Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Magutshwa and Bafunani are partners in a baking company, trading as Nolanga Bakery, and they share profits and losses in the ratio of 3:1 respectively.

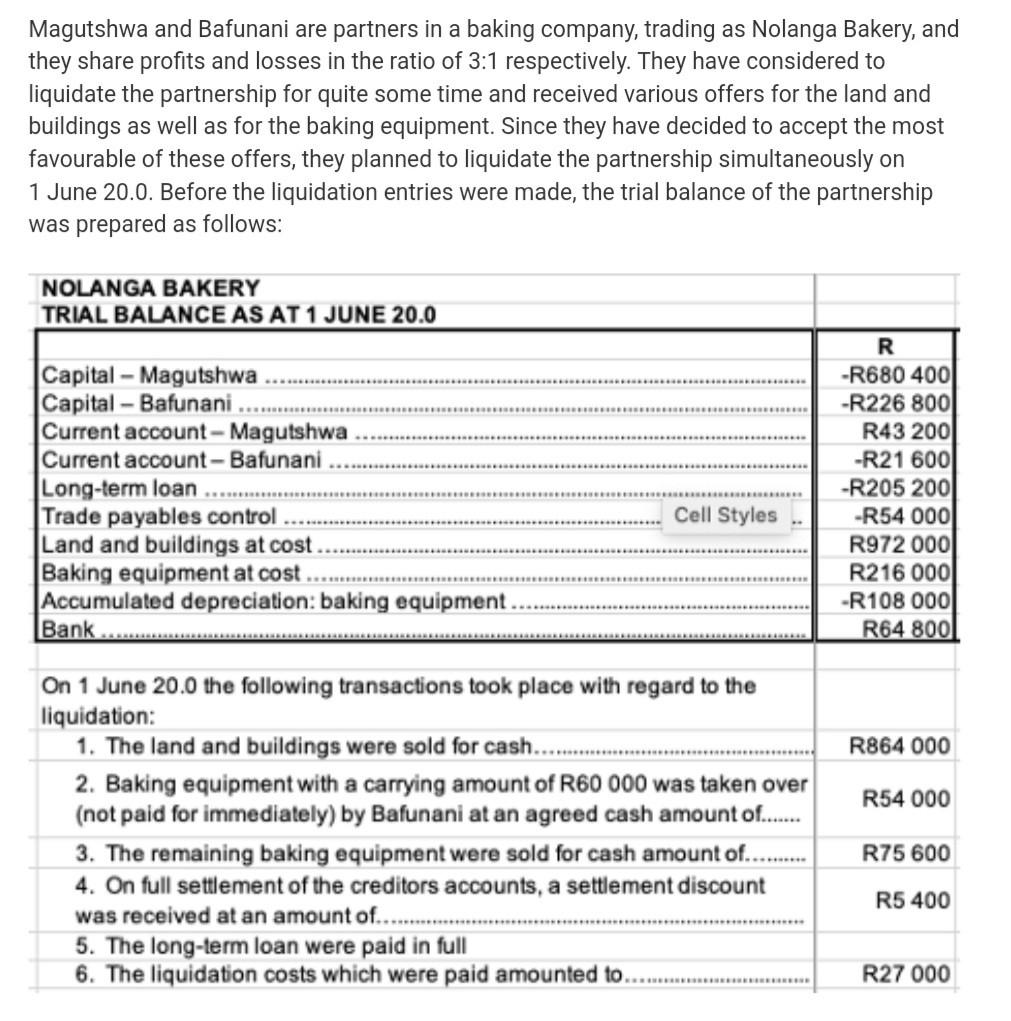

Magutshwa and Bafunani are partners in a baking company, trading as Nolanga Bakery, and they share profits and losses in the ratio of 3:1 respectively. They have considered to liquidate the partnership for quite some time and received various offers for the land and buildings as well as for the baking equipment. Since they have decided to accept the most favourable of these offers, they planned to liquidate the partnership simultaneously on 1 June 20.0. Before the liquidation entries were made, the trial balance of the partnership was prepared as follows: NOLANGA BAKERY TRIAL BALANCE AS AT 1 JUNE 20.0 Capital - Magutshwa Capital - Bafunani. Current account - Magutshwa Current account - Bafunani Long-term loan Trade payables control Land and buildings at cost. Baking equipment at cost Accumulated depreciation: baking equipment Bank R -R680 400 -R226 800 R43 200 -R21 600 -R205 200 -R54 000 R972 000 R216 000 -R108 000 R64 800 Cell Styles R864 000 R54 000 On 1 June 20.0 the following transactions took place with regard to the liquidation: 1. The land and buildings were sold for cash...... 2. Baking equipment with a carrying amount of R60 000 was taken over (not paid for immediately) by Bafunani at an agreed cash amount of..... 3. The remaining baking equipment were sold for cash amount of... 4. On full settlement of the creditors accounts, a settlement discount was received at an amount of..... 5. The long-term loan were paid in full 6. The liquidation costs which were paid amounted to R75 600 R5 400 R27 000 QUESTION 2 Which one of the following alternatives represents the correct amount that must be allocated to Bafunani on as liquidation profit (loss) of Nolanga Bakery on 1 June 20.0? . A. 27 000 . B. 30 000 C. 29 400 D. 35 350

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started