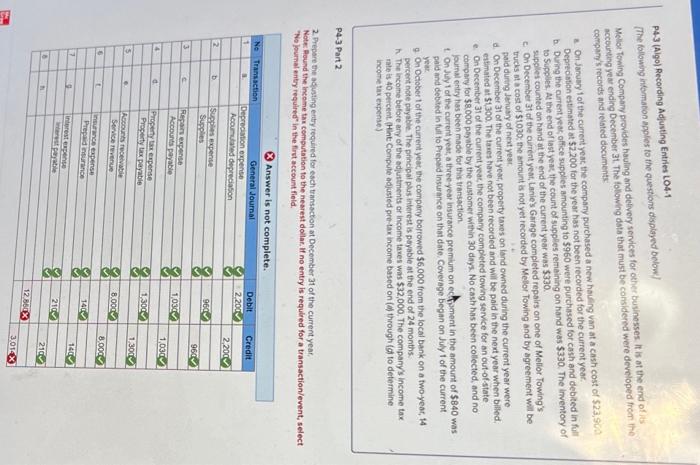

P4-3 (Algo) Recording Adjusting Entries LO4.1 (The following intematon applies to the guestions displayed belowl Melot fowing Company provides hauling and detivery senices for other businesses it is at the end of is acceunting year ending December 31 . The following data that must be considered were developed from the company's records and related documents: a. On january tot the current yeac the company purchased a new hauing van at a cash cost of 523,900 Depreciation estmated at $2,200 for the year has not been recorded for the current year. b. Duing the curment yeak office supplies amounting to $960 wete purchased for cash and debited in full to Scupples. At the end of last yeas the count of supples rerieining on hand was $330. The irventory of supgles counted on hand at the end of the current year was $330. c. On December 3t of the cuirent yeat, Laries Garage completed repairs on one of Mellor Towing's truds at a cost of 51030 ; the ameunt is not yet recorded by Melor Towing and by agreement will be paid durting lenusyy of next yeat: d. On December 31 of the curreat year, property taxes on tand owhed during the current year were ettimated at 51300 . The tares have not been recorded and will be paid in the next year when billed: e On December 31 of the current yeac, the company completed towing service for an out-ofstate compary for $8.000 peynble by the customer within 30 days. No cash has been collected, and no fournal ertry has been made for this transaction. 1. On Juyy 1 of the current yest, a three yeat insurance premium on echisment in the amount of 5840 was pald and debted in fult to Prepaid insurance on that date. Coverage began on July 1 of the current year If On Odiober tof the current yeac, the compary borrowed $6,000 from the local bank on a two-yeac, 14 percent note payatle. The pincipal plus interest is poyable at the end of 24 months. h. The income before ary of the odjutments of income taxes wis $32,000. The companys income tax tate is 40 percent. (Hint Compute adjusted pre-tax income based on (i) through (g) to determine income tax expense) P4-3 Part 2 2. Prepare the actusting entry reculied for esch transacton at Decomber 31 of the current yeaf, Note flound the inceme tax computation to the nesiest dollar. If no entry is requbed for a transaction/event, select. "No pomal entry required" in the first account field