Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P5-3A. ( Note) The previous answer was incomplete.kindly prepare completely the following: 1.Journal 2. Ledger 3.complete Worksheet please please please 4.statement of account 5.Balance sheet

P5-3A.

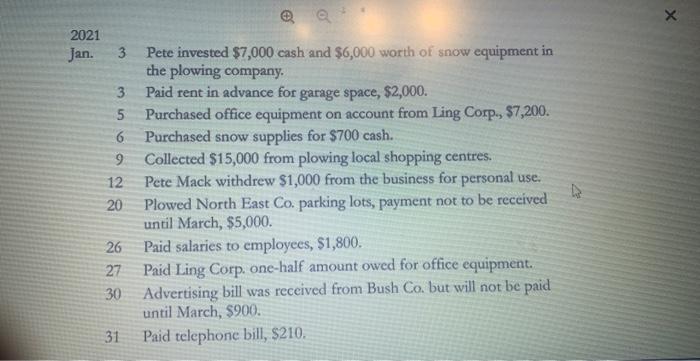

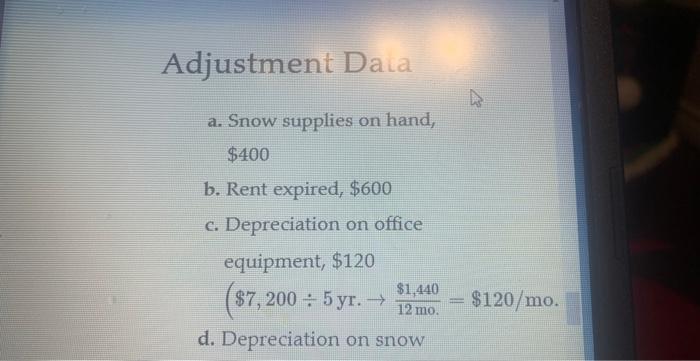

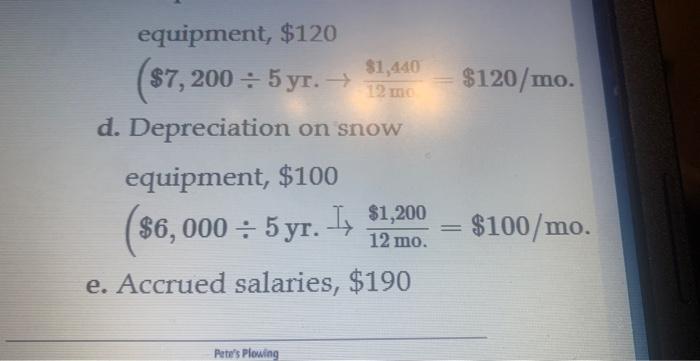

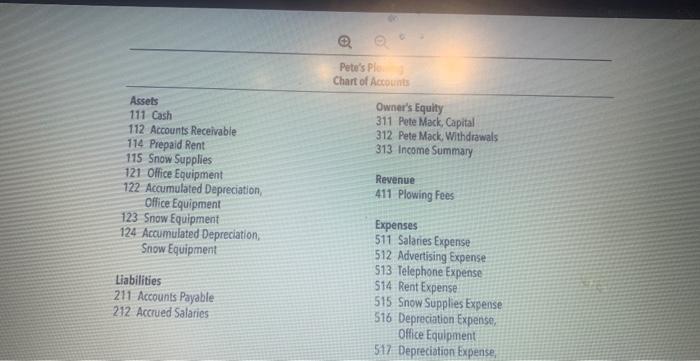

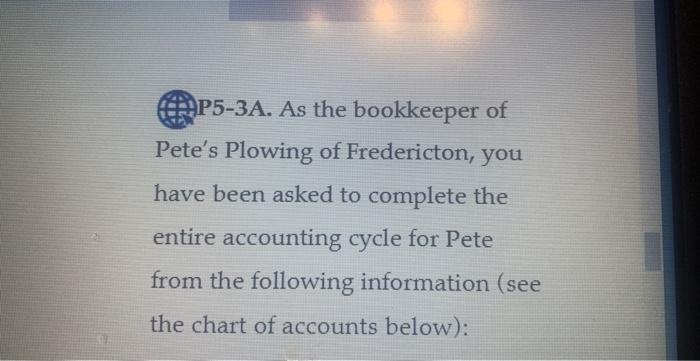

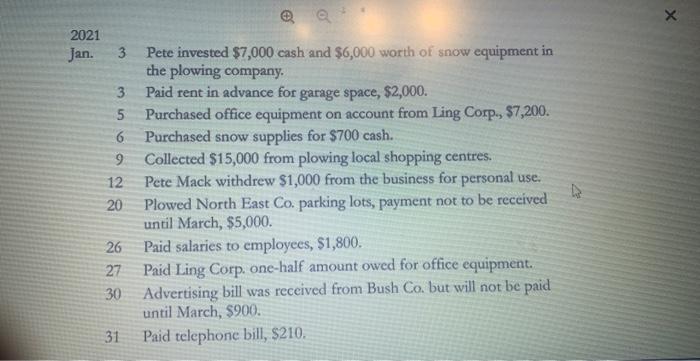

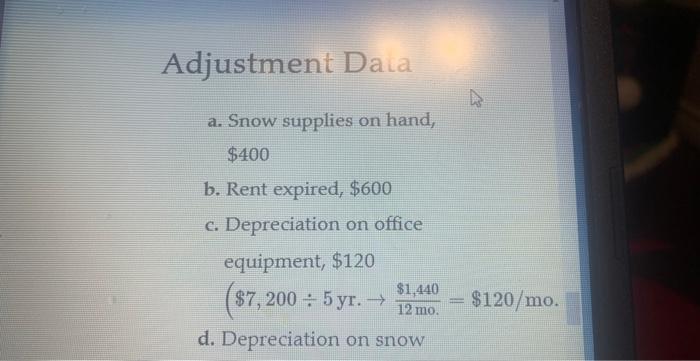

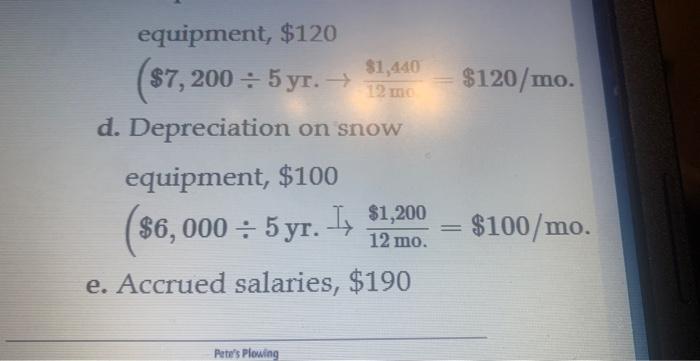

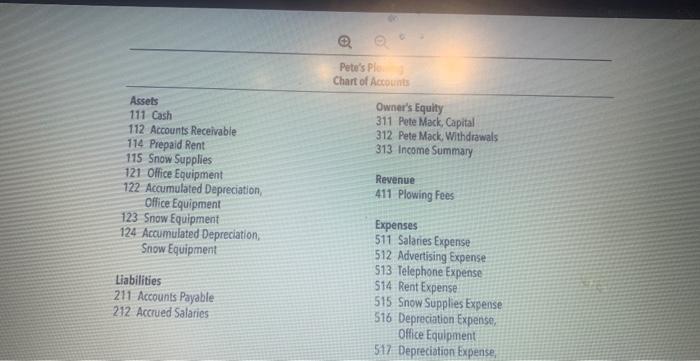

(1)P5-3A. As the bookkeeper of Pete's Plowing of Fredericton, you have been asked to complete the entire accounting cycle for Pete from the following information (see the chart of accounts below): 3 Pete invested $7,000 cash and $6,000 worth of snow equipment in the plowing company. 3 Paid rent in advance for garage space, $2,000. 5 Purchased office equipment on account from Ling Corp., $7,200. 6 Purchased snow supplies for $700 cash. 9 Collected $15,000 from plowing local shopping centres. 12 Pete Mack withdrew $1,000 from the business for personal use. 20 Plowed North East Co. parking lots, payment not to be received until March, $5,000. 26 Paid salaries to employees, $1,800. 27 Paid Ling Corp. one-half amount owed for office equipment. 30 Advertising bill was received from Bush Co. but will not be paid until March, $900. 31 Paid telephone bill, \$210. Classroom Demo... 31 Paid telephone bill, $210 Comprehensive review of the entire accounting cycle, Chapters 1 (150 min ) Check Figure Net Income $15,780 Adjustment DaLa a. Snow supplies on hand, $400 b. Rent expired, $600 c. Depreciation on office equipment, $120 ($7,2005yr.12mo$1,440=$120/mo d. Depreciation on snow equipment, $120 ($7,2005yr.12mc$1,440=$120/mo d. Depreciation on snow equipment, \$100 ($6,0005yr.I12mo$1,200=$100/mo e. Accrued salaries, $190 Pete's P/ Chart of Acxounts

( Note) The previous answer was incomplete.kindly prepare completely the following:

1.Journal

2. Ledger

3.complete Worksheet please please please

4.statement of account

5.Balance sheet

Trial balance

I sent this question many many times but answer is not complete.Please please send answer completely thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started