Question

P6.12 (LO5). Ethics (Pension Funding) Tim Buhl, newly appointed controller of STL, is considering ways to reduce his company's expenditures on annual pension costs. One

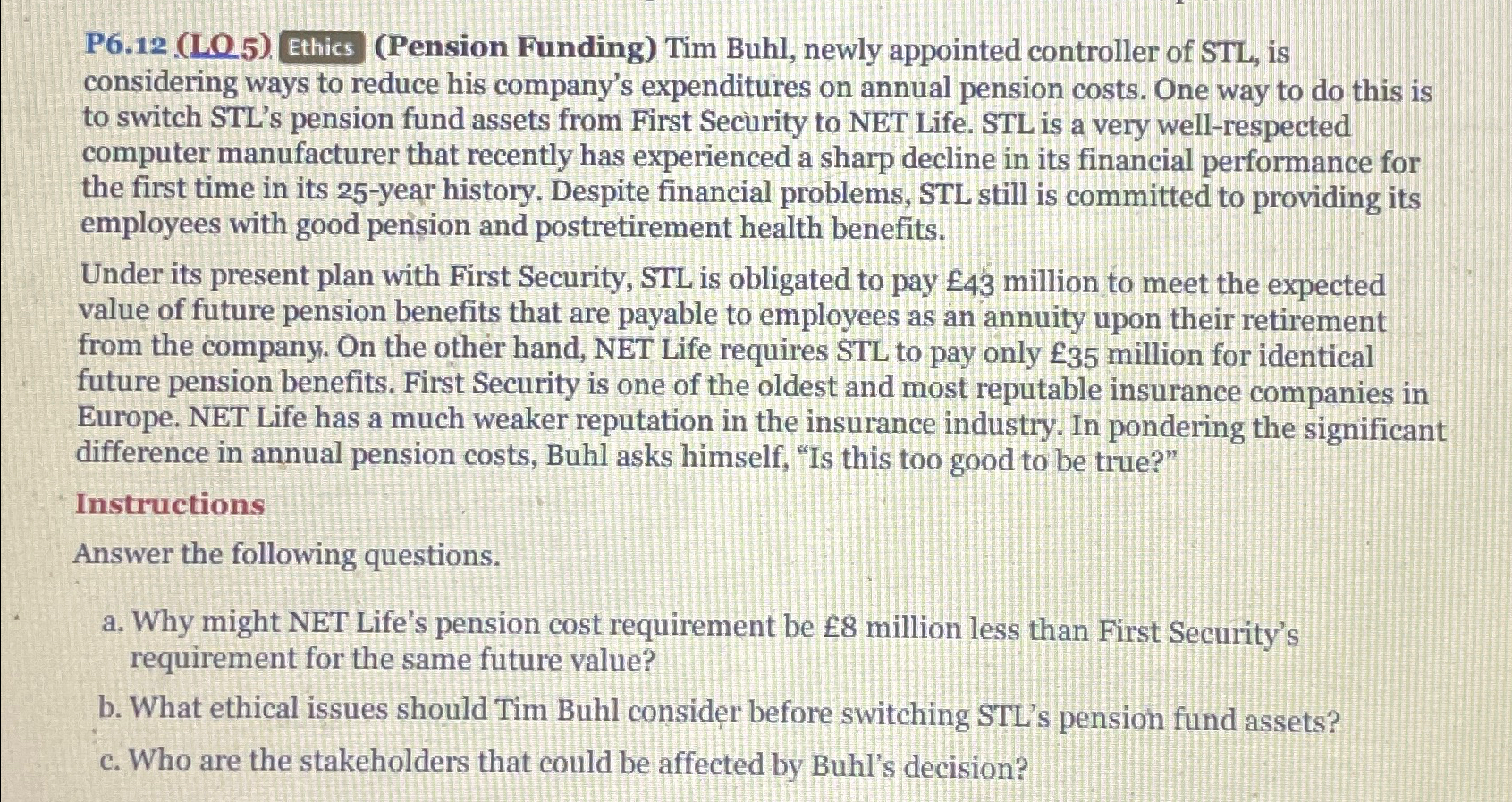

P6.12 (LO5). Ethics (Pension Funding) Tim Buhl, newly appointed controller of STL, is considering ways to reduce his company's expenditures on annual pension costs. One way to do this is to switch STL's pension fund assets from First Security to NET Life. STL is a very well-respected computer manufacturer that recently has experienced a sharp decline in its financial performance for the first time in its 25-year history. Despite financial problems, STL still is committed to providing its employees with good perision and postretirement health benefits.\ Under its present plan with First Security, STL is obligated to pay

43million to meet the expected value of future pension benefits that are payable to employees as an annuity upon their retirement from the company. On the other hand, NET Life requires STL to pay only

35million for identical future pension benefits. First Security is one of the oldest and most reputable insurance companies in Europe. NET Life has a much weaker reputation in the insurance industry. In pondering the significant difference in annual pension costs, Buhl asks himself, "Is this too good to be true?"\ Instructions\ Answer the following questions.\ a. Why might NET Life's pension cost requirement be

8million less than First Security's requirement for the same future value?\ b. What ethical issues should Tim Buhl consider before switching STL's pension fund assets?\ c. Who are the stakeholders that could be affected by Buhl's decision?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started