Answered step by step

Verified Expert Solution

Question

1 Approved Answer

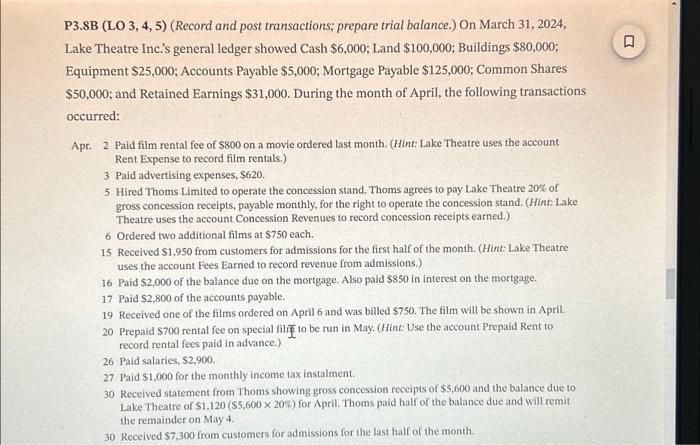

P3.8B (LO 3, 4, 5) (Record and post transactions; prepare trial balance.) On March 31, 2024, Lake Theatre Inc.'s general ledger showed Cash $6,000; Land

P3.8B (LO 3, 4, 5) (Record and post transactions; prepare trial balance.) On March 31, 2024, Lake Theatre Inc.'s general ledger showed Cash $6,000; Land $100,000; Buildings $80,000; Equipment $25,000; Accounts Payable $5,000; Mortgage Payable $125,000; Common Shares $50,000; and Retained Earnings $31,000. During the month of April, the following transactions occurred: Apr. 2 Paid film rental fee of $800 on a movie ordered last month. (Hint: Lake Theatre uses the account Rent Expense to record film rentals.) 3 Paid advertising expenses, $620. 5 Hired Thoms Limited to operate the concession stand. Thoms agrees to pay Lake Theatre 20% of gross concession receipts, payable monthly, for the right to operate the concession stand. (Hint: Lake Theatre uses the account Concession Revenues to record concession receipts earned.) 6 Ordered two additional films at $750 each. 15 Received $1,950 from customers for admissions for the first half of the month. (Hint: Lake Theatre uses the account Fees Earned to record revenue from admissions.) 16 Paid $2,000 of the balance due on the mortgage. Also paid $850 in interest on the mortgage. 17 Paid $2,800 of the accounts payable. 19 Received one of the films ordered on April 6 and was billed $750. The film will be shown in April. 20 Prepaid $700 rental fee on special film to be run in May. (Hint: Use the account Prepaid Rent to record rental fees paid in advance.) 26 Paid salaries, $2,900. 27 Paid $1,000 for the monthly income tax instalment. 30 Received statement from Thoms showing gross concession receipts of $5,600 and the balance due to Lake Theatre of $1,120 ($5,600 x 20%) for April. Thoms paid half of the balance due and will remit the remainder on May 4. 30 Received $7,300 from customers for admissions for the last half of the month. 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started