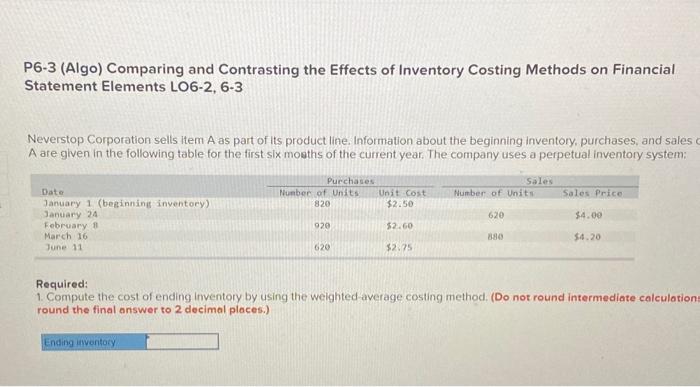

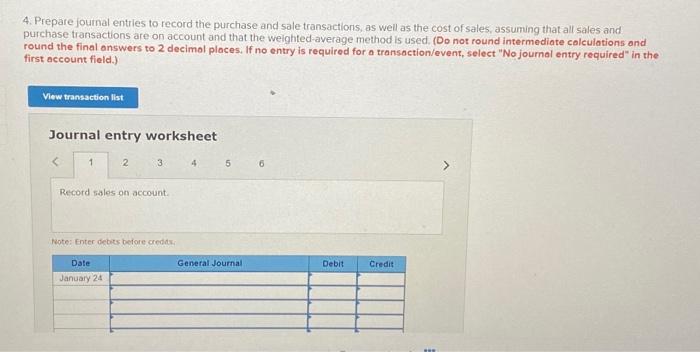

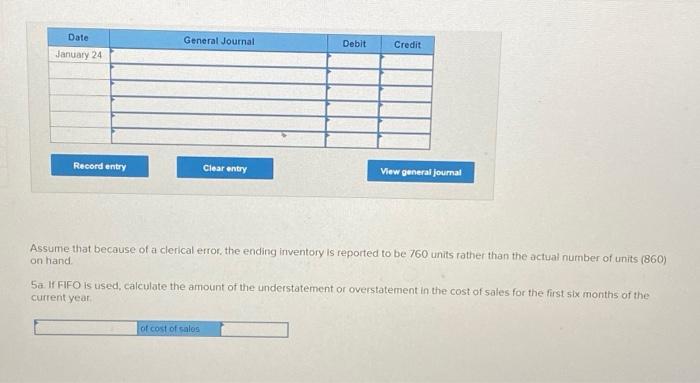

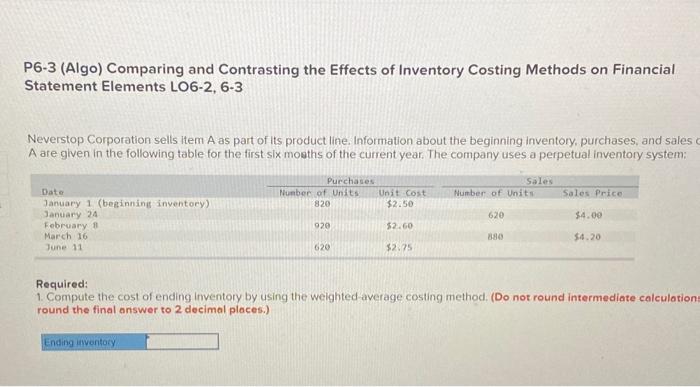

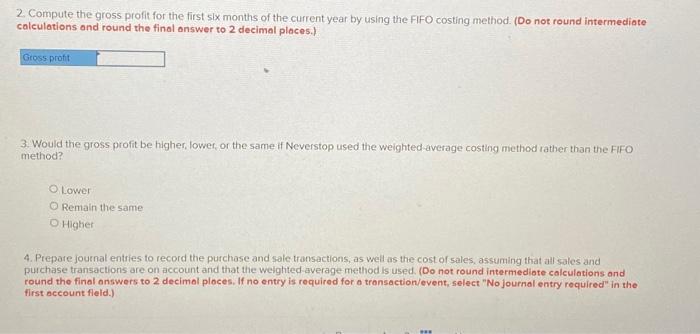

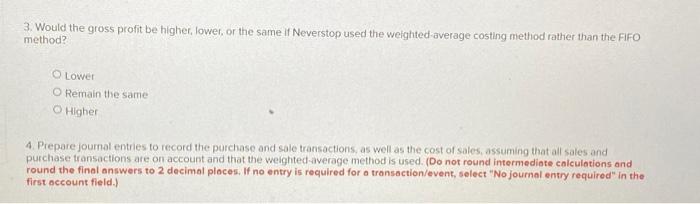

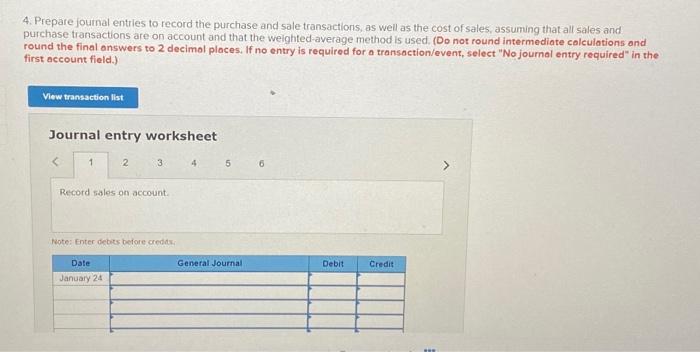

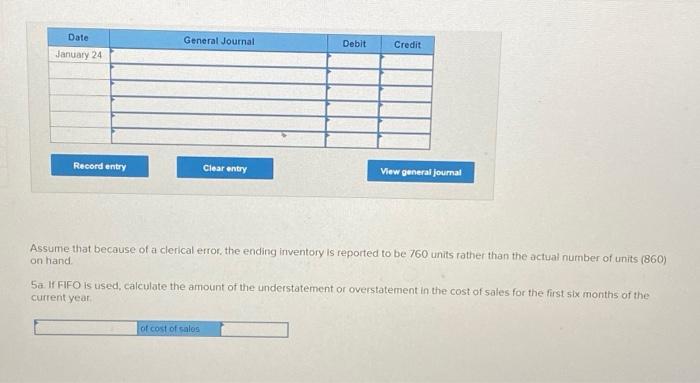

P6-3 (Algo) Comparing and Contrasting the Effects of Inventory Costing Methods on Financial Statement Elements LO6-2, 6-3 Neverstop Corporation sells item A as part of its product line. Information about the beginning inventory, purchases, and sales A are given in the following table for the first six moaths of the current year. The company uses a perpetual inventory system: Required: 1. Compute the cost of ending inventory by using the weighted-average costing method. (Do not round intermediate calculotio round the final answer to 2 decimal places.) 2. Compute the gross profit for the first six months of the current year by using the FIFO costing method. (Do not round intermediate calculations and round the final answer to 2 decimal places.) 3. Would the gross profit be higher, lowe, or the same if Neverstop used the weighted-average costing method rather than the FIFO method? Lower Remain the same Higher 4. Prepare journat entries to record the purchose and sale transactions, as well as the cost of sales, assuming that all sales and purchase transactions are on account and that the weighted-average methodis used. (Do not round intermediote calculations ond round the final answers to 2 decimal ploces. If no entry is required for a transaction/event, select "No journal entry required" in the first account fleld.) 3. Would the gross profit be higher, lower, or the same if Neverstop used the weighted average costing method rather than the Fifo method? Lowet Remain the same Higher 4. Prepare journal entries to record the purchase and sale transactions, as well as the cost of sales, assuming that all sales and purchase transactions are on account and that the weighted -average method is used. (Do not round intermediote calculations ond round the final answers to 2 decimal ploces. If no entry is required for a transaction/event, select "No journal entry required" in the first occount field.) 4. Prepare joumal entries to record the purchase and sale transactions, as well as the cost of sales, assuming that all sales and purchase transactions are on account and that the weighted-average method is used. (Do not round intermediote colculations and round the final answers to 2 decimol places, If no entry is required for a transoction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Assume that because of a clerical error, the ending inventory is reported to be 760 units rather than the actual number of units ( 860 ) on hand. 5a. If FIFO is used, calculate the amount of the understatement or overstatement in the cost of sales for the first six months of the current year