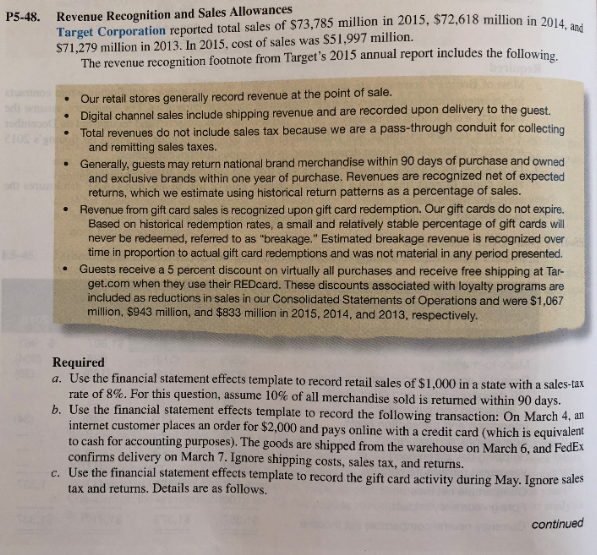

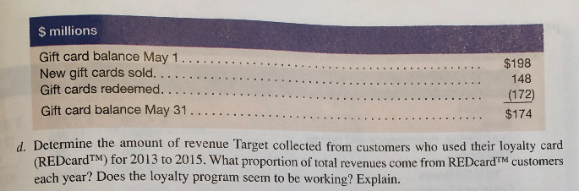

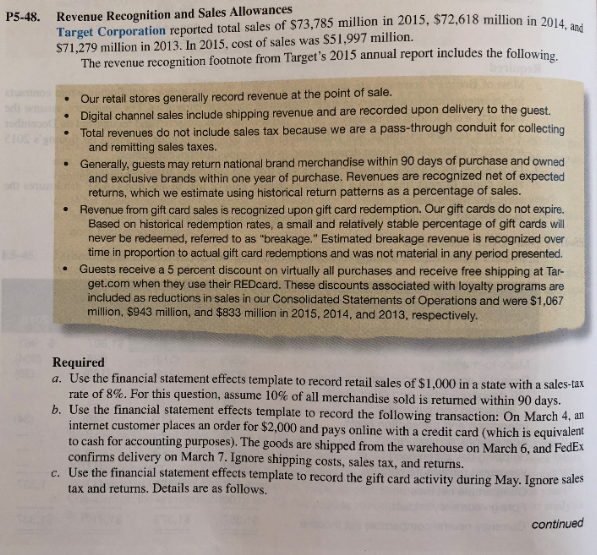

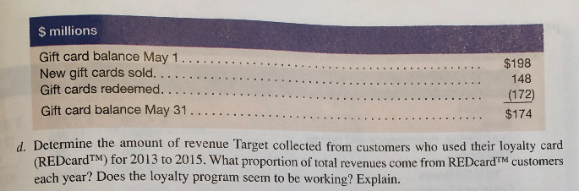

P5-48. Revenue Recognition and Sales Allowances 8 million in 2014 Target Corporation reported total sales of $73,785 million in 2015, $72,618 million in 201 S71,279 million in 2013. In 2015, cost of sales was S51,997 million The revenue recognition footnote from Target's 2015 annual report includes the followi Our retail stores generally record revenue at the point of sale. . Digital channel sales include shipping revenue and are recorded upon delivery to the guest Total revenues do not include sales tax because we are a pass-through conduit for collecting and remitting sales taxes Generally, guests may return national brand merchandise within 90 days of purchase and owned and exclusive brands within one year of purchase. Revenues are recognized net of expected returns, which we estimate using historical return patterns as a percentage of sales. Revenue from gift card sales is recognized upon gift card redemption. Our gift cards do not expire. Based on historical redemption rates, a small and relatively stable percentage of gift cards will never be redeemed, referred to as "breakage." Estimated breakage revenue is recognized over time in proportion to actual gift card redemptions and was not material in any period presented. Guests receive a 5 percent discount on virtually all purchases and receive free shipping at Tar- get.com when they use their REDcard. These discounts associated with loyalty programs are included as reductions in sales in our Consolidated Statements of Operations and were $1,067 . e million, $943 million, and $833 million in 2015, 2014, and 2013, respectively Required a. Use the financial statement effects template to record retail sales of $1,000 in a state with a sales-tax rate of 8%. For this question assume 10% of all merchandise sold is returned within 90 days. Use the financial statement effects template to record the following transaction: O internet customer places an order for $2,000 and pays onlin n March 4, an ent e with a credit card (which is equival g purposes).The goods are shipped from the warehouse on March 6, and FedEx confirms delivery on March 7. Ignore shipping costs, sales tax, and returns Use the financial statement effects template to record the gift ard activity during May. Ignore sal tax and returns. Details are as follows. continued P5-48. Revenue Recognition and Sales Allowances 8 million in 2014 Target Corporation reported total sales of $73,785 million in 2015, $72,618 million in 201 S71,279 million in 2013. In 2015, cost of sales was S51,997 million The revenue recognition footnote from Target's 2015 annual report includes the followi Our retail stores generally record revenue at the point of sale. . Digital channel sales include shipping revenue and are recorded upon delivery to the guest Total revenues do not include sales tax because we are a pass-through conduit for collecting and remitting sales taxes Generally, guests may return national brand merchandise within 90 days of purchase and owned and exclusive brands within one year of purchase. Revenues are recognized net of expected returns, which we estimate using historical return patterns as a percentage of sales. Revenue from gift card sales is recognized upon gift card redemption. Our gift cards do not expire. Based on historical redemption rates, a small and relatively stable percentage of gift cards will never be redeemed, referred to as "breakage." Estimated breakage revenue is recognized over time in proportion to actual gift card redemptions and was not material in any period presented. Guests receive a 5 percent discount on virtually all purchases and receive free shipping at Tar- get.com when they use their REDcard. These discounts associated with loyalty programs are included as reductions in sales in our Consolidated Statements of Operations and were $1,067 . e million, $943 million, and $833 million in 2015, 2014, and 2013, respectively Required a. Use the financial statement effects template to record retail sales of $1,000 in a state with a sales-tax rate of 8%. For this question assume 10% of all merchandise sold is returned within 90 days. Use the financial statement effects template to record the following transaction: O internet customer places an order for $2,000 and pays onlin n March 4, an ent e with a credit card (which is equival g purposes).The goods are shipped from the warehouse on March 6, and FedEx confirms delivery on March 7. Ignore shipping costs, sales tax, and returns Use the financial statement effects template to record the gift ard activity during May. Ignore sal tax and returns. Details are as follows. continued