Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P5: Errors & Changes in Accounting Policy & Tax Strategy Ramadan began operations on January 1, 2023. Financial statements for 2021 and 2022 contained

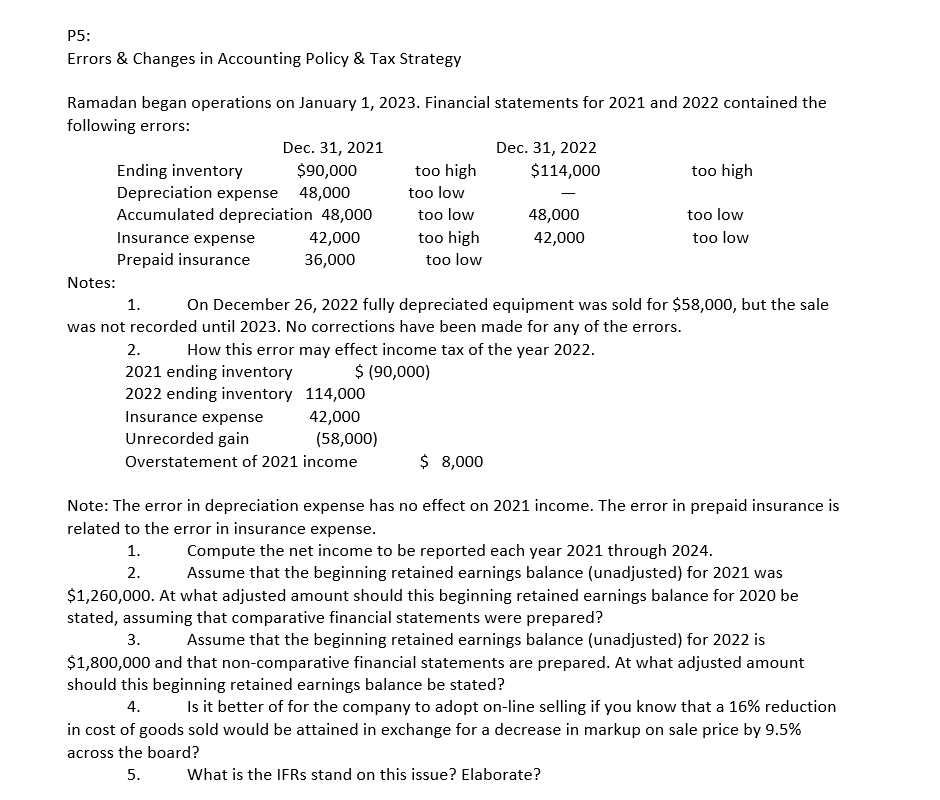

P5: Errors & Changes in Accounting Policy & Tax Strategy Ramadan began operations on January 1, 2023. Financial statements for 2021 and 2022 contained the following errors: Dec. 31, 2021 Dec. 31, 2022 Ending inventory $90,000 too high $114,000 Depreciation expense 48,000 too low - Accumulated depreciation 48,000 too low 48,000 Insurance expense 42,000 too high 42,000 Prepaid insurance 36,000 too low Notes: too high too low too low 1. On December 26, 2022 fully depreciated equipment was sold for $58,000, but the sale was not recorded until 2023. No corrections have been made for any of the errors. 2. How this error may effect income tax of the year 2022. 2021 ending inventory $ (90,000) 2022 ending inventory 114,000 Insurance expense Unrecorded gain 42,000 (58,000) $ 8,000 Overstatement of 2021 income Note: The error in depreciation expense has no effect on 2021 income. The error in prepaid insurance is related to the error in insurance expense. 1. Compute the net income to be reported each year 2021 through 2024. 2. Assume that the beginning retained earnings balance (unadjusted) for 2021 was $1,260,000. At what adjusted amount should this beginning retained earnings balance for 2020 be stated, assuming that comparative financial statements were prepared? 3. Assume that the beginning retained earnings balance (unadjusted) for 2022 is $1,800,000 and that non-comparative financial statements are prepared. At what adjusted amount should this beginning retained earnings balance be stated? 4. Is it better of for the company to adopt on-line selling if you know that a 16% reduction in cost of goods sold would be attained in exchange for a decrease in markup on sale price by 9.5% across the board? 5. What is the IFRS stand on this issue? Elaborate?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started