Answered step by step

Verified Expert Solution

Question

1 Approved Answer

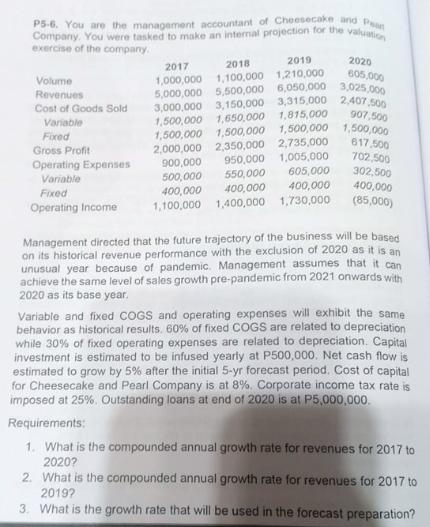

P5-6. You are the management accountant of Cheesecake and Pan Company. You were tasked to make an internal projection for the valuation exercise of

P5-6. You are the management accountant of Cheesecake and Pan Company. You were tasked to make an internal projection for the valuation exercise of the company. Volume Revenues Cost of Goods Sold Variable 2017 2018 2019 2020 605,000 1,000,000 1,100,000 1,210,000 5,000,000 5,500,000 6,050,000 3,025,000 3,000,000 3,150,000 3,315,000 2,407,500 1,500,000 1,650,000 1,815,000 1,500,000 1,500,000 1,500,000 907,500 1,500,000 Fixed Gross Profit 2,000,000 2,350,000 2,735,000 617,500 Operating Expenses Variable 950,000 900,000 500,000 550,000 1,005,000 702,500 605,000 302,500 Fixed 400,000 400,000 400,000 400,000 (85,000) Operating Income 1,100,000 1,400,000 1,730,000 Management directed that the future trajectory of the business will be based on its historical revenue performance with the exclusion of 2020 as it is an unusual year because of pandemic. Management assumes that it can achieve the same level of sales growth pre-pandemic from 2021 onwards with 2020 as its base year. Variable and fixed COGS and operating expenses will exhibit the same behavior as historical results. 60% of fixed COGS are related to depreciation while 30% of fixed operating expenses are related to depreciation. Capital investment is estimated to be infused yearly at P500,000. Net cash flow is estimated to grow by 5% after the initial 5-yr forecast period. Cost of capital for Cheesecake and Pearl Company is at 8%. Corporate income tax rate is imposed at 25%. Outstanding loans at end of 2020 is at P5,000,000. Requirements: 1. What is the compounded annual growth rate for revenues for 2017 to 2020? 2. What is the compounded annual growth rate for revenues for 2017 to 2019? 3. What is the growth rate that will be used in the forecast preparation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started