Answered step by step

Verified Expert Solution

Question

1 Approved Answer

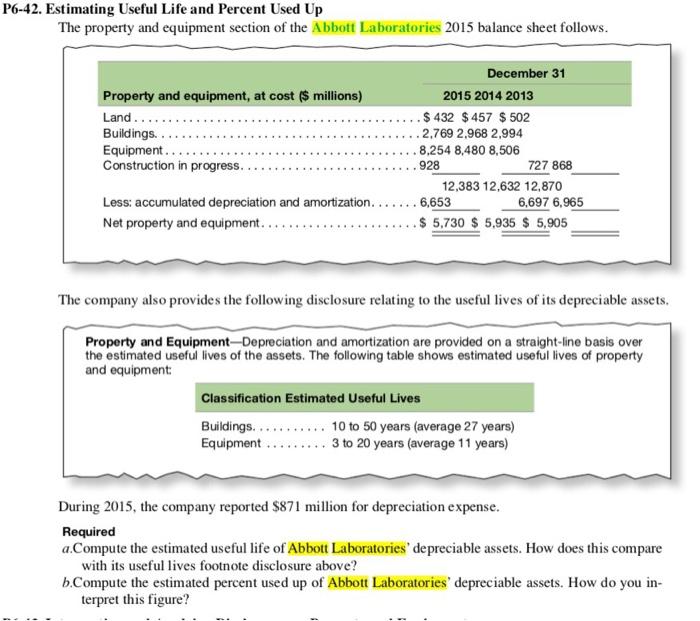

P6-42. Estimating Useful Life and Percent Used Up The property and equipment section of the Abbott Laboratories 2015 balance sheet follows. Property and equipment,

P6-42. Estimating Useful Life and Percent Used Up The property and equipment section of the Abbott Laboratories 2015 balance sheet follows. Property and equipment, at cost ($ millions) Land...... Buildings.. Equipment.... Construction in progress. Less: accumulated depreciation and amortization..... Net property and equipment...... December 31 2015 2014 2013 $ 432 $457 $502 2,769 2,968 2,994 8,254 8,480 8,506 .928 727 868 12,383 12,632 12,870 6,653 $5,730 $ 5,935 $ 5,905 Classification Estimated Useful Lives Buildings........... Equipment The company also provides the following disclosure relating to the useful lives of its depreciable assets. Property and Equipment Depreciation and amortization are provided on a straight-line basis over the estimated useful lives of the assets. The following table shows estimated useful lives of property and equipment: 6,697 6,965 10 to 50 years (average 27 years) 3 to 20 years (average 11 years) During 2015, the company reported $871 million for depreciation expense. Required a.Compute the estimated useful life of Abbott Laboratories' depreciable assets. How does this compare with its useful lives footnote disclosure above? b.Compute the estimated percent used up of Abbott Laboratories' depreciable assets. How do you in- terpret this figure?

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a total depreciation expenses for 2015 is 871 million Total number of years 2711 38 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started