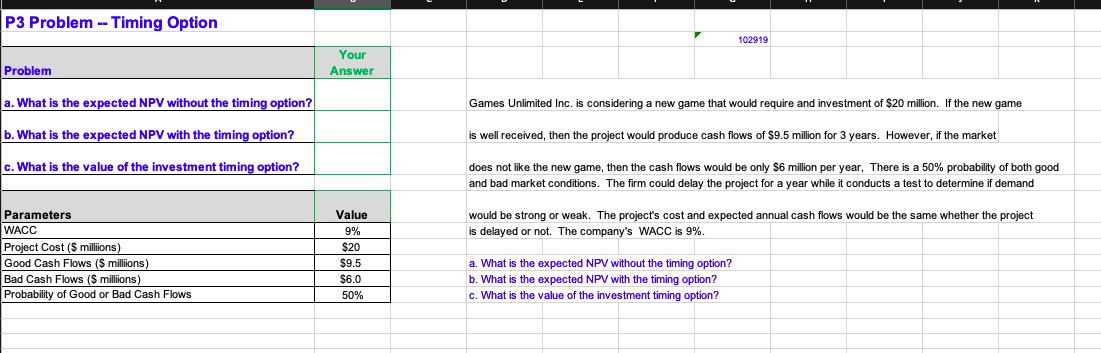

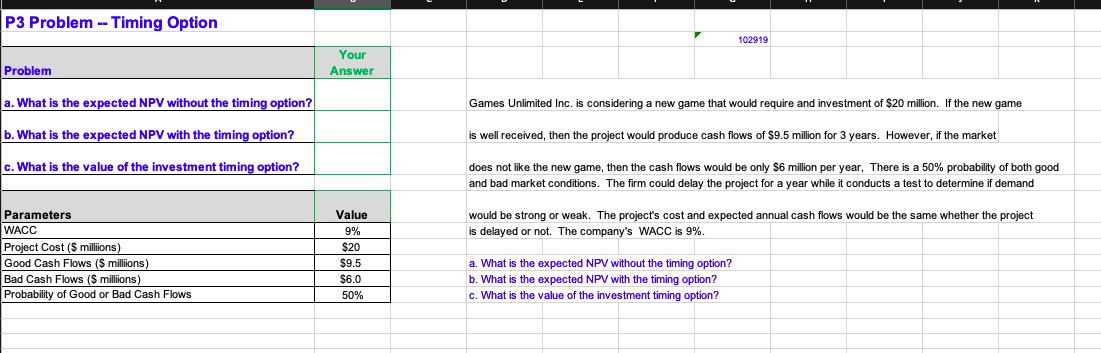

P3 Problem -- Timing Option 102919 Your Answer Problem a. What is the expected NPV without the timing option? Games Unlimited Inc. is considering a new game that would require and investment of $20 million. If the new game b. What is the expected NPV with the timing option? is well received, then the project would produce cash flows of $9.5 million for 3 years. However, if the market c. What is the value of the investment timing option? does not like the new game, then the cash flows would be only $6 million per year. There is a 50% probability of both good and bad market conditions. The firm could delay the project for a year while it conducts a test to determine if demand Value would be strong or weak. The project's cost and expected annual cash flows would be the same whether the project is delayed or not. The company's WACC is 9%. 9% Parameters WACC Project Cost ($ millions) Good Cash Flows ($ milliions) Bad Cash Flows ($ millions) Probability of Good or Bad Cash Flows $20 $9.5 $6.0 50% a. What is the expected NPV without the timing option? b. What is the expected NPV with the timing option? c. What is the value of the investment timing option? P3 Problem -- Timing Option 102919 Your Answer Problem a. What is the expected NPV without the timing option? Games Unlimited Inc. is considering a new game that would require and investment of $20 million. If the new game b. What is the expected NPV with the timing option? is well received, then the project would produce cash flows of $9.5 million for 3 years. However, if the market c. What is the value of the investment timing option? does not like the new game, then the cash flows would be only $6 million per year. There is a 50% probability of both good and bad market conditions. The firm could delay the project for a year while it conducts a test to determine if demand Value would be strong or weak. The project's cost and expected annual cash flows would be the same whether the project is delayed or not. The company's WACC is 9%. 9% Parameters WACC Project Cost ($ millions) Good Cash Flows ($ milliions) Bad Cash Flows ($ millions) Probability of Good or Bad Cash Flows $20 $9.5 $6.0 50% a. What is the expected NPV without the timing option? b. What is the expected NPV with the timing option? c. What is the value of the investment timing option