Answered step by step

Verified Expert Solution

Question

1 Approved Answer

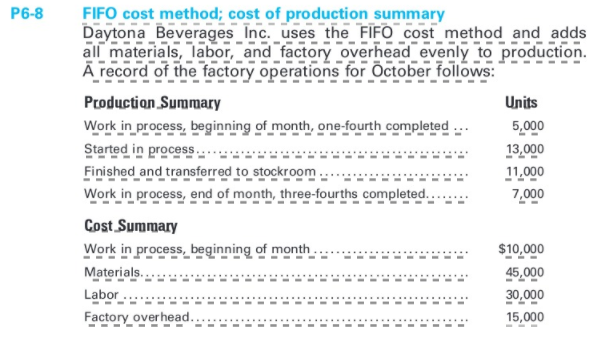

P6-8 FIFO cost method; cost of production summary. I'm having trouble trying to fill this out. Any help would be great!! P6-8 FIFO cost method;

P6-8 FIFO cost method; cost of production summary.

I'm having trouble trying to fill this out. Any help would be great!!

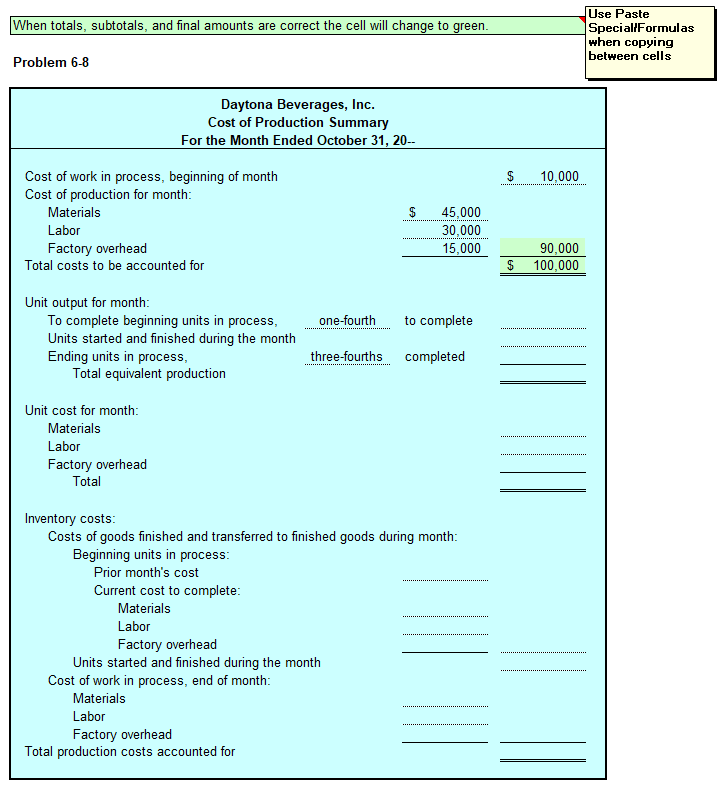

P6-8 FIFO cost method; cost of production summary Daytona Beverages Inc. uses the FIFO cost method and adds all materials, labor, and factory overhead evenly to production. A record of the factory operations for October follows: Production Summary Units Work in process, beginning of month, one-fourth completed 5,000 Started in process 13,000 Finished and transferred to stockroom 11,000 Work in process, end of month, three-fourths completed... 7,000 Cost Summary Work in process, beginning of month. $10,000 Materials. 45,000 Labor 30,000 Factory overhead. 15,000 When totals, subtotals, and final amounts are correct the cell will change to green. Use Paste Special Formulas when copying between cells Problem 6-8 Daytona Beverages, Inc. Cost of Production Summary For the Month Ended October 31, 20-- $ 10,000 $ Cost of work in process, beginning of month Cost of production for month: Materials Labor Factory overhead Total costs to be accounted for 45,000 30,000 15,000 $ 90,000 100,000 one-fourth to complete Unit output for month: To complete beginning units in process, Units started and finished during the month Ending units in process, Total equivalent production three-fourths completed .................... Unit cost for month: Materials Labor Factory overhead Total Inventory costs: Costs of goods finished and transferred to finished goods during month: Beginning units in process: Prior month's cost Current cost to complete: Materials Labor Factory overhead Units started and finished during the month Cost of work in process, end of month: Materials Labor Factory overhead Total production costs accounted forStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started