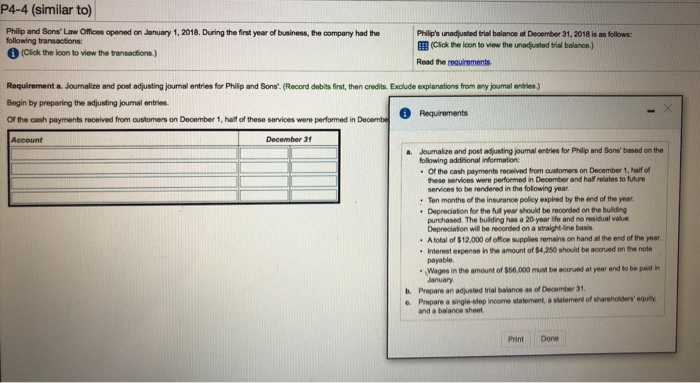

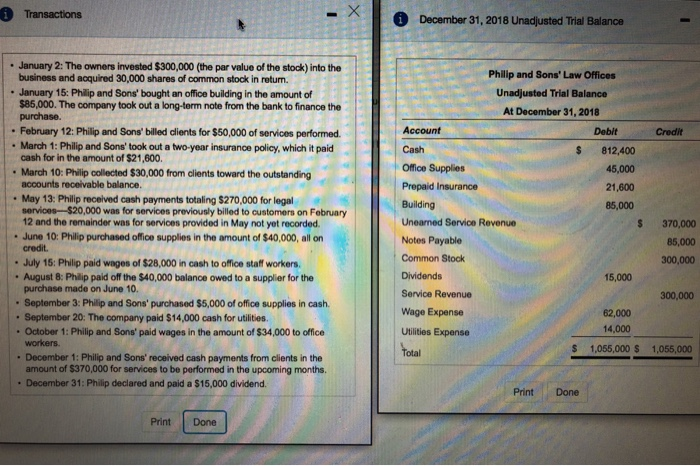

P4-4 (similar to) Philip and Sons' Law Offices opened on January 1, 2018. During the first year of business, the company had the following transactions: 1(Click the loon to view the transactions.) Philip's unadjusted trial balance at December 31, 2018 is as follows EII (Click the icon to view the unadjusted trial balance.) Read the requrements Requirement a. Joumalize and post adjusting journal entries for Philip and Sons. (Record debits first, then credits. Exclude explanations from any joumal entries.) Begin by preparing the adjusting joumal entries Of the cash payments received from austomers on Deoember 1, hailf of these services were performed in Decembe Requirements Account December 31 aJournaize and post adjusting jounal entries for Philip and Sons based on the following addisional information Of the cash payments received from customers on December 1, half of hese services were performed in December and haf relates to future services to be rendered in the folowing year :Ten months of the insurance policy expired by the nd of the yea Depreciation for the full year should be recorded on the building purchased. The building has a 20-year ife and no residual value. Depreciaton will be recorded on a straight-line basis A total of $12,000 of office supplies remains on hand at the end of the year Interest expense in the amount of $4,250 should be accrued on the note payable Wages in the amount of $66,000 must be acorued at year and to be paid in January b. Propare an adjusted trial balance as of December 31 G. Propare a single etop income statement, a statement of shareholders' equity and a balance sheet Print Done Transactions December 31, 2018 Unadjusted Trial Balance January 2: The owners invested $300,000 (the par value of the stock) into the business and acquired 30,000 shares of common stock in return. January 15: Philip and Sons' bought an office building in the amount of $85,000. The company took out a long-term note from the bank to finance the purchase. Philip and Sons' Law Offices Unadjusted Trial Balance At December 31, 2018 . February 12: Philip and Sons' billed clients for $50,000 of services performed. March 1: Philip and Sons' took out a two-year insurance policy, which it paicd Account Cash Office Supplies Prepaid Insurance Building Unearned Service Revenue Notes Payable Common Stock Debit Credit $ 812,400 45,000 21,600 85,000 cash for in the amount of $21,600. March 10: Philip collected $30,000 from clients toward the outstanding accounts receivable balance. May 13: Philip received cash payments totaling $270,000 for legal services-$20,000 was for services previously billed to customers on Fobruary 12 and the remainder was for services provided in May not yet recorded. June 10: Philip purchased office supplies in the amount of $40,000, all on credit $ 370,000 85,000 300,000 July 15: Philip paid wages of $28,000 in cash to office staff workers. .August 8: Philip paid off the $40,000 balance owed to a supplier for the 15,000 purchase made on June 10. September 3: Philip and Sons' purchased $5,000 of office supplies in cash. September 20: The company paid $14,000 cash for utilities. October 1: Philip and Sons' paid wages in the amount of $34,000 to office workers December 1: Philip and Sons received cash payments from clients in the amount of $370,000 for services to be performed in the upcoming months. December 31: Philip declared and paid a $15,000 dividend. Service Revenue Wage Expense Utilities Expense 300,000 . 62,000 14,000 $ 1,055,000 S 1,055,000 Print Done Print Done