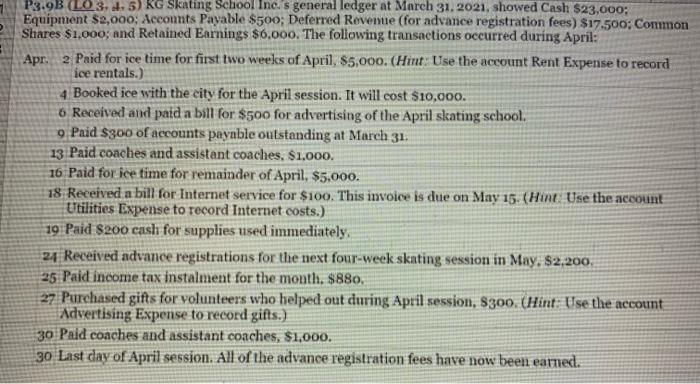

P3.9B (LO3, 5) KG Skating School Inc. s general ledger at March 31, 2021, showed Cash $23,000: Equipment $2,000: Accounts Payable $500; Deferred Revenue (for advance registration fees) $17.500: Common Shares $1.000; and Retained Earnings $6.000. The following transactions occurred during April: Apr.2 Paid for ice time for first two weeks of April, $5,000. (Hint: Use the account Rent Expense to record ice rentals.) 4 Booked ice with the city for the April session. It will cost $10,000. 6 Received and paid a bill for $500 for advertising of the April skating school. 9 Paid $300 of accounts payable outstanding at March 31. 13 Paid coaches and assistant coaches. $1,000. 16 Paid for ice time for remainder of April, $5,000. 18 Received a bill for Internet service for $100. This invoice is due on May 15. (Het Use the account Utilities Expense to record Internet costs.) 19 Paid $200 cash for supplies used immediately 24 Received advance registrations for the next four-week skating session in May. $2,200, 25 Paid income tax instalment for the month. $880. 27 Purchased gifts for volunteers who helped out during April session, $300. (Hint: Use the account Advertising Expense to record gifts.) 30 Paid coaches and assistant coaches, $1,000. 30 Last day of April session. All of the advance registration fees have now been earned. P3.9B (LO3, 5) KG Skating School Inc. s general ledger at March 31, 2021, showed Cash $23,000: Equipment $2,000: Accounts Payable $500; Deferred Revenue (for advance registration fees) $17.500: Common Shares $1.000; and Retained Earnings $6.000. The following transactions occurred during April: Apr.2 Paid for ice time for first two weeks of April, $5,000. (Hint: Use the account Rent Expense to record ice rentals.) 4 Booked ice with the city for the April session. It will cost $10,000. 6 Received and paid a bill for $500 for advertising of the April skating school. 9 Paid $300 of accounts payable outstanding at March 31. 13 Paid coaches and assistant coaches. $1,000. 16 Paid for ice time for remainder of April, $5,000. 18 Received a bill for Internet service for $100. This invoice is due on May 15. (Het Use the account Utilities Expense to record Internet costs.) 19 Paid $200 cash for supplies used immediately 24 Received advance registrations for the next four-week skating session in May. $2,200, 25 Paid income tax instalment for the month. $880. 27 Purchased gifts for volunteers who helped out during April session, $300. (Hint: Use the account Advertising Expense to record gifts.) 30 Paid coaches and assistant coaches, $1,000. 30 Last day of April session. All of the advance registration fees have now been earned