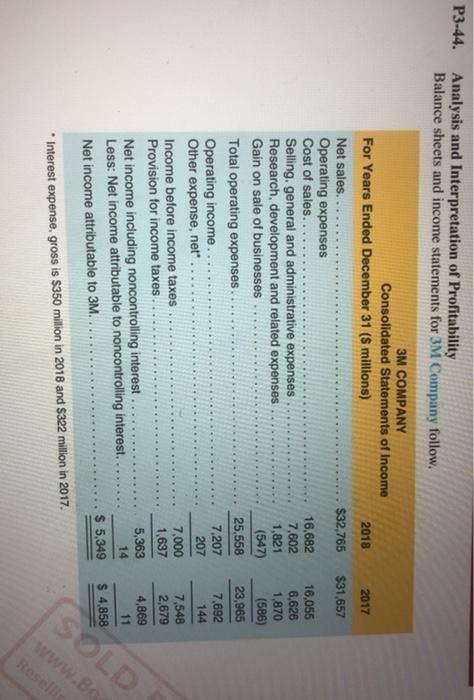

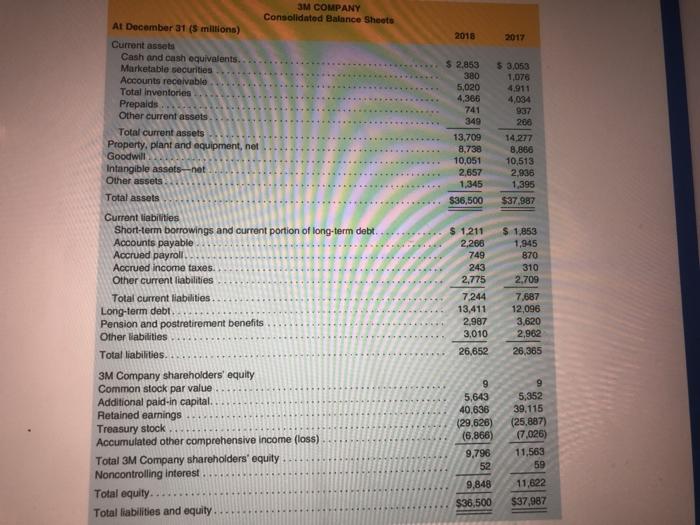

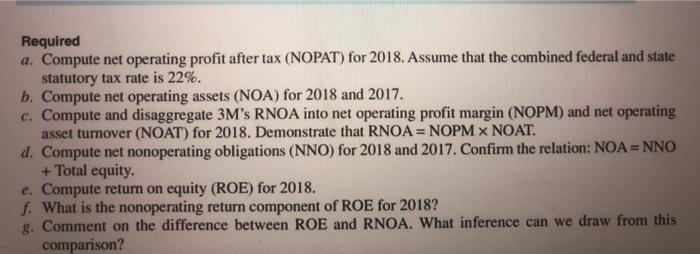

P3-44. Analysis and Interpretation of Profitability Balance sheets and income statements for 3M Company follow. 2018 2017 $32,765 $31,657 3M COMPANY Consolidated Statements of Income For Years Ended December 31 ($ millions) Net sales. Operating expenses Cost of sales.. Selling, general and administrative expenses Research, development and related expenses Gain on sale of businesses Total operating expenses Operating income Other expense, net Income before income taxes Provision for income taxes Net income including noncontrolling interest Less: Net income attributable to noncontrolling interest. Net income attributable to 3M. 16,682 7,602 1,821 (547) 25,558 7,207 207 16,055 6,626 1,870 (586) 23,965 7,692 144 7,000 1,637 5,363 14 7,548 2,679 4,869 11 $ 4,858 SOLD $ 5,349 www.Bo Reselle Interest expense, gross is $350 million in 2018 and $322 million in 2017. Required a. Compute net operating profit after tax (NOPAT) for 2018. Assume that the combined federal and state statutory tax rate is 22%. b. Compute net operating assets (NOA) for 2018 and 2017. c. Compute and disaggregate 3M's RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2018. Demonstrate that RNOA = NOPM x NOAT. d. Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Total equity. e. Compute return on equity (ROE) for 2018. f. What is the nonoperating return component of ROE for 2018? 8. Comment on the difference between ROE and RNOA. What inference can we draw from this comparison? 2018 2017 $ 3,053 1,076 3M COMPANY Consolidated Balance Sheets At December 31 (5 millions) Current assets Cash and cash equivalents... Marketable securities Accounts receivable Total Inventories Prepalds Other current assets Total current assets Property, plant and equipment, net Goodwill Intangible assets.net Other assets Total assets $ 2,853 380 5,020 4,366 741 349 13,709 8,738 10,051 2,657 1,345 $36,500 937 206 14,277 8.886 10,513 2936 1,395 $37.987 . $ 1211 2,268 749 243 2,775 Current liabilities Short-term borrowings and current portion of long-term debt Accounts payable Accrued payroll Accrued income taxes. Other current liabilities Total current liabilities. Long-term debt Pension and postretirement benefits Other liabilities Total liabilities. 7244 13,411 2.987 3,010 26,652 $ 1,853 1,945 870 310 2.709 7,687 12,096 3,620 2,982 26.365 3M Company shareholders' equity Common stock par value Additional paid-in capital. Retained earnings Treasury stock Accumulated other comprehensive income (loss) Total 3M Company shareholders' equity Noncontrolling interest Total equity Total liabilities and equity 9 5,643 40,636 (29,626) (6,866) 9,796 52 9 5,352 39.115 (25,887) (7,026) 11,563 59 9,848 $36,500 11,822 $37,987