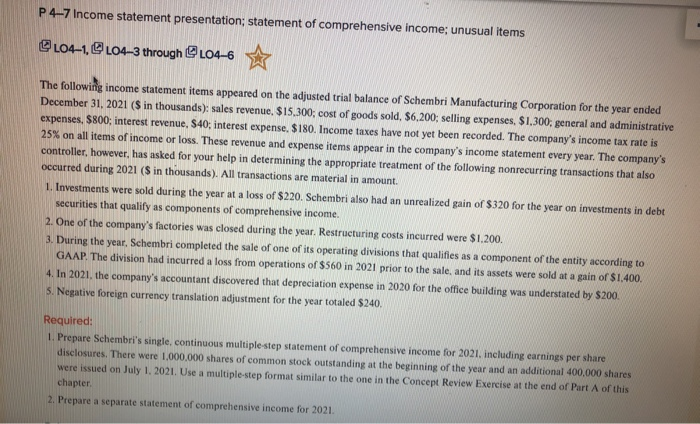

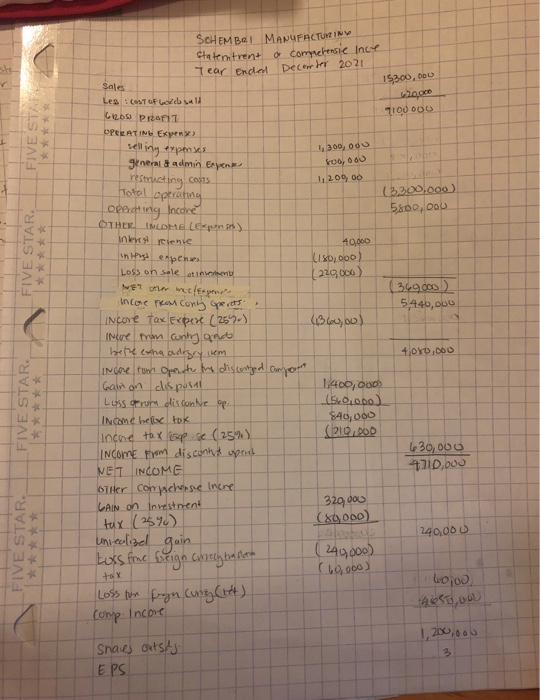

P4-7 Income statement presentation; statement of comprehensive income; unusual items @104- 1 104-3 through L04-6 The following income statement items appeared on the adjusted trial balance of Schembri Manufacturing Corporation for the year ended December 31, 2021 (S in thousands): sales revenue, $15,300; cost of goods sold. $6,200; selling expenses. $1.300: general and administrative expenses, $800; interest revenue, S40, interest expense, $180. Income taxes have not yet been recorded. The company's income tax rate is 25% on all items of income or loss. These revenue and expense items appear in the company's income statement every year. The company's controller, however, has asked for your help in determining the appropriate treatment of the following nonrecurring transactions that also occurred during 2021 (S in thousands). All transactions are material in amount. 1. Investments were sold during the year at a loss of $220. Schembri also had an unrealized gain of $320 for the year on investments in debt securities that qualify as components of comprehensive income. 2. One of the company's factories was closed during the year. Restructuring costs incurred were $1.200. . During the year. Schembri completed the sale of one of its operating divisions that qualifies as a component of the entity according to GAAP. The division had incurred a loss from operations of $560 in 2021 prior to the sale, and its assets were sold at a gain of $1,400. 4. In 2021, the company's accountant discovered that depreciation expense in 2020 for the office building was understated by $200. 5. Negative foreign currency translation adjustment for the year totaled $240. Required: 1. Prepare Schembri's single, continuous multiple step statement of comprehensive income for 2021. including earnings per share disclosures. There were 1,000,000 shares of common stock outstanding at the beginning of the year and an additional 400,000 shares were issued on July 1, 2021. Use a multiple-step format similar to the one in the Concept Review Exercise at the end of Part of this chapter 2. Prepare a separate statement of comprehensive income for 2021 FIVESTA FIVE STAR SCHEMBRI MANUFACTURIN statentrent a competensie ince Tear Ended December 2021 15300,000 Sales Les : COST OF Wodels 20,000 Lo priorit 100 DO selling expenses 1,300,000 general & admin Expon fuo, restructing costs 1,20900 Total operating 13.300.000) operating income 5800, OU OTHER INCOME LES interest relenie 40,000 interes expenses (180,000) Loss on sale ative (229.000) NET other nelexpens (369000) Incore From conly Gerets 5.440,000 Income Tax Expex (257) 4360,00) Incre from cantry and bepe extra adogry irem 1,080,000 Incore tom operates the discented comfort Gain on disposal 1.400,000 Loss of rom disconte op. 150,000) Income helor tox 840,000 incone tax exp se (25%). (210,00D Income from discontud opent L230,000 NET INCOME 4710,oo other comprehense incre GAIN on investment 320,000 tax (25%) (80.000) unrealizel 240,000 gain toxs frue beign concly trasloch (249,000) tox ( 60,000) 60,00 Loss for fryn Cung (4) Comp. Incore 1,200.000 Snaces outsds. EPS FIVE STAR FIVE STAR 40st, an