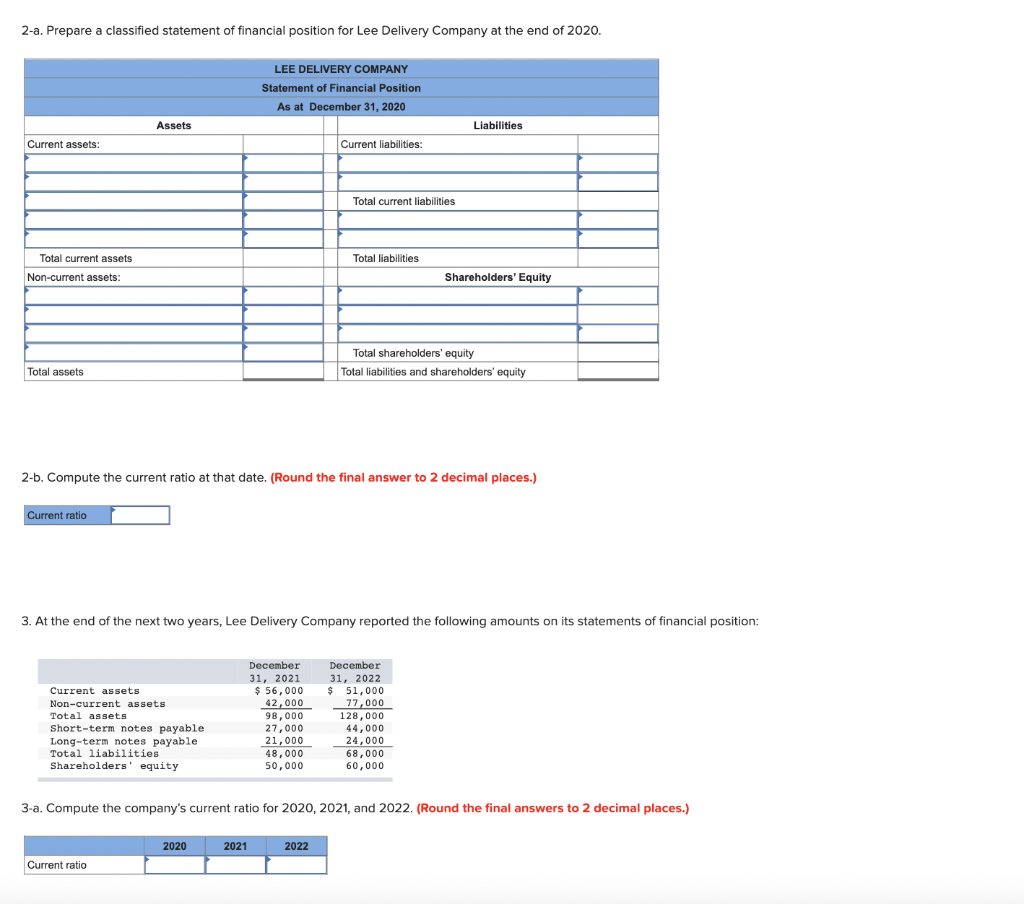

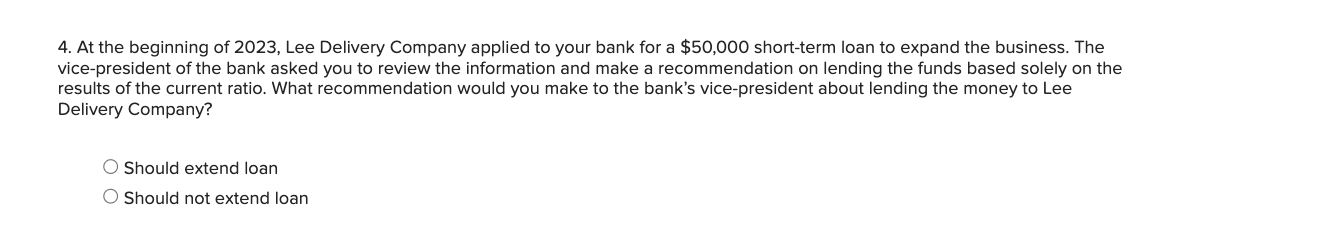

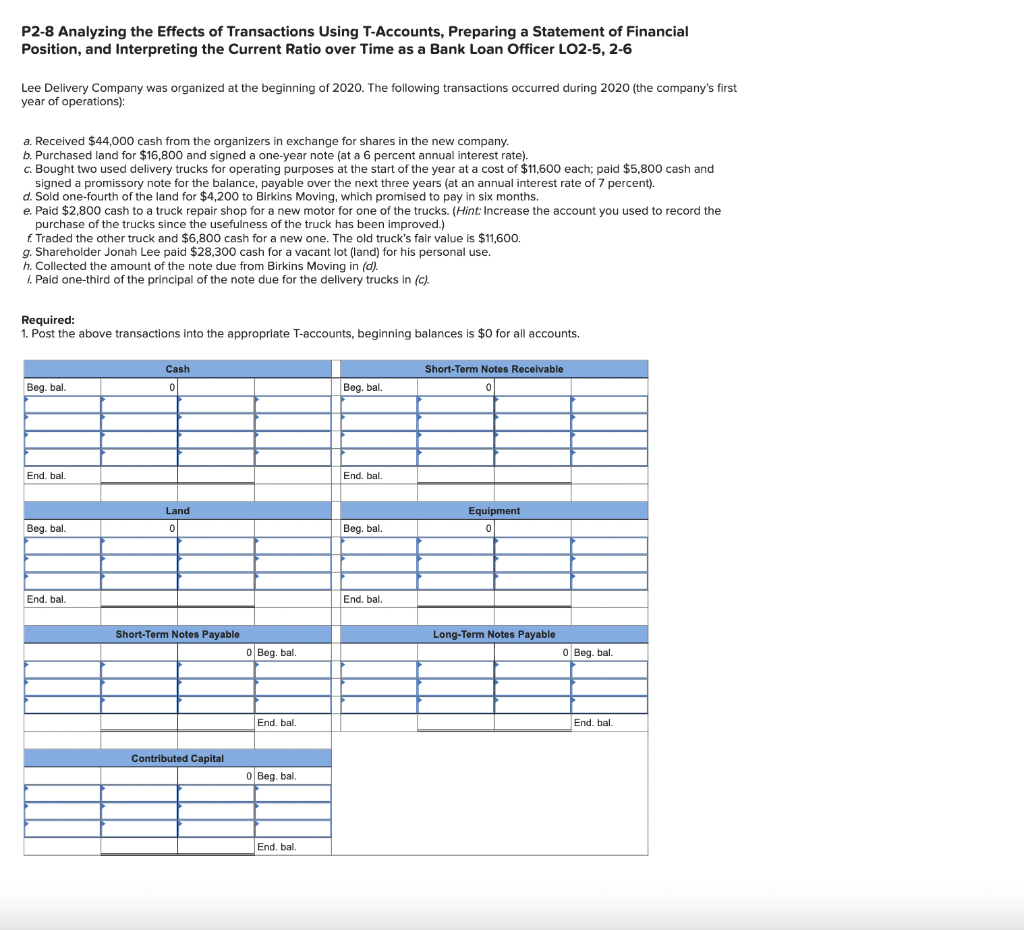

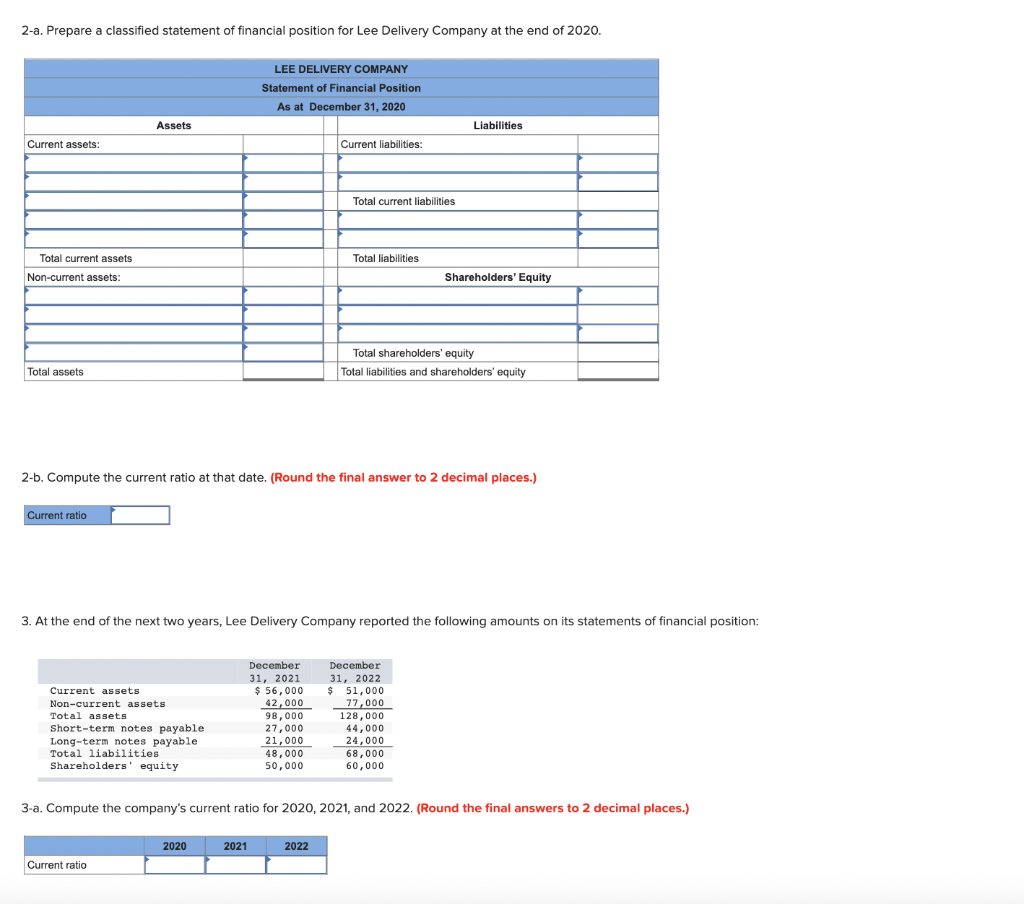

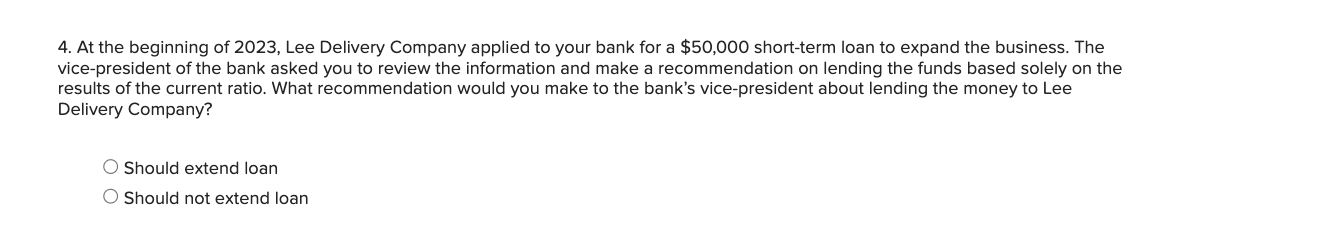

P2-8 Analyzing the Effects of Transactions Using T-Accounts, Preparing a Statement of Financial Position, and Interpreting the Current Ratio over Time as a Bank Loan Officer LO2-5, 2-6 Lee Delivery Company was organized at the beginning of 2020. The following transactions occurred during 2020 (the company's first year of operations): a. Received $44,000 cash from the organizers in exchange for shares in the new company. b. Purchased land for $16,800 and signed a one-year note (at a 6 percent annual interest rate). c. Bought two used delivery trucks for operating purposes at the start of the year at a cost of $11,600 each; paid $5,800 cash and signed a promissory note for the balance, payable over the next three years (at an annual interest rate of 7 percent). d. Sold one-fourth of the land for $4,200 to Birkins Moving, which promised to pay in six months. e. Paid $2,800 cash to a truck repair shop for a new motor for one of the trucks. (Hint Increase the account you used to record the purchase of the trucks since the usefulness of the truck has been improved.) f. Traded the other truck and $6,800 cash for a new one. The old truck's fair value is $11,600. g. Shareholder Jonah Lee paid $28,300 cash for a vacant lot (land) for his personal use. h. Collected the amount of the note due from Birkins Moving in (d). 1. Paid one-third of the principal of the note due for the delivery trucks in (c). 2-a. Prepare a classified statement of financial position for Lee Delivery Company at the end of 2020. 2-b. Compute the current ratio at that date. (Round the final answer to 2 decimal places.) 3. At the end of the next two years, Lee Delivery Company reported the following amounts on its statements of financial position: 3-a. Compute the company's current ratio for 2020, 2021, and 2022. (Round the final answers to 2 decimal places.) 4. At the beginning of 2023 , Lee Delivery Company applied to your bank for a $50,000 short-term loan to expand the business. The vice-president of the bank asked you to review the information and make a recommendation on lending the funds based solely on the results of the current ratio. What recommendation would you make to the bank's vice-president about lending the money to Lee Delivery Company? Should extend loan Should not extend loan