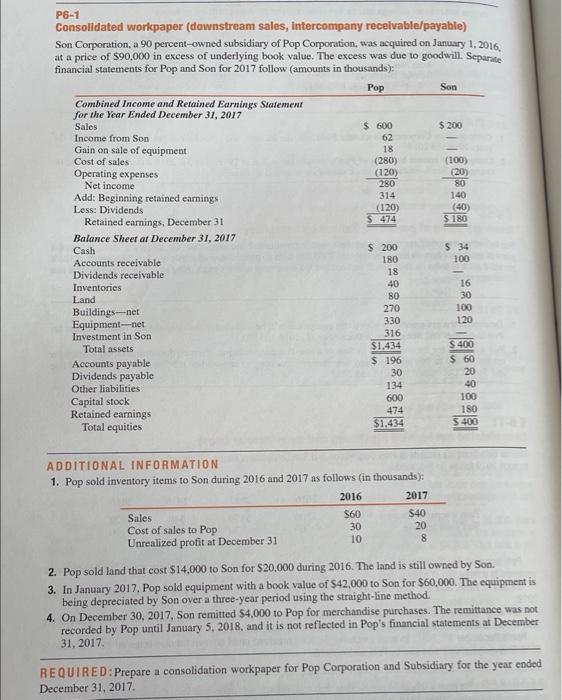

P6-1 Consolidated workepaper (downstream sales, intercompany receivable payable) Son Corporation, a 90 percent-owned subsidiary of Pop Corporation, was acquired on January 1, 2016. at a price of $90,000 in excess of underlying book value. The excess was due to goodwill. Separate financial statements for Pop and Son for 2017 follow (amounts in thousands): Pop Son Combined Income and Retained Earnings Statement for the Year Ended December 31, 2017 Sales $ 600 $ 200 Income from Son 62 Gain on sale of equipment 18 Cost of sales (280) (100) Operating expenses (120) (20) Net income 280 SO Add: Beginning retained earnings 314 140 Less: Dividends (120) (40) Retained earnings, December 31 S474 $ 180 Balance Sheef at December 31, 2017 Cash $ 200 $ 34 Accounts receivable 180 100 Dividends receivable 18 Inventories 40 16 Land 80 30 Buildings--net 270 100 Equipment--net 330 120 Investment in Son 316 Total assets $1.434 $ 400 Accounts payable $ 196 $ 60 Dividends payable 30 20 Other liabilities 134 40 Capital stock 600 100 Retained earnings 474 180 Total equities $1.434 5 400 ADDITIONAL INFORMATION 1. Pop sold inventory items to Son during 2016 and 2017 as follows (in thousands): 2016 2017 Sales $60 $40 Cost of sales to Pop 30 20 Unrealized profit at December 31 10 8 2. Pop sold land that cost $14,000 to Son for $20,000 during 2016. The land is still owned by Son. 3. In January 2017. Pop sold equipment with a book value of $42,000 to Son for $60,000. The equipment is being depreciated by Son over a three-year period using the straight-line method. 4. On December 30, 2017, Son remitted $4,000 to Pop for merchandise purchases. The remittance was not recorded by Pop until January 5, 2018, and it is not reflected in Pop's financial statements at December 31, 2017 REQUIRED: Prepare a consolidation workpaper for Pop Corporation and Subsidiary for the year ended December 31, 2017 P6-1 Consolidated workepaper (downstream sales, intercompany receivable payable) Son Corporation, a 90 percent-owned subsidiary of Pop Corporation, was acquired on January 1, 2016. at a price of $90,000 in excess of underlying book value. The excess was due to goodwill. Separate financial statements for Pop and Son for 2017 follow (amounts in thousands): Pop Son Combined Income and Retained Earnings Statement for the Year Ended December 31, 2017 Sales $ 600 $ 200 Income from Son 62 Gain on sale of equipment 18 Cost of sales (280) (100) Operating expenses (120) (20) Net income 280 SO Add: Beginning retained earnings 314 140 Less: Dividends (120) (40) Retained earnings, December 31 S474 $ 180 Balance Sheef at December 31, 2017 Cash $ 200 $ 34 Accounts receivable 180 100 Dividends receivable 18 Inventories 40 16 Land 80 30 Buildings--net 270 100 Equipment--net 330 120 Investment in Son 316 Total assets $1.434 $ 400 Accounts payable $ 196 $ 60 Dividends payable 30 20 Other liabilities 134 40 Capital stock 600 100 Retained earnings 474 180 Total equities $1.434 5 400 ADDITIONAL INFORMATION 1. Pop sold inventory items to Son during 2016 and 2017 as follows (in thousands): 2016 2017 Sales $60 $40 Cost of sales to Pop 30 20 Unrealized profit at December 31 10 8 2. Pop sold land that cost $14,000 to Son for $20,000 during 2016. The land is still owned by Son. 3. In January 2017. Pop sold equipment with a book value of $42,000 to Son for $60,000. The equipment is being depreciated by Son over a three-year period using the straight-line method. 4. On December 30, 2017, Son remitted $4,000 to Pop for merchandise purchases. The remittance was not recorded by Pop until January 5, 2018, and it is not reflected in Pop's financial statements at December 31, 2017 REQUIRED: Prepare a consolidation workpaper for Pop Corporation and Subsidiary for the year ended December 31, 2017