Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P5.1 A motel has established a petty cash fund of $100 that is controlled by the day shift desk clerk. During October, the following disbursements

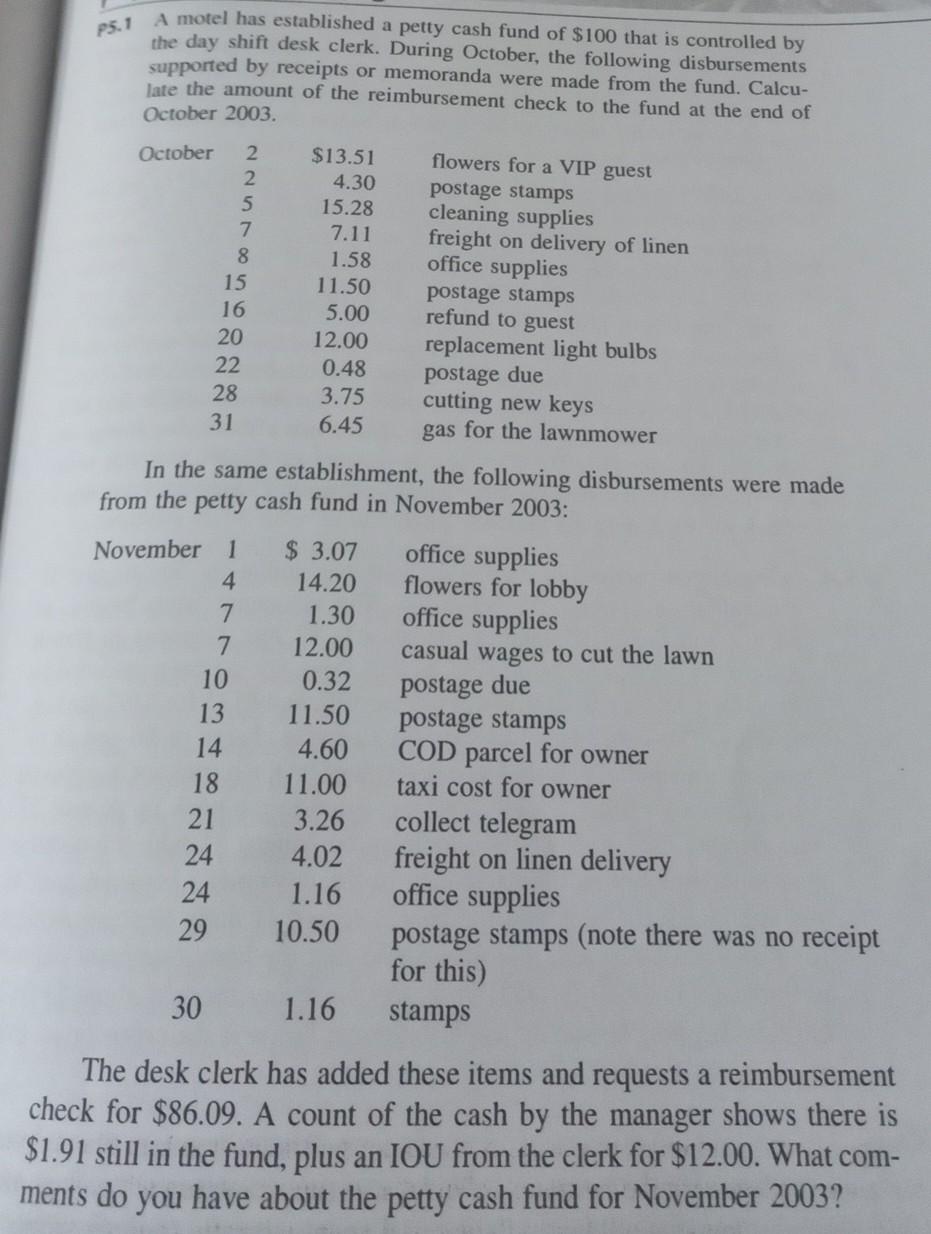

P5.1 A motel has established a petty cash fund of $100 that is controlled by the day shift desk clerk. During October, the following disbursements supported by receipts or memoranda were made from the fund. Calcu- late the amount of the reimbursement check to the fund at the end of October 2003 October 2 2 5 7 8 15 16 20 22 28 31 $13.51 4.30 15.28 7.11 1.58 11.50 5.00 12.00 0.48 3.75 6.45 flowers for a VIP guest postage stamps cleaning supplies freight on delivery of linen office supplies postage stamps refund to guest replacement light bulbs postage due cutting new keys gas for the lawnmower In the same establishment, the following disbursements were made from the petty cash fund in November 2003: November 1 4 7 7 10 13 14 office supplies flowers for lobby office supplies casual wages to cut the lawn postage due $ 3.07 14.20 1.30 12.00 0.32 11.50 4.60 11.00 3.26 4.02 1.16 10.50 18. 21 24 postage stamps COD parcel for owner taxi cost for owner collect telegram freight on linen delivery office supplies postage stamps (note there was no receipt for this) stamps 24 29 30 1.16 The desk clerk has added these items and requests a reimbursement check for $86.09. A count of the cash by the manager shows there is $1.91 still in the fund, plus an IOU from the clerk for $12.00. What com- ments do you have about the petty cash fund for November 2003

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started