Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P5-2, E5-9 Buildings Cash (in bank) Cash on hand) Cash Surrender Value of Life Insurance Commission Expense Common Stock Copyrights Debt Investments (trading) Dividends Payable

P5-2, E5-9

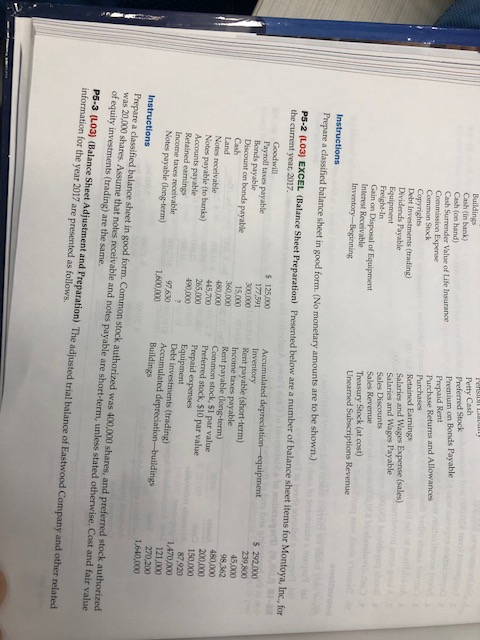

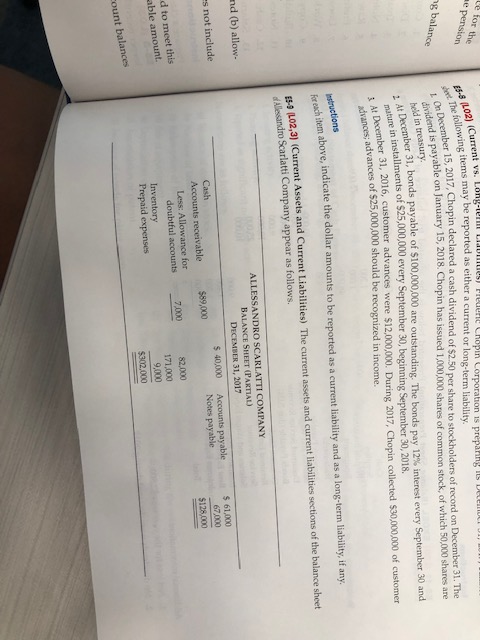

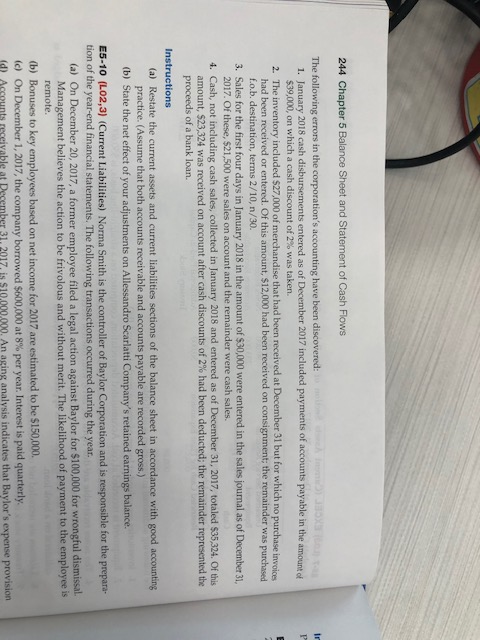

Buildings Cash (in bank) Cash on hand) Cash Surrender Value of Life Insurance Commission Expense Common Stock Copyrights Debt Investments (trading) Dividends Payable Equipment Freight.In Gain on Disposal of Equipment Interest Receivable Inventory-Beginning Petty Cash Preferred Stock Premium on Bonds Payable Prepaid Rent Purchase Returns and Allowances Purchases Retained bamings Salaries and Wages Expense (sales) Salaries and Wages Payable Sales Discounts Sales Revenue Treasury Stock (at cost) Uneamed Subscriptions Revenue Instructions pure a classified balance sheet in good form. (No monetary amounts are to be shown. PS-2 (L03) EXCEL (Balance Sheet Preparation) Presented below are a number of balance sheet items for Montoya, Inc., for the current year, 2017 Goodwill $ 125.000 Accumulated depreciation equipment $ 292,000 Payroll taxes payable 177,591 Inventory Bonds payable 239,800 300,000 Discount on bonds payable Rent payable (short-term) 45,000 15,000 Cash Income taxes payable 360.000 98,32 Land Rent payable (long-term) 480.000 Notes receivable Common stock, S1 par value 480,000 445,700 Notes payable (to banks) Preferred stock. $10 par value 200,000 265,000 Accounts payable Prepaid expenses 150.000 490.000 Retained eaming Equipment 87.920 Income taxes receivable Debt investments (trading) 1.470.000 Notes payable (long-term) 97.630 Accumulated depreciation-buildings 121,000 1,600,000 Buildings 270,200 Instructions 1,640,000 Prepare a classified balance sheet in good form. Common stock authorized was 400,000 shares, and preferred stock authorized was 20,000 shares. Assume that notes receivable and notes payable are short-term, unless stated otherwise. Cost and fair value of equity investments (trading) are the same. P5-3 (L03) (Balance Sheet Adjustment and preparation) The adjusted trial balance of Eastwood Company and other related information for the year 2017 are presented as follows. Le for the ne pension 25-8 L02) Cur sertThe followi I on December 15 Current VS. Long Frederic Chopin Corporation is preparing 15 Decem wwing items may be reported as either a current or long-term liability. aber 15, 2017, Chopin declared a cash dividend of $2.50 per share to stockholders of record on December 31. The is payable on January 15, 2018. Chopin has issued 1,000,000 shares of common stock, of which 50,000 shares are ng balance dividend is payable held in treasury 2 At December mature in installments a nber 31, bonds payable of $100,000,000 are outstanding. The bonds pay 12% interest every September 30 and ninstallments of $25,000,000 every September 30, beginning September 30, 2018. cember 31, 2016, customer advances were $12,000,000. During 2017, Chopin collected $30,000,000 of customer sadvances of $25,000,000 should be recognized in income. At December 31 advances, advances of so Instructions em above, indicate the dollar amounts to be reported as a current liability and as a long term liability, if any. L02,3) (Current Assets and Current Liabilities) The current assets and current liabilities sections of the balance sheet Alessandro Scarlatti Company appear as follows. nd (b) allow- $ 61,000 67.000 $128.000 es not include ALLESSANDRO SCARLATTI COMPANY BALANCE SHEET (PARTIAL) DECEMBER 31, 2017 Cash $ 40,000 Accounts payable Notes payable $89,000 Accounts receivable Less: Allowance for doubtful accounts 7.000 82,000 171.000 Inventory 9,000 Prepaid expenses $302.000 d to meet this able amount count balances 244 Chapter 5 Balance Sheet and Statement of Cash Flows SA The following errors in the corporation's accounting have been discovered: 1. January 2018 cash disbursements entered as of December 2017 included payments of accounts payable in the amount of $39,000, on which a cash discount of 270 was taken. 2. The inventory included $27,000 of merchandise that had been received at December 31 but for which no purchase involces had been received or entered. Of this amount, $12,000 had been received on consignment; the remainder was purchased f.o.b. destination, terms 2/10, n/30. 3. Sales for the first four days in January 2018 in the amount of $30,000 were entered in the sales journal as of December 31. 2017. Of these, $21,500 were sales on account and the remainder were cash sales. 4. Cash, not including cash sales, collected in January 2018 and entered as of December 31, 2017, totaled $35,324. Of this amount, $23,324 was received on account after cash discounts of 2% had been deducted; the remainder represented the proceeds of a bank loan. Instructions (a) Restate the current assets and current liabilities sections of the balance sheet in accordance with good accounting practice. (Assume that both accounts receivable and accounts payable are recorded gross.) (b) State the net effect of your adjustments on Allessandro Scarlatti Company's retained earnings balance. E5-10 (L02,3) (Current Liabilities) Norma Smith is the controller of Baylor Corporation and is responsible for the preparar tion of the year-end financial statements. The following transactions occurred during the year. (a) On December 20, 2017, a former employee filed a legal action against Baylor for $100,000 for wrongful dismissa Management believes the action to be frivolous and without merit. The likelihood of payment to the employee is remote. (b) Bonuses to key employees based on net income for 2017 are estimated to be $150,000 (0) On December 1, 2017, the company borrowed $600,000 at 8% per year. Interest is paid quarterly Id Accounts receivable at December 31, 2017. is $10.000.000. An aging analysis indicates that Baylor's expense provisionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started