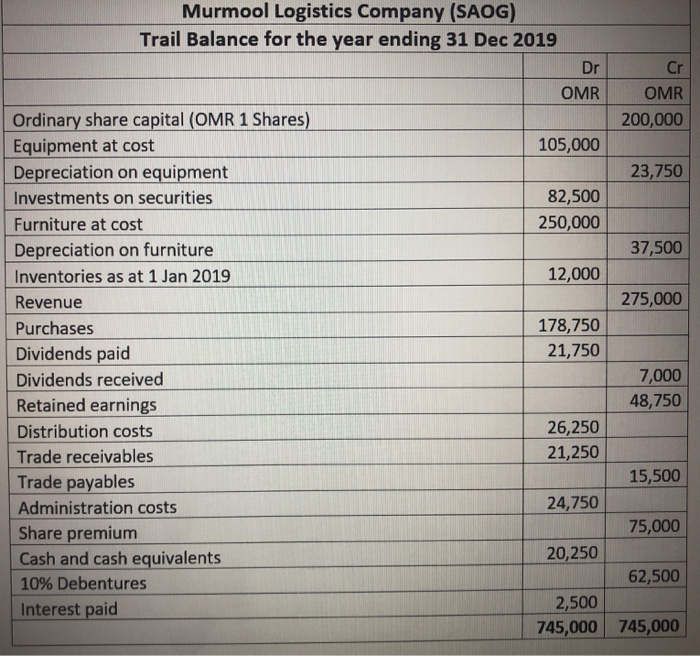

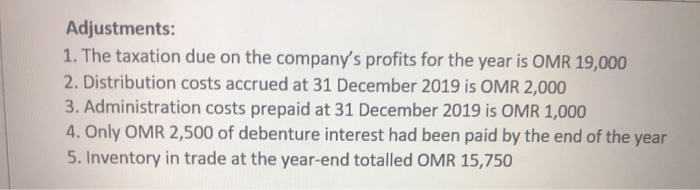

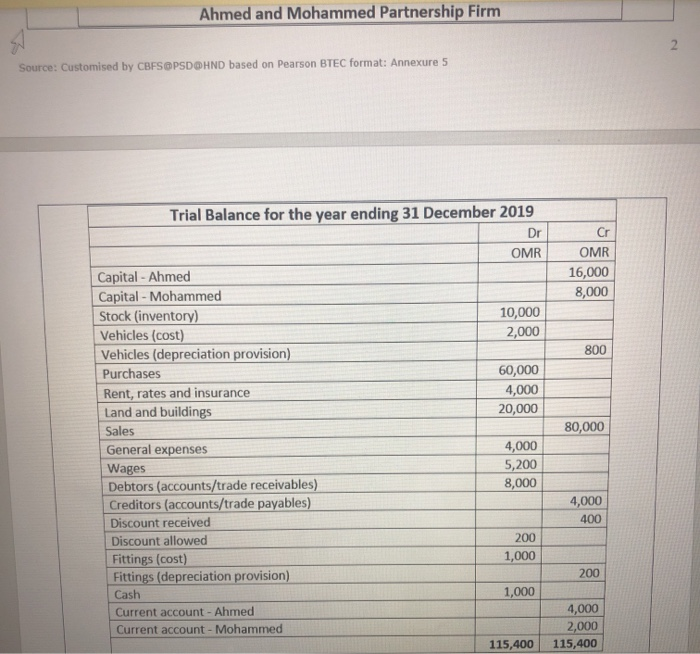

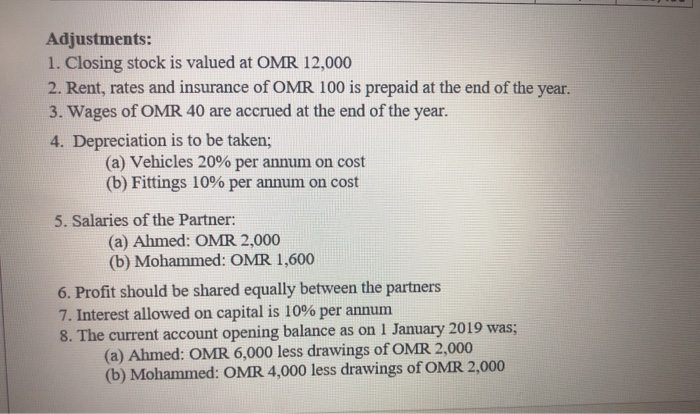

P3 Prepare final accounts from given trial balance. P4 Produce final accounts for a range of examples that include sole- traders, partnerships or limited companies. Murmool Logistics Company (SAOG) Trail Balance for the year ending 31 Dec 2019 Dr Cr OMR OMR 200,000 105,000 23,750 82,500 250,000 37,500 12,000 275,000 178,750 21,750 Ordinary share capital (OMR 1 Shares) Equipment at cost Depreciation on equipment Investments on securities Furniture at cost Depreciation on furniture Inventories as at 1 Jan 2019 Revenue Purchases Dividends paid Dividends received Retained earnings Distribution costs Trade receivables Trade payables Administration costs Share premium Cash and cash equivalents 10% Debentures Interest paid 7,000 48,750 26,250 21,250 15,500 24,750 75,000 20,250 62,500 2,500 745,000 745,000 Adjustments: 1. The taxation due on the company's profits for the year is OMR 19,000 2. Distribution costs accrued at 31 December 2019 is OMR 2,000 3. Administration costs prepaid at 31 December 2019 is OMR 1,000 4. Only OMR 2,500 of debenture interest had been paid by the end of the year 5. Inventory in trade at the year-end totalled OMR 15,750 Ahmed and Mohammed Partnership Firm Source: Customised by CBFSPSDOHND based on Pearson BTEC format: Annexure 5 Trial Balance for the year ending 31 December 2019 Dr OMR Cr OMR 16,000 8,000 10,000 2,000 800 60,000 4,000 20,000 80,000 Capital - Ahmed Capital - Mohammed Stock (inventory) Vehicles (cost) Vehicles (depreciation provision) Purchases Rent, rates and insurance Land and buildings Sales General expenses Wages Debtors (accounts/trade receivables) Creditors (accounts/trade payables) Discount received Discount allowed Fittings (cost) Fittings (depreciation provision) Cash Current account - Ahmed Current account - Mohammed 4,000 5,200 8,000 4,000 400 200 1,000 200 1,000 4,000 2,000 115,400 115,400 Adjustments: 1. Closing stock is valued at OMR 12,000 2. Rent, rates and insurance of OMR 100 is prepaid at the end of the year. 3. Wages of OMR 40 are accrued at the end of the year. 4. Depreciation is to be taken; (a) Vehicles 20% per annum on cost (b) Fittings 10% per annum on cost 5. Salaries of the Partner: (a) Ahmed: OMR 2,000 (b) Mohammed: OMR 1,600 6. Profit should be shared equally between the partners 7. Interest allowed on capital is 10% per annum 8. The current account opening balance as on 1 January 2019 was; (a) Ahmed: OMR 6,000 less drawings of OMR 2,000 (b) Mohammed: OMR 4,000 less drawings of OMR 2,000