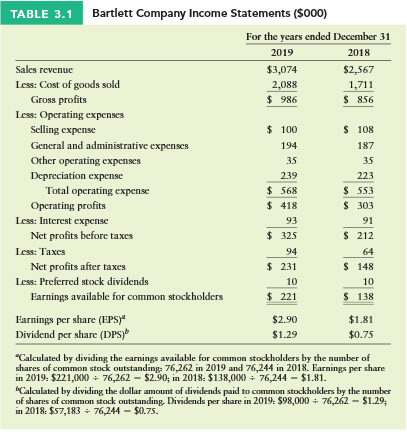

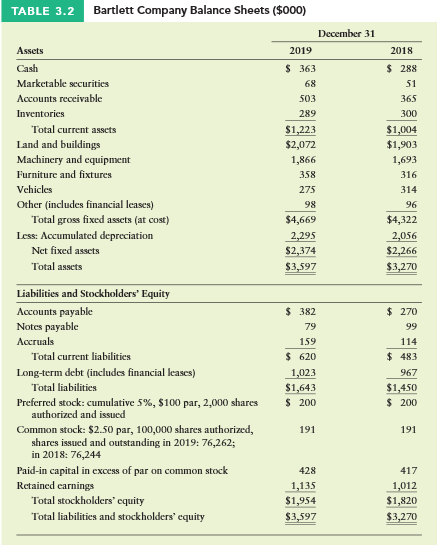

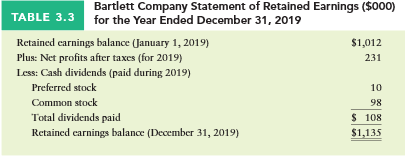

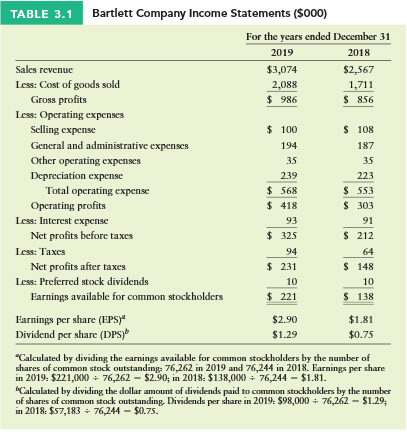

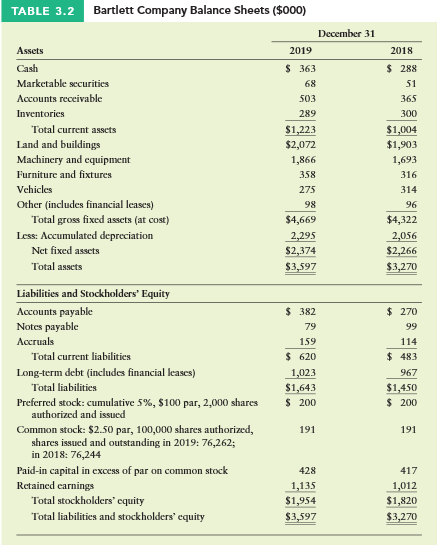

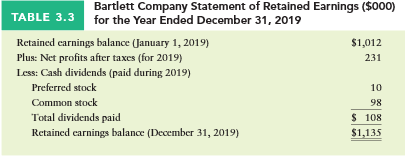

P3-18 Using Tables 3.1, 3.2, and 3.3, conduct a complete ratio analysis of the Bartlett Company for the years 2018 and 2019. You should assess the firms liquidity, activ-ity, debt, and profitability ratios. Highlight any particularly positive or negative developments that you uncover when comparing ratios from 2018 and 2019.

Bartlett Company Income Statements ($000) TABLE 3.1 For the years ended December 31 2019 $3,074 2,088 $ 986 2018 $2,567 1,711 S 856 Sales revenue Less: Cost of goods sold Gross profits Less: Operating expenses Selling expense $ 100 194 35 239 568 $ 418 93 $325 94 $231 10 108 187 3.5 223 S 553 S 303 91 S 212 64 S 148 10 General and administrative expenses Other operating expenses Depreciation expense Total operating expense Operating profits Less: Interest expense Net profits before taxes Less: Taxes Net profits after taxes Less: Preferred stock dividends Earnings available for common stockholders 5221 138 $1.81 $0.75 Earnings per share (EPS Dividend per share (DPS)b $2.90 S1.29 Calculated by dividing the earnings available for common stockholders by the number of shares of common stock outstanding: 76,262 in 2019 and 76,244 in 2018. Earnings per share in 2019. $221,00076,262-$2.90, in 2018:$138,00076,244- $1.81 Calculated by dividing the dollar amount of dividends paid toon stockholders by the number of shares of common stock outstanding. Dividends per share in 2019. $98,000 76,262 - $1.29 in 2018: $57,18376,244-$0.7S. Bartlett Company Balance Sheets ($000) TABLE 3.2 December 31 2019 S 363 68 503 289 2018 $ 288 Accounts receivable $1,004 $1,903 1,693 316 314 Total current asscts Land and buildings Machinery and equipment Furniture and fixtures Vehicles Other (includes financial leases) $2,072 1,866 275 98 $4,669 Total gross fixed assets (at Less: Accumulated depreciation $4,322 cost) Net fixed assets Total assets Liabilities and Stockholders' Equity Accounts payable Notes payable $ 382 $ 270 159 620 1,023 114 Total current liabilities $ 483 Long-term debt (includes financial leases) Preferred stock: cumulative 5%, $100 par, 2,000 shares Common stock: $2.50 par, 100,000 shares authorized, Total liabilities 1,450 $ 200 S 200 authorized and issued 191 191 shares issued and outstanding in 2019: 76,262; in 2018: 76,244 Paid-in capital in excess of par on common stock Retained earnings 417 ,012 $1,820 428 1,135 $1,954 S3,597 Total stockholders' equity Total liabilities and stockholders' equity Bartlett Company Statement of Retained Earnings ($000) for the Year Ended December 31, 2019 TABLE 3.3 earnings balance January 1,2019) Retained c Plus: Net profits after taxes (for 2019) Less: Cash dividends (paid during 2019) 1,012 231 Preferred stock Common stock Total dividends paid Retained carnings balance (December 31, 2019) 10 98 S 108 1,135