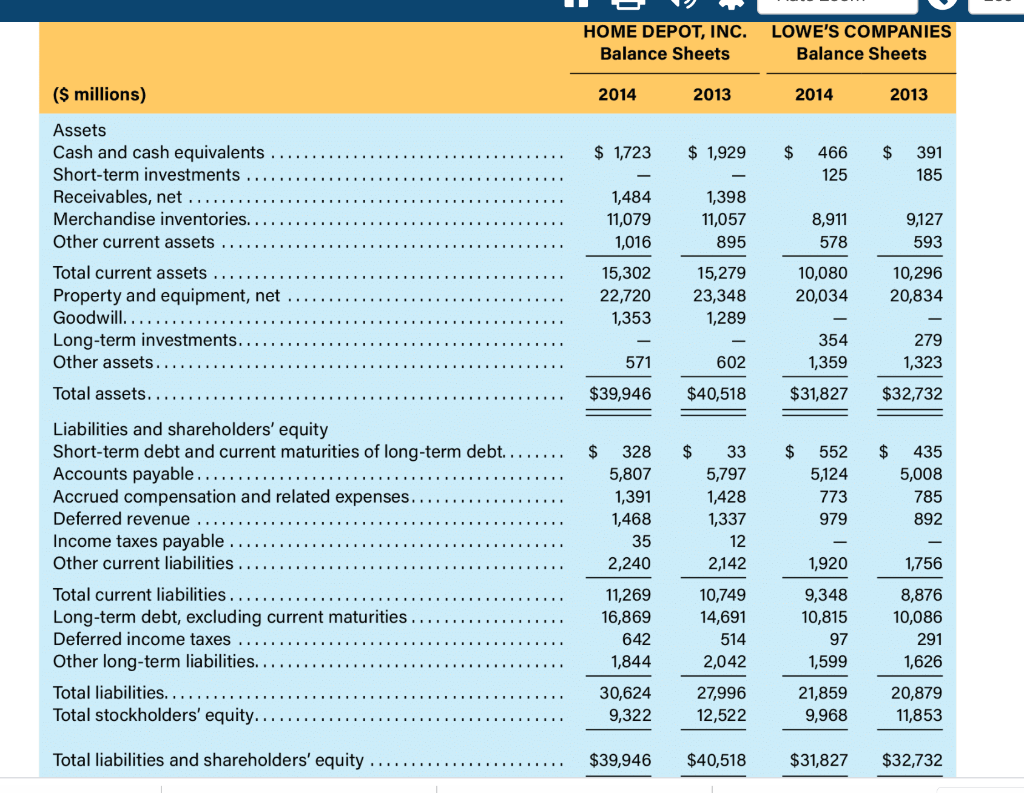

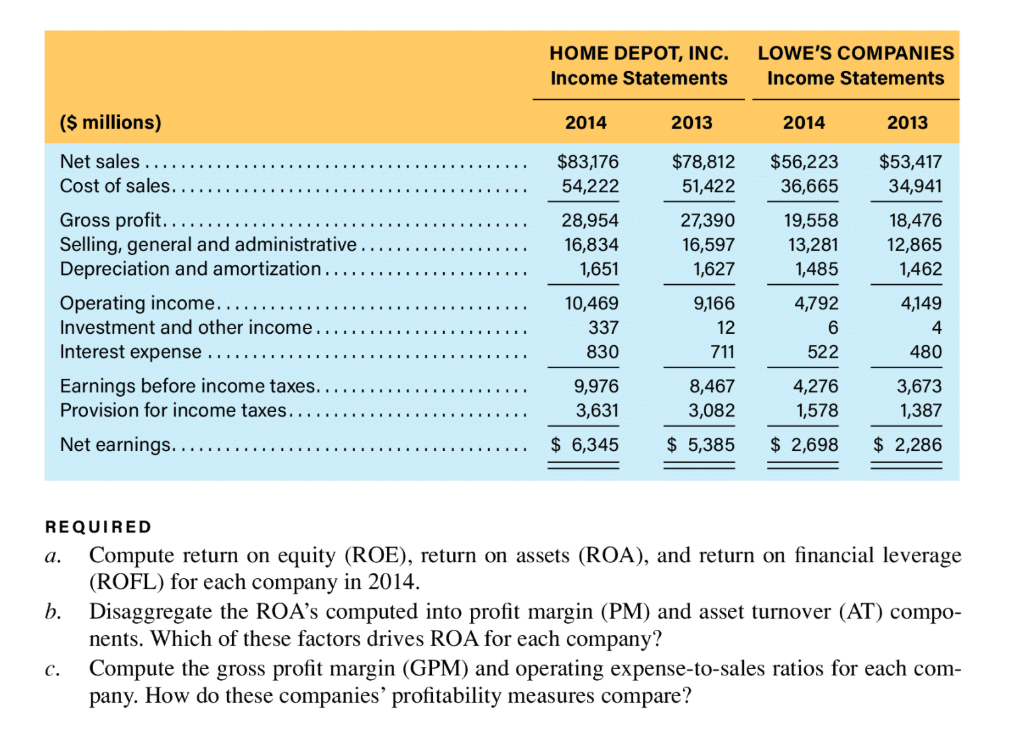

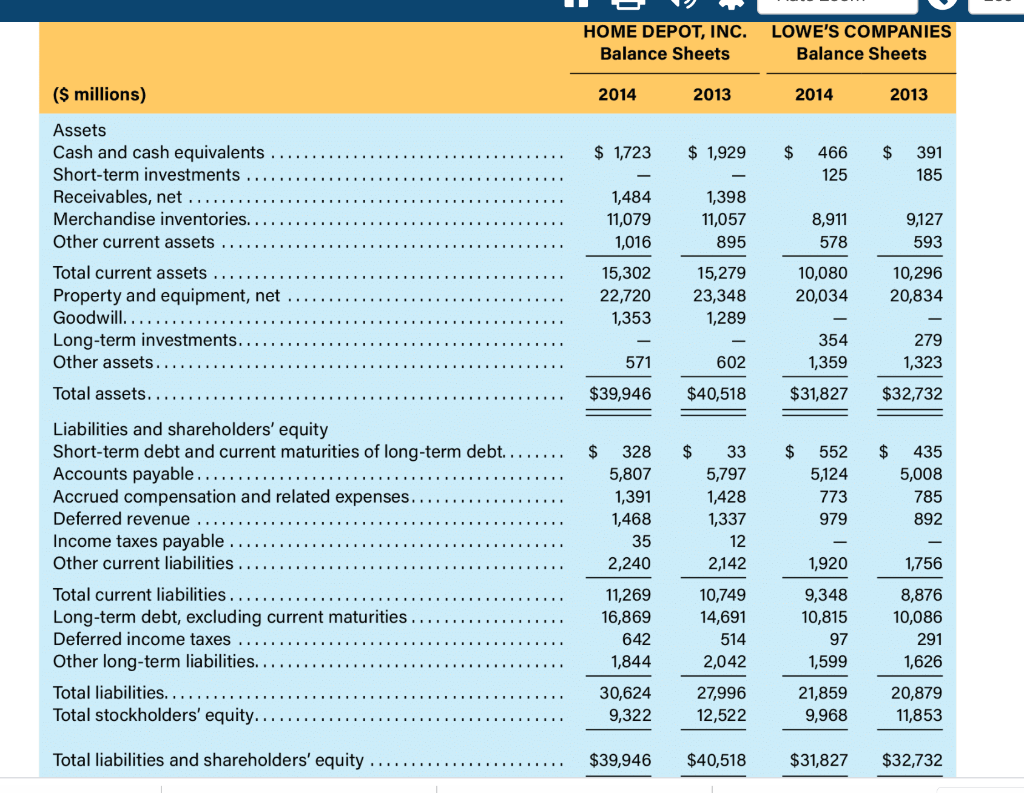

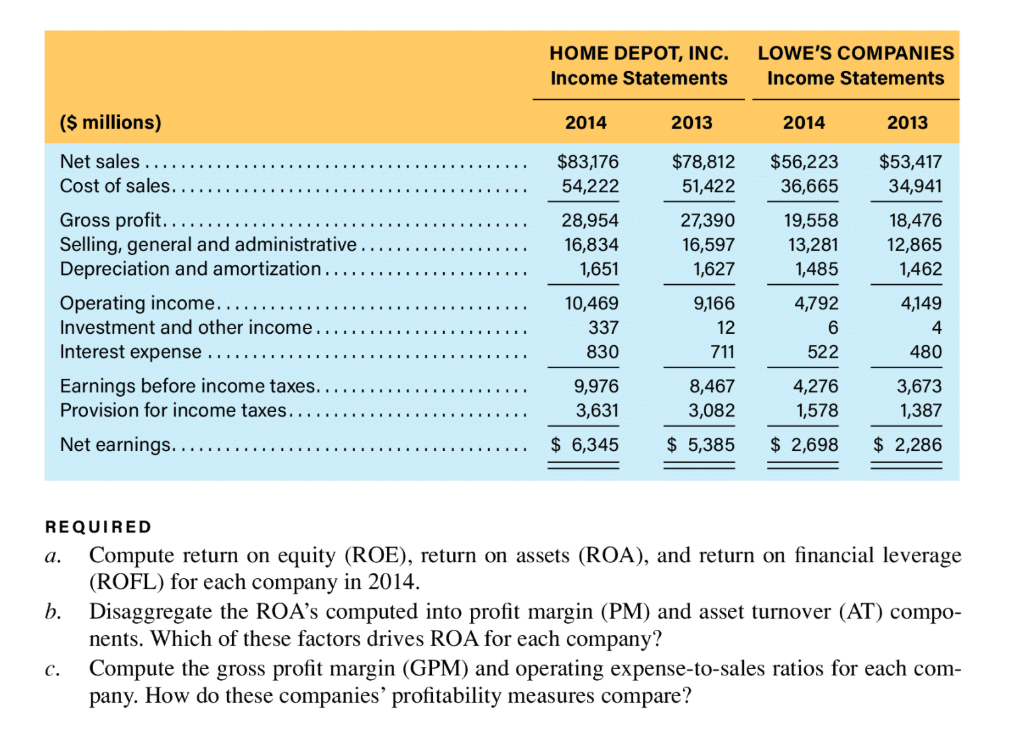

P5-38. Analysis and Interpretation of Return on Investment for Competitors Balance sheets and income statements for The Home Depot, Inc., and Lowe's Companies, Inc., follow. Refer to these financial statements to answer the requirements. HOME DEPOT, INC. Balance Sheets LOWE'S COMPANIES Balance Sheets ($ millions) 2014 2013 2014 2013 $ 1,723 $ 1,929 $ 466 125 391 185 Assets Cash and cash equivalents Short-term investments Receivables, net ... Merchandise inventories. Other current assets Total current assets Property and equipment, net Goodwill... Long-term investments. Other assets.. 1,484 11,079 1,016 1,398 11,057 8,911 578 9,127 593 895 15,302 22,720 1,353 15,279 23,348 1,289 10,080 20,034 10,296 20,834 354 1,359 279 1,323 571 602 Total assets..... $39,946 $40,518 $31,827 $32,732 $ $ $ $ 328 5,807 1,391 1,468 35 2,240 33 5,797 1,428 1,337 12 2,142 552 5,124 773 979 435 5,008 785 892 Liabilities and shareholders' equity Short-term debt and current maturities of long-term debt.. Accounts payable.... Accrued compensation and related expenses.. Deferred revenue Income taxes payable Other current liabilities Total current liabilities .... Long-term debt, excluding current maturities Deferred income taxes Other long-term liabilities. Total liabilities... Total stockholders' equity. 1,756 11,269 16,869 642 1,844 10,749 14,691 514 2,042 1,920 9,348 10,815 97 1,599 21,859 9,968 8,876 10,086 291 1,626 30,624 9,322 27,996 12,522 20,879 11,853 Total liabilities and shareholders' equity $39,946 $40,518 $31,827 $32,732 HOME DEPOT, INC. Income Statements LOWE'S COMPANIES Income Statements ($ millions) 2014 2013 2014 2013 Net sales Cost of sales. $83,176 54,222 $78,812 51,422 $56,223 36,665 $53,417 34,941 28,954 16,834 1,651 27,390 16,597 1,627 19,558 13,281 1,485 18,476 12,865 1,462 Gross profit.. Selling, general and administrative. Depreciation and amortization. Operating income.. Investment and other income. Interest expense ... Earnings before income taxes.. Provision for income taxes... Net earnings...... 10,469 337 830 9,166 12 711 4,792 6 522 4,149 4 480 8,467 9,976 3,631 4,276 1,578 3,673 1,387 3,082 $ 6,345 $ 5,385 $ 2,698 $ 2,286 a. REQUIRED Compute return on equity (ROE), return on assets (ROA), and return on financial leverage (ROFL) for each company in 2014. b. Disaggregate the ROA's computed into profit margin (PM) and asset turnover (AT) compo- nents. Which of these factors drives ROA for each company? Compute the gross profit margin (GPM) and operating expense-to-sales ratios for each com- pany. How do these companies' profitability measures compare? C