Question

P5.6 Consolidation and analytical check on non-controlling interests On 1 January 20x3, P Co acquired 90% ownership interest of Y Co for $2,000,000. At that

P5.6 Consolidation and analytical check on non-controlling interests

On 1 January 20x3, P Co acquired 90% ownership interest of Y Co for $2,000,000. At that date, the following relate to Y Co:

Book value of net assets on 1 January 20x3...........................$1,500,000

Excess of fair value over book value of intellectual property...$ 100,000

It was estimated that the intellectual property had a remaining useful life of five years from 1 January 20x3. The fair value of non-controlling interests of Y Co as at the date of acquisition was $200,000. There was no changed in the share capital of Y Co since the acquisition date. There were no other items in equity other than share capital and retained earnings.

On 1 July 20x4, Y Co transferred its equipment to P Co at a transfer price of $120,000. The equipment was purchased from external vendors on 1 July 20x1 at a price of $140,000. Its estimated useful life was five years from the date of purchase and it had no residual value. The original estimates remained unchanged at the date of transfer.

Y Co sold inventory on the following dates:

| Date of Transfer | 1 October 20x4 | 1 June 20x5 |

|---|---|---|

| Invoice Price | $150,000 | $350,000 |

| Original cost | 100,000 | 400,000 |

| In P's warehouse at end 20x4 | 40% of original batch | |

| In P's warehouse at end 20x5 | 10% of original batch | 30% of original batch |

Losses on transfers are indicative of impairment loss in the underlying asset. Tax rate was 20%. Tax effects are to be recognised.

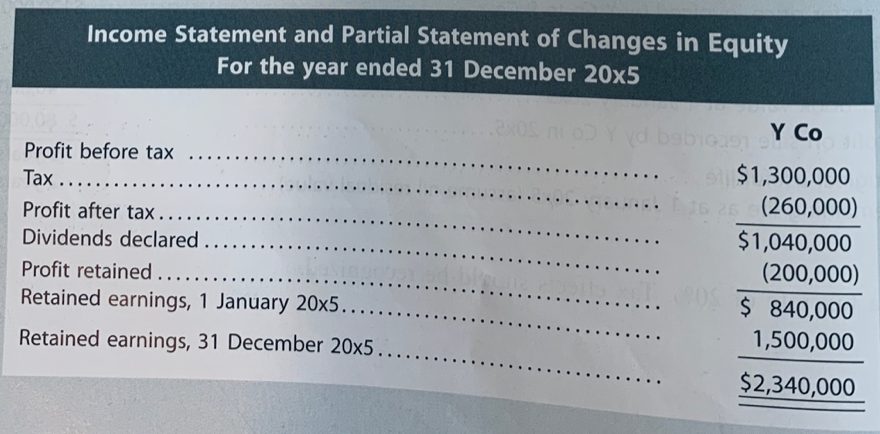

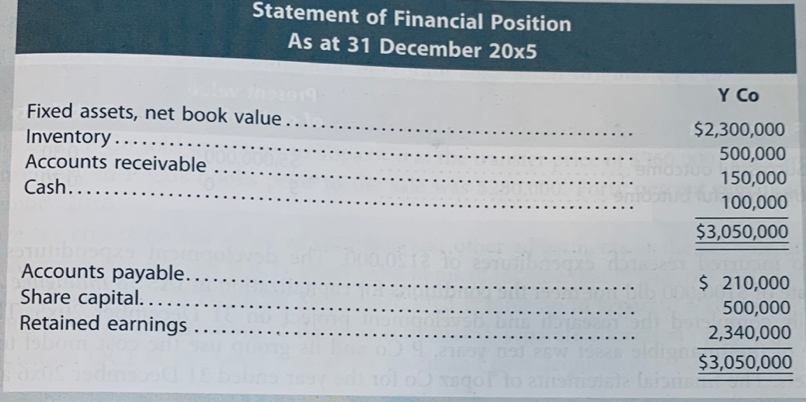

Extracts of Y Co's Financial Statements for the Year ended 31 December 20x5 are shown below:

Required:

1. Prepare the necessary consolidation adjustments for the year ended December 20x5

2. Perform an analytical check on non-controlling interests as at 31 December 20x5

3. If P Co measures non-controlling interests as a proportion of identifiable net assets as at acquisition date, prepare the consolidation adjustment(s) that differs from part 1, and perform an analytical check on non-controlling interests' balance as at 31 December 20x5

Income Statement and Partial Statement of Changes in Equity For the year ended 31 December 20x5 Profit before tax .. Tax .................. Profit after tax......... Dividends declared ........ Profit retained ......... ........... Retained earnings, 1 January 20x5... Retained earnings, 31 December 20x5.. Od baby Co .......... $1,300,000 (260,000) $1,040,000 (200,000) $ 840,000 1,500,000 $2,340,000 Statement of Financial Position As at 31 December 20x5 Fixed assets, net book value..... Inventory. Accounts receivable ...... Cash........ Y CO $2,300,000 500,000 150,000 100,000 $3,050,000 Accounts payable..... Share capital......... Retained earnings .. $ 210,000 500,000 2,340,000 $3,050,000 Income Statement and Partial Statement of Changes in Equity For the year ended 31 December 20x5 Profit before tax .. Tax .................. Profit after tax......... Dividends declared ........ Profit retained ......... ........... Retained earnings, 1 January 20x5... Retained earnings, 31 December 20x5.. Od baby Co .......... $1,300,000 (260,000) $1,040,000 (200,000) $ 840,000 1,500,000 $2,340,000 Statement of Financial Position As at 31 December 20x5 Fixed assets, net book value..... Inventory. Accounts receivable ...... Cash........ Y CO $2,300,000 500,000 150,000 100,000 $3,050,000 Accounts payable..... Share capital......... Retained earnings .. $ 210,000 500,000 2,340,000 $3,050,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started