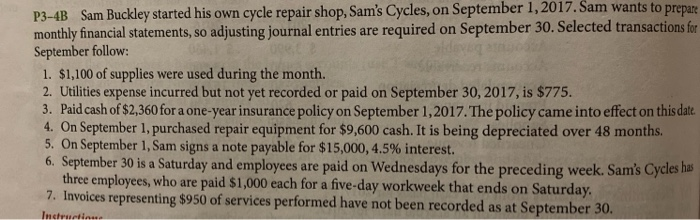

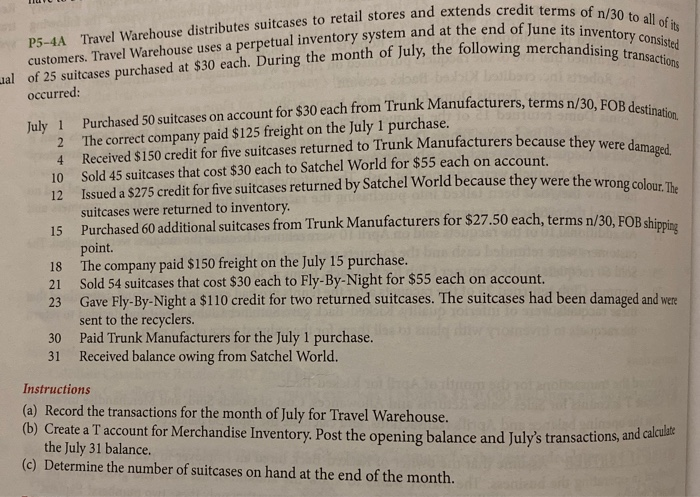

P3-4B Sam Buckley started his own cycle repair shop, Sam's Cycles, on September 1, 2017. Sam wants to prepare monthly financial statements, so adjusting journal entries are required on September 30. Selected transactions for September follow: 1. $1,100 of supplies were used during the month. 2. Utilities expense incurred but not yet recorded or paid on September 30, 2017, is $775. 3. Paid cash of $2,360 for a one-year insurance policy on September 1, 2017. The policy came into effect on this date. 4. On September 1, purchased repair equipment for $9,600 cash. It is being depreciated over 48 months. 5. On September 1, Sam signs a note payable for $15,000, 4.5% interest. 6. September 30 is a Saturday and employees are paid on Wednesdays for the preceding week. Sam's Cycles has three employees, who are paid $1,000 each for a five-day workweek that ends on Saturday, 7. Invoices representing $950 of services performed have not been recorded as at September 30. Incrutin ds credit terms of n/30 to all of its of lune its inventory consisted wing merchandising transactions urers, terms n/30, FOB destination, cause they were damaged. P5-4A Travel Warehouse distributes suitcases to retail stores and extends credit ter customers. Travel Warehouse uses a perpetual inventory system and at the end of luneita al of 25 suitcases purchased at $30 each. During the month of July, the following mercha occurred: July 1 Purchased 50 suitcases on account for $30 each from Trunk Manufacturers, terms / 2 The correct company paid $125 freight on the July 1 purchase. 4 Received $150 credit for five suitcases returned to Trunk Manufacturers because they were 10 Sold 45 suitcases that cost $30 each to Satchel World for $55 each on account. 12 Issued a $275 credit for five suitcases returned by Satchel World because they were the wron suitcases were returned to inventory. 15 Purchased 60 additional suitcases from Trunk Manufacturers for $27.50 each, terms n/30. FOR chin point. 18 The company paid $150 freight on the July 15 purchase. 21 Sold 54 suitcases that cost $30 each to Fly-By-Night for $55 each on account. 23 Gave Fly-By-Night a $110 credit for two returned suitcases. The suitcases had been damaged and were sent to the recyclers. 30 Paid Trunk Manufacturers for the July 1 purchase. 31 Received balance owing from Satchel World. Instructions (a) Record the transactions for the month of July for Travel Warehouse. (b) Create a T account for Merchandise Inventory. Post the opening balance and July's transactions, and care the July 31 balance. (c) Determine the number of suitcases on hand at the end of the month. P3-4B Sam Buckley started his own cycle repair shop, Sam's Cycles, on September 1, 2017. Sam wants to prepare monthly financial statements, so adjusting journal entries are required on September 30. Selected transactions for September follow: 1. $1,100 of supplies were used during the month. 2. Utilities expense incurred but not yet recorded or paid on September 30, 2017, is $775. 3. Paid cash of $2,360 for a one-year insurance policy on September 1, 2017. The policy came into effect on this date. 4. On September 1, purchased repair equipment for $9,600 cash. It is being depreciated over 48 months. 5. On September 1, Sam signs a note payable for $15,000, 4.5% interest. 6. September 30 is a Saturday and employees are paid on Wednesdays for the preceding week. Sam's Cycles has three employees, who are paid $1,000 each for a five-day workweek that ends on Saturday, 7. Invoices representing $950 of services performed have not been recorded as at September 30. Incrutin ds credit terms of n/30 to all of its of lune its inventory consisted wing merchandising transactions urers, terms n/30, FOB destination, cause they were damaged. P5-4A Travel Warehouse distributes suitcases to retail stores and extends credit ter customers. Travel Warehouse uses a perpetual inventory system and at the end of luneita al of 25 suitcases purchased at $30 each. During the month of July, the following mercha occurred: July 1 Purchased 50 suitcases on account for $30 each from Trunk Manufacturers, terms / 2 The correct company paid $125 freight on the July 1 purchase. 4 Received $150 credit for five suitcases returned to Trunk Manufacturers because they were 10 Sold 45 suitcases that cost $30 each to Satchel World for $55 each on account. 12 Issued a $275 credit for five suitcases returned by Satchel World because they were the wron suitcases were returned to inventory. 15 Purchased 60 additional suitcases from Trunk Manufacturers for $27.50 each, terms n/30. FOR chin point. 18 The company paid $150 freight on the July 15 purchase. 21 Sold 54 suitcases that cost $30 each to Fly-By-Night for $55 each on account. 23 Gave Fly-By-Night a $110 credit for two returned suitcases. The suitcases had been damaged and were sent to the recyclers. 30 Paid Trunk Manufacturers for the July 1 purchase. 31 Received balance owing from Satchel World. Instructions (a) Record the transactions for the month of July for Travel Warehouse. (b) Create a T account for Merchandise Inventory. Post the opening balance and July's transactions, and care the July 31 balance. (c) Determine the number of suitcases on hand at the end of the month