Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show calculations. this is only info given P 5-6 Workspapers (noncontrolling interest, downstream sales, year after acquisition) Pop Corporation acquired a 75 percent interest in

show calculations.

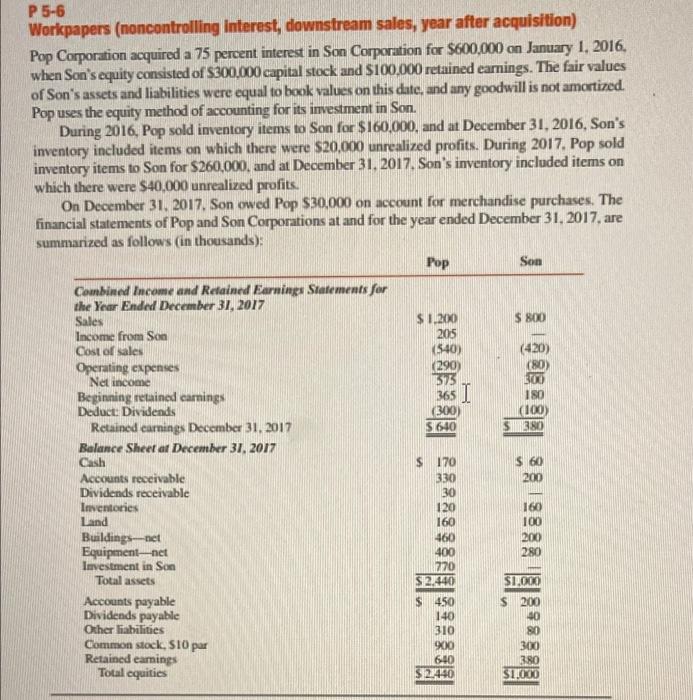

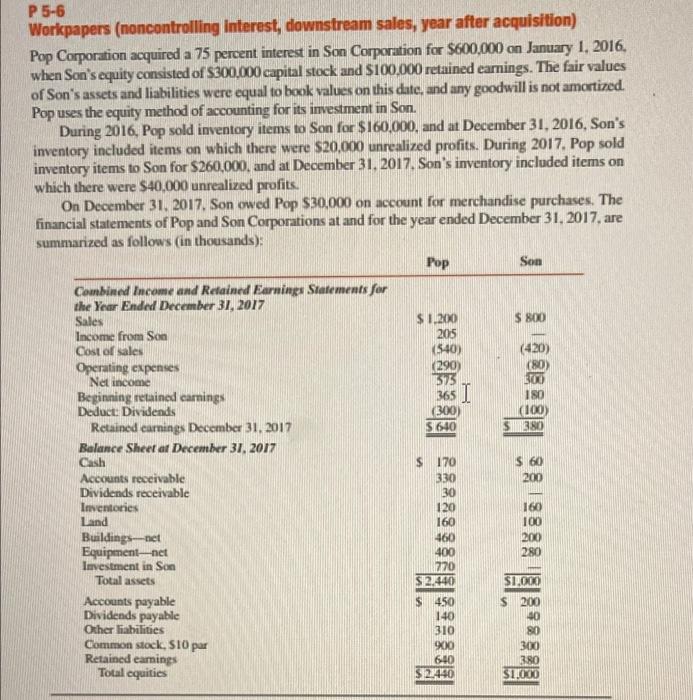

P 5-6 Workspapers (noncontrolling interest, downstream sales, year after acquisition) Pop Corporation acquired a 75 percent interest in Son Corporation for $600,000 on January 1, 2016. when Son's equity consisted of $300.000 capital stock and $100,000 retained earnings. The fair values of Son's assets and liabilities were equal to book values on this date, and any goodwill is not amortized. Pop uses the equity method of accounting for its investment in Son. During 2016, Pop sold inventory items to Son for $160,000, and at December 31, 2016, Son's inventory included items on which there were $20,000 unrealized profits. During 2017. Pop sold inventory items to Son for $260,000, and at December 31, 2017. Son's inventory included items on which there were $40,000 unrealized profits. On December 31, 2017. Son owed Pop $30,000 on account for merchandise purchases. The financial statements of Pop and Son Corporations at and for the year ended December 31, 2017, are summarized as follows (in thousands); Pop Son Combined Income and Retained Earnings Statements for the Year Ended December 31, 2017 Sales $ 1.200 $ 800 Income from Son 205 Cost of sales (540) (420) Operating expenses (290) Net Income 373 300 Beginning retained earnings 180 Deduct: Dividends (300) (100) Retained earnings December 31, 2017 $1640 5380 Balance Sheet af December 31, 2017 Cash $ 170 S60 Accounts receivable 330 200 Dividends receivable 30 Inventories 120 160 Land 160 100 Buildingsnet 460 200 Equipment net 400 280 Investment in Son 270 Total assets $12.440 $1.000 Accounts payable S450 $ 200 Dividends payable 140 40 Other liabilities 310 80 Common stock, S10 par X0 300 Retained earnings 640 3.80 Total equitics $ 2,90 ST1000 365 I 3. Prepare your Income and Dividend Calculations using the method explained in the power point. 4. Prepare all of the journal entries needed for the consolidated worksheet. 5.Complete the consolidated worksheet. P 5-6 Workspapers (noncontrolling interest, downstream sales, year after acquisition) Pop Corporation acquired a 75 percent interest in Son Corporation for $600,000 on January 1, 2016. when Son's equity consisted of $300.000 capital stock and $100,000 retained earnings. The fair values of Son's assets and liabilities were equal to book values on this date, and any goodwill is not amortized. Pop uses the equity method of accounting for its investment in Son. During 2016, Pop sold inventory items to Son for $160,000, and at December 31, 2016, Son's inventory included items on which there were $20,000 unrealized profits. During 2017. Pop sold inventory items to Son for $260,000, and at December 31, 2017. Son's inventory included items on which there were $40,000 unrealized profits. On December 31, 2017. Son owed Pop $30,000 on account for merchandise purchases. The financial statements of Pop and Son Corporations at and for the year ended December 31, 2017, are summarized as follows (in thousands); Pop Son Combined Income and Retained Earnings Statements for the Year Ended December 31, 2017 Sales $ 1.200 $ 800 Income from Son 205 Cost of sales (540) (420) Operating expenses (290) Net Income 373 300 Beginning retained earnings 180 Deduct: Dividends (300) (100) Retained earnings December 31, 2017 $1640 5380 Balance Sheet af December 31, 2017 Cash $ 170 S60 Accounts receivable 330 200 Dividends receivable 30 Inventories 120 160 Land 160 100 Buildingsnet 460 200 Equipment net 400 280 Investment in Son 270 Total assets $12.440 $1.000 Accounts payable S450 $ 200 Dividends payable 140 40 Other liabilities 310 80 Common stock, S10 par X0 300 Retained earnings 640 3.80 Total equitics $ 2,90 ST1000 365 I 3. Prepare your Income and Dividend Calculations using the method explained in the power point. 4. Prepare all of the journal entries needed for the consolidated worksheet. 5.Complete the consolidated worksheet this is only info given

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started