Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P5.5 (LO 1, 2, 3), AP The management team of Mohamed Industries was evaluating its performance for the first half of the year. Production

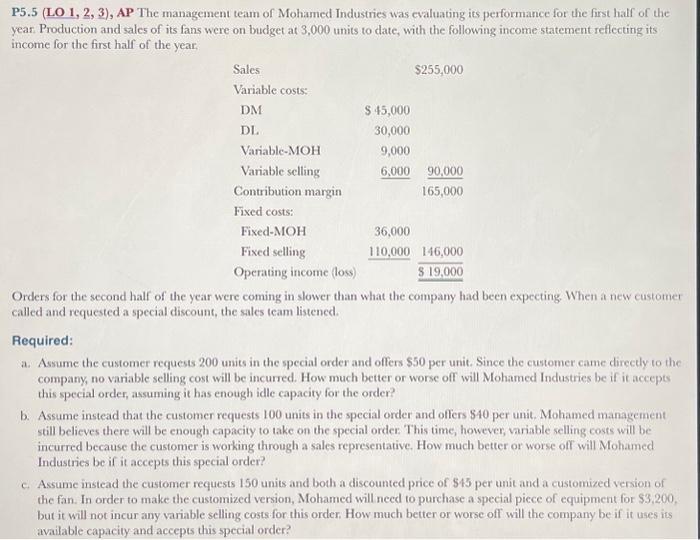

P5.5 (LO 1, 2, 3), AP The management team of Mohamed Industries was evaluating its performance for the first half of the year. Production and sales of its fans were on budget at 3,000 units to date, with the following income statement reflecting its income for the first half of the year. Sales Variable costs: DM DL Variable-MOH Variable selling Contribution margin Fixed costs: Fixed-MOH Fixed selling Operating income (loss) $ 45,000 30,000 9,000 6,000 36,000 110,000 $255,000 90,000 165,000 146,000 $ 19,000 Orders for the second half of the year were coming in slower than what the company had been expecting. When a new customer called and requested a special discount, the sales team listened. Required: a. Assume the customer requests 200 units in the special order and offers $50 per unit. Since the customer came directly to the company, no variable selling cost will be incurred. How much better or worse off will Mohamed Industries be if it accepts this special order, assuming it has enough idle capacity for the order? b. Assume instead that the customer requests 100 units in the special order and offers $40 per unit. Mohamed management still believes there will be enough capacity to take on the special order. This time, however, variable selling costs will be incurred because the customer is working through a sales representative. How much better or worse off will Mohamed Industries be if it accepts this special order? c. Assume instead the customer requests 150 units and both a discounted price of $45 per unit and a customized version of the fan. In order to make the customized version, Mohamed will need to purchase a special piece of equipment for $3,200, but it will not incur any variable selling costs for this order. How much better or worse off will the company be if it uses its available capacity and accepts this special order?

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Special Order with 200 Units at 50 per Unit No Variable Selling Cost Additional Revenue 200 units ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started