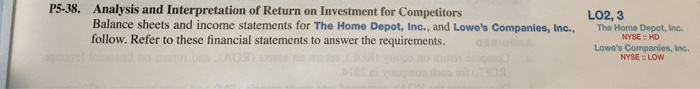

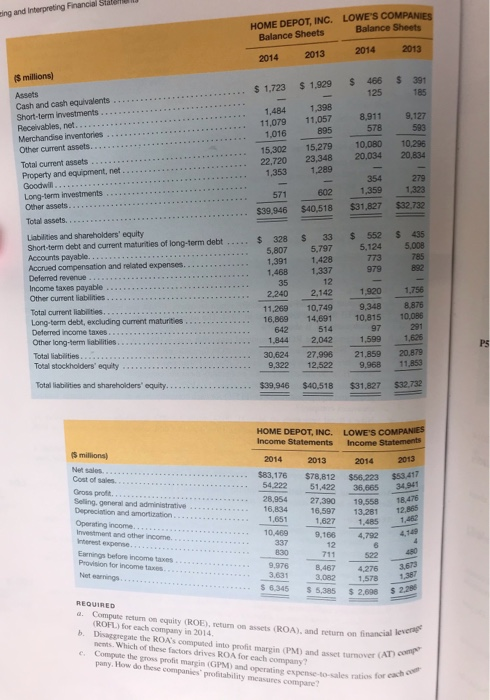

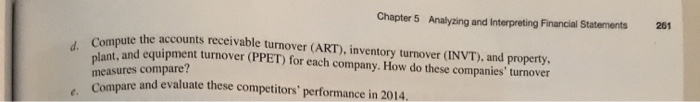

P5-38. Analysis and Interpretation of Return on Investment for Competitors Balance sheets and income statements for The Home Depot, Inc., and Lowe's Companies, Inc., follow. Refer to these financial statements to answer the requirements. LO2, 3 The Home Depot, Inc. NYSE - HD Lowe's Companies, Inc. NYSE: LOW Computeretum on equity (ROE), cumont (ROA), and return on financial love b. Det the ROAS Computed to profit margin (PM) and asset tumer An C. Com the profit margin (GIM) and opening en to-ales ratios for each ring and interpreting Financial Stal HOME DEPOT, INC. LOWE'S COMPANIES Balance Sheets Balance Sheets 2014 2013 2014 2013 $ $ 1,723 $ 1,929 466 125 $ 391 185 1,398 11,057 895 8,911 9,127 593 578 1,484 11.079 1.016 15,302 22,720 1,353 15.279 23.348 1.289 10,080 20.034 10.296 20,834 602 571 $39.946 354 1.359 $31,827 279 1,323 $32.732 $40,518 $ millions) Assets Cash and cash equivalents Short-term investments Receivables, net.. Merchandise inventories Other current assets. Total current assets Property and equipment, net Goodwill..... Long-term investments Other assets. Total assets Liabilities and shareholders' equity Short-term debt and current maturities of long-term debt Accounts payable Accrued compensation and related expenses. Deferred revenue Income taxes payable Other current liabilities Total current liabilities Long-term debt, excluding current maturities Deferred income taxes Other long-term abilities Total liabilities. Total stockholders' equity $ 552 5,124 773 979 $ 435 5.000 785 892 $ 328 5,807 1,391 1,468 35 2.240 11,269 16,889 642 1.844 30.624 9,322 $ 33 5,797 1.428 1.337 12 2.142 10.749 14,691 514 2,042 27.996 12.522 1,920 9,348 10.815 97 1.599 21,859 9.968 1.756 8.876 10,086 291 1.625 PS 20.879 11,853 Total liabilities and shareholders' equity. $39,946 $40,518 $31.827 HOME DEPOT, INC. Income Statements LOWE'S COMPANIES Income Statements 2013 (5 millions) Net sales Cost of sales Cross profit Selling general and administrative Depreciation and amortization Operating income Investment and other income 2014 $83,176 54.222 28,954 16,834 1,651 10.469 337 830 9,976 3.631 $ 8.345 $53.417 34941 18,478 12.85 2013 $78,812 51.422 27.390 16,597 1.627 9.166 12 711 8,467 3.082 $ 5.385 2014 $56.223 36,665 19,558 13.281 1,485 4,792 4 480 Eings before income Provision for income tang 522 4,276 1,578 $ 2,690 3.673 1,387 $ 2.295 REQUIRED (ROFL) for each company in 2014 Which of these factors drives ROA for each company? pomy. How do these companies profitability measures compare 261 Chapter 5 Analyzing and Interpreting Financial Statements Compute the account streceivable purnover (ART), inventory turnover (INVT), and property plant, and equipment turnover (PPET) for each company. How do these companies" turnover Compare and evaluate these competitors' performance in 2014. measures compare