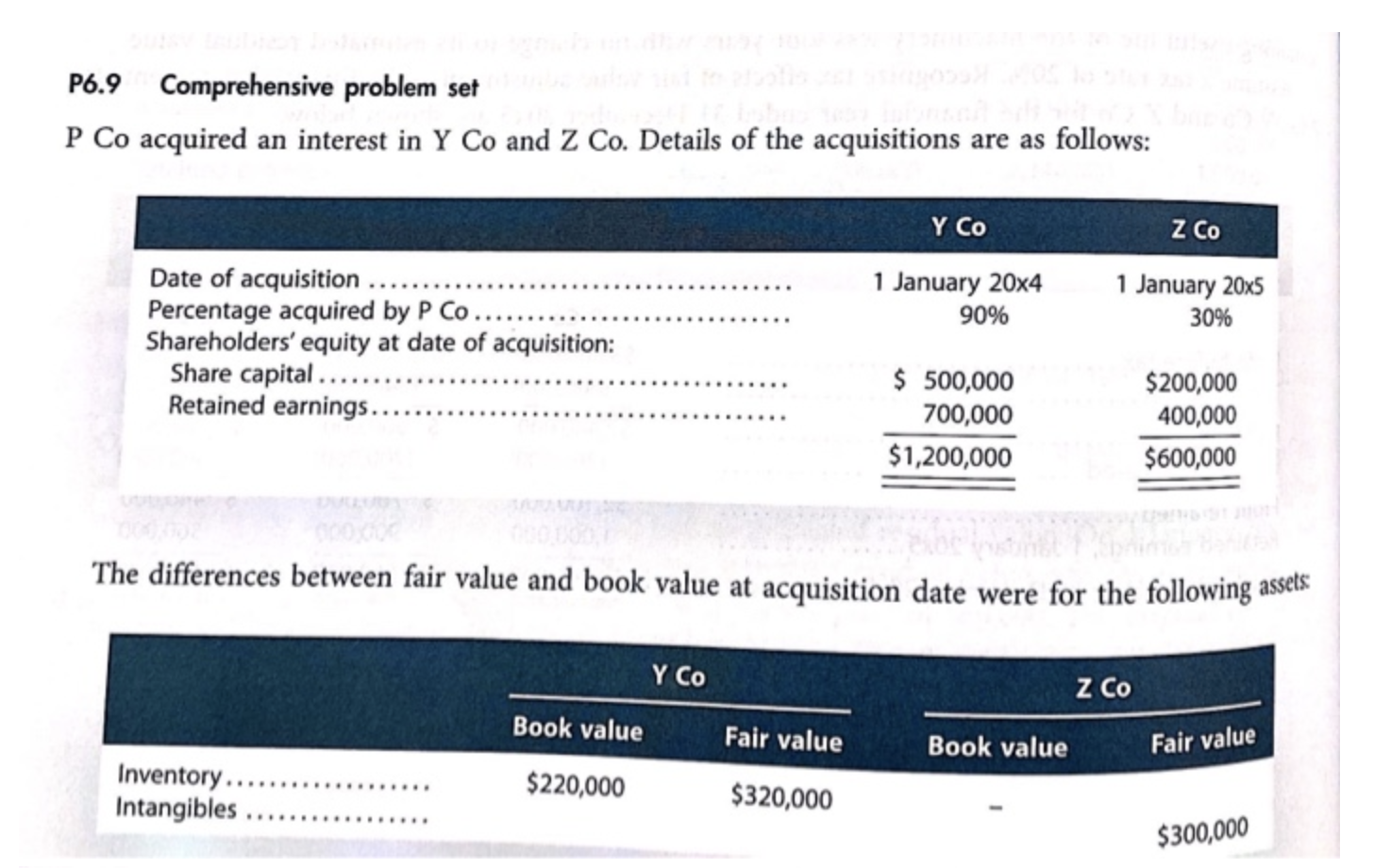

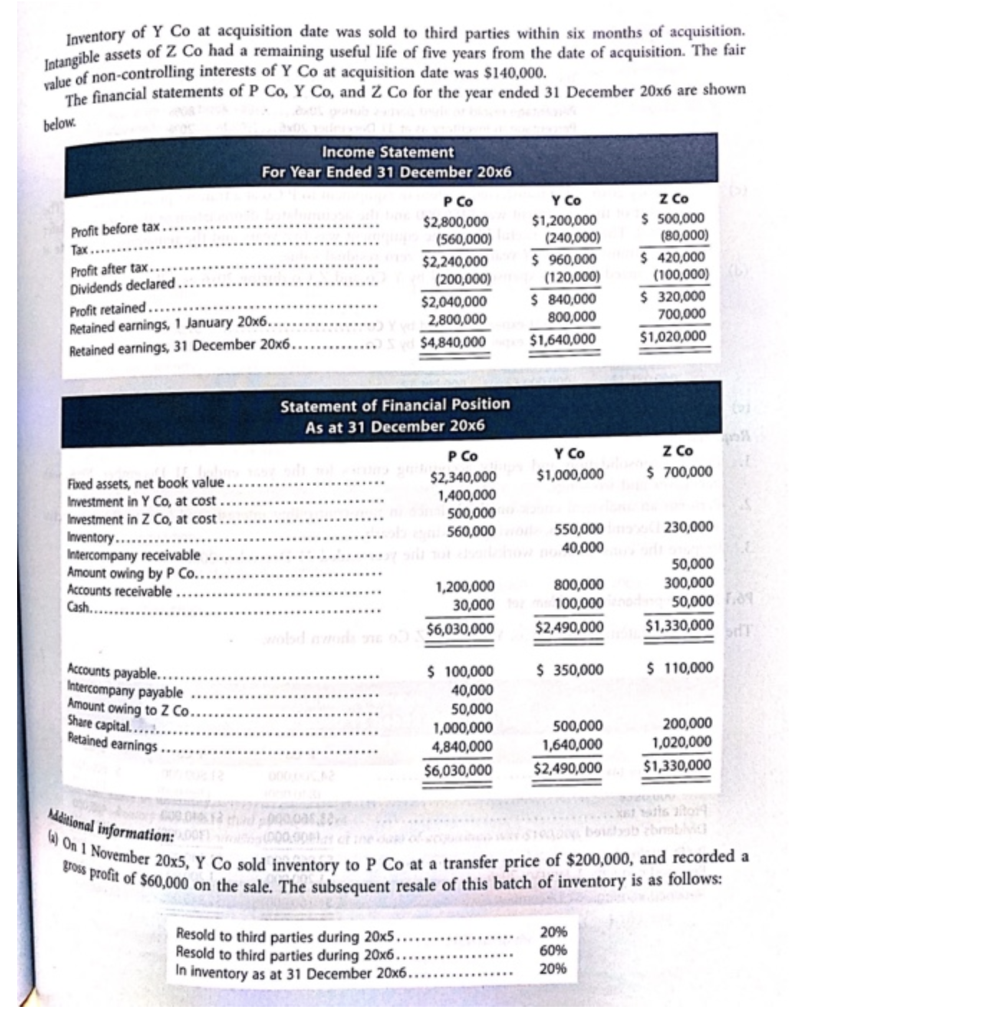

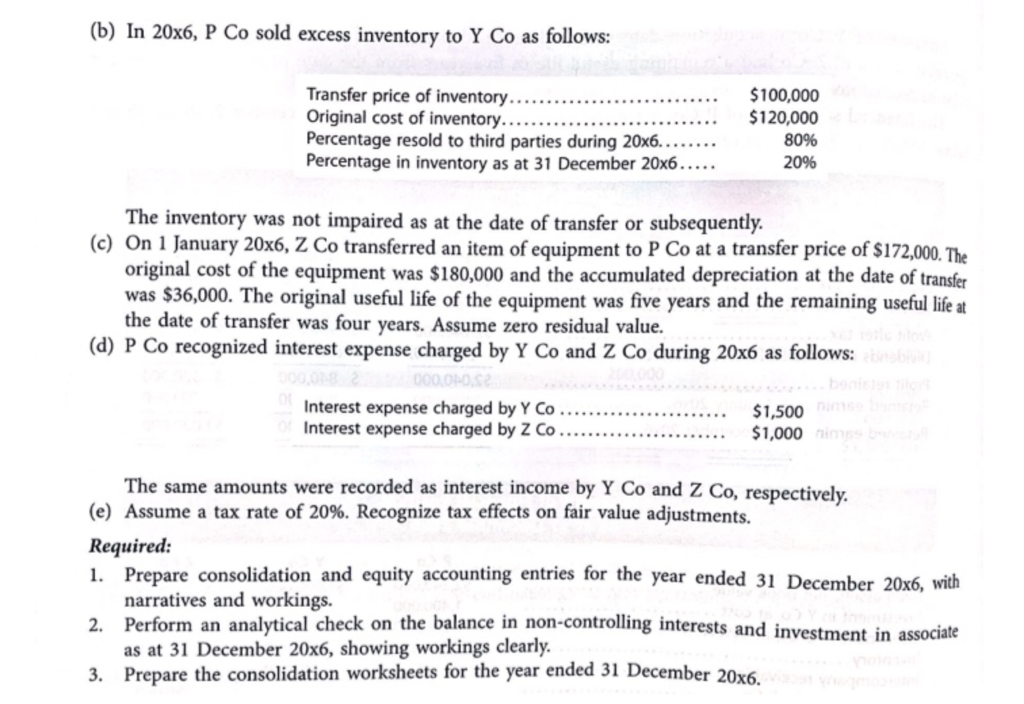

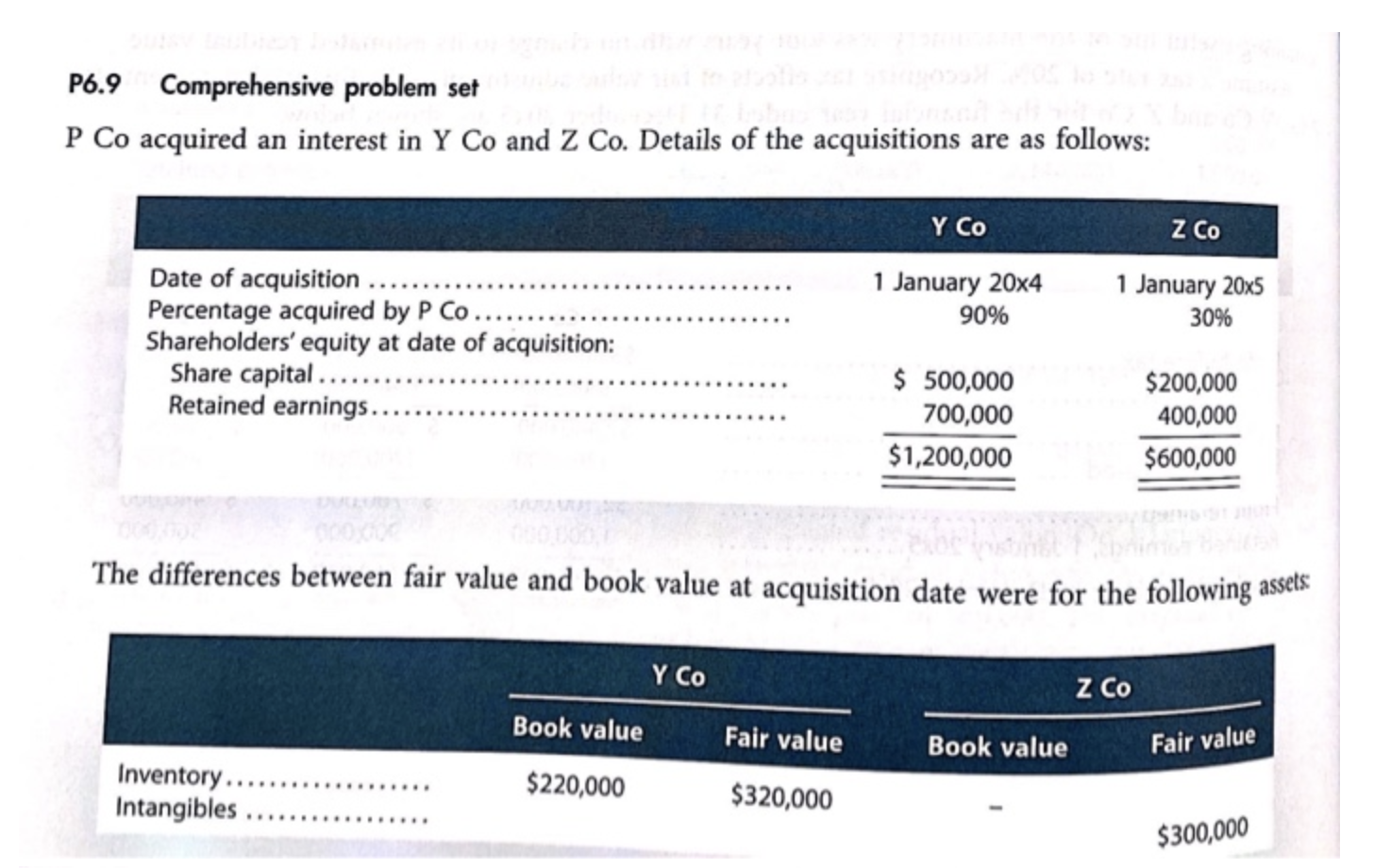

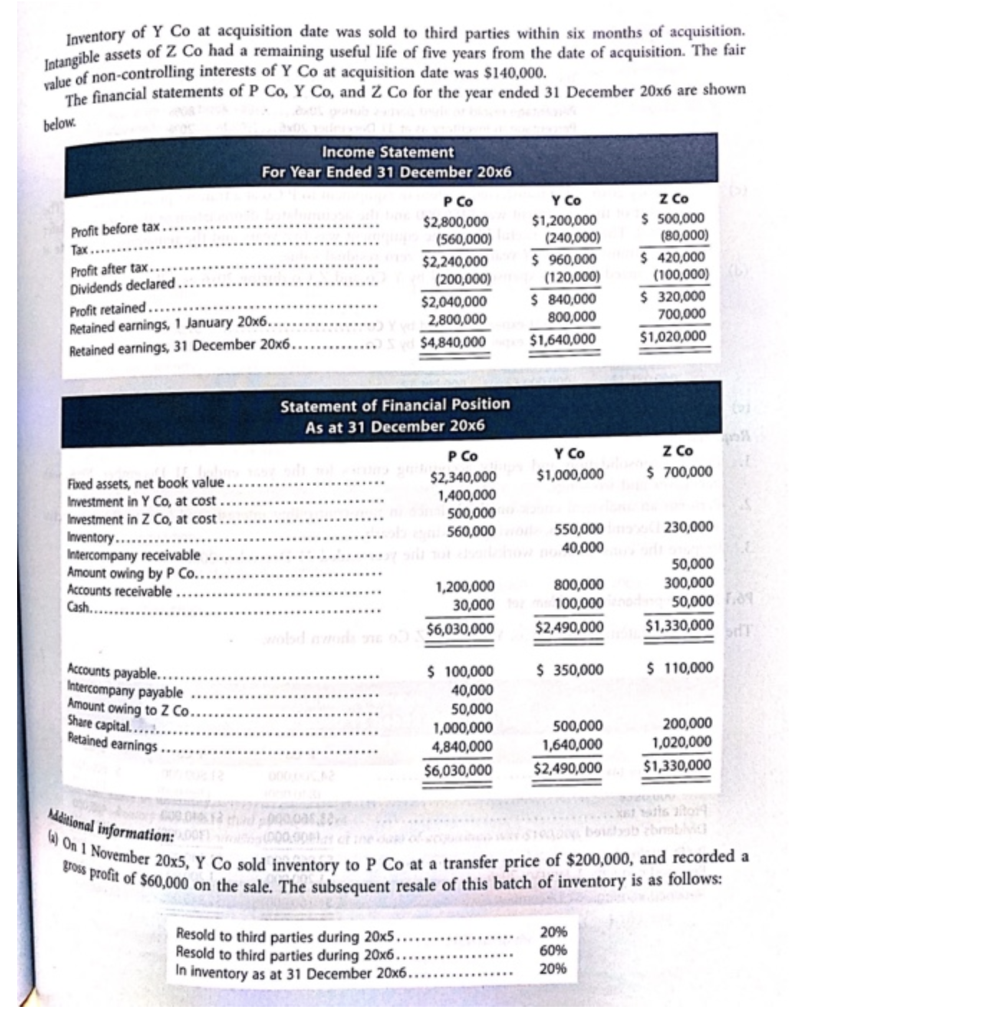

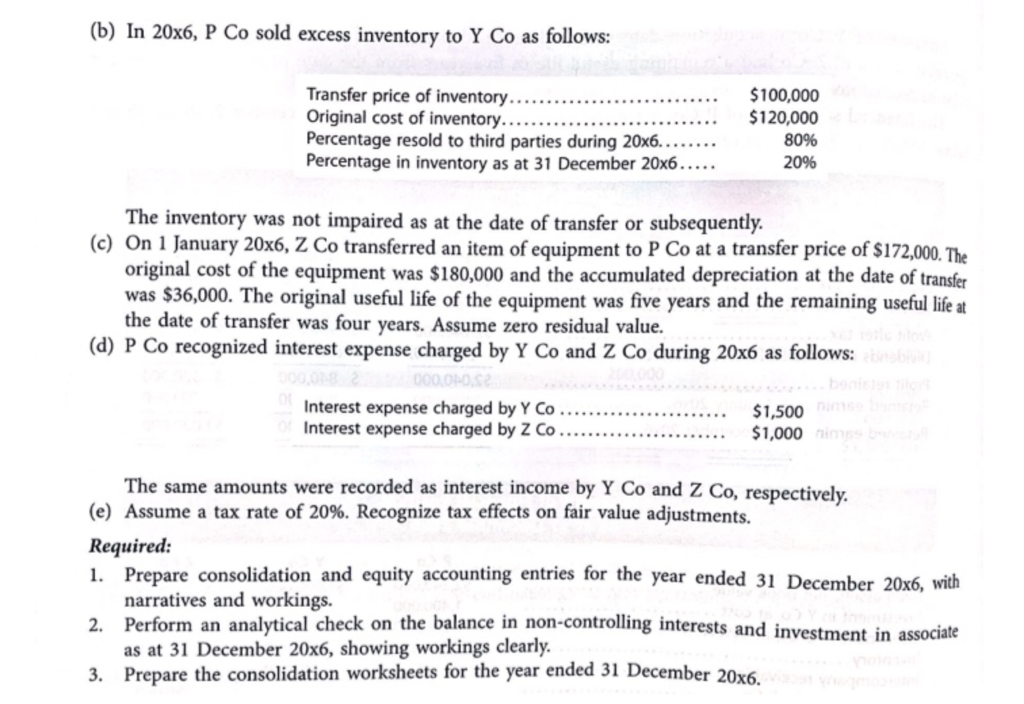

P6.9 Comprehensive problem set P Co acquired an interest in Y Co and Z Co. Details of the acquisitions are as follows: Y Co Z CO 1 January 20x4 90% 1 January 20x5 30% Date of acquisition Percentage acquired by P Co. Shareholders' equity at date of acquisition: Share capital ........ Retained earnings. $ 500,000 700,000 $1,200,000 $200,000 400,000 $600,000 The differences between fair value and book value at acquisition date were for the following assets Y CO Z Co Book value Fair value Book value Fair value Inventory..... Intangibles $220,000 $320,000 $300,000 On 1 November 20x5, Y Co sold inventory to P Co at a transfer price of $200,000, and recorded a gross profit of $60,000 on the sale. The subsequent resale of this batch of inventory is as follows: Inventory of Y Co at acquisition date was sold to third parties within six months of acquisition Intangible assets of Z Co had a remaining useful life of five years from the date of acquisition. The fair value of non-controlling interests of Y Co at acquisition date was $140,000, The financial statements of P Co, Y Co, and Z Co for the year ended 31 December 20x6 are shown below. Income Statement For Year Ended 31 December 20x6 Profit before tax. Profit after tax.... Dividends declared Profit retained Retained earnings, 1 January 20x6. Retained earnings, 31 December 20x6.. P CO $2,800,000 (560,000) $2,240,000 (200,000) $2,040,000 2,800,000 $4,840,000 Y CO $1,200,000 (240,000) $ 960,000 (120,000) $ 840,000 800,000 $1,640,000 Z CO $ 500,000 (80,000) $ 420,000 (100,000) $ 320,000 700,000 $1,020,000 Statement of Financial Position As at 31 December 20x6 z Co $ 700,000 P Co Y CO $2,340,000 $1,000,000 1,400,000 500,000 560,000 550,000 40,000 Foxed assets, net book value. Investment in Y Co, at cost. Investment in Z Co, at cost Inventory..... Intercompany receivable Amount owing by P Co. Accounts receivable Cash. 230,000 1,200,000 30,000 $6,030,000 800,000 100,000 $2,490,000 50,000 300,000 50,000 $1,330,000 $ 350,000 $ 110,000 Accounts payable.... Intercompany payable Amount owing to Z Co Share capital...... Retained earnings $ 100,000 40,000 50,000 1,000,000 4,840,000 $6,030,000 500,000 1,640,000 $2,490,000 200,000 1,020,000 $1,330,000 Mditional information: Resold to third parties during 20x5. Resold to third parties during 20x6.. In inventory as at 31 December 20x6.. 20% 6096 20% (b) In 20x6, P Co sold excess inventory to Y Co as follows: Transfer price of inventory. Original cost of inventory. Percentage resold to third parties during 20x6. Percentage in inventory as at 31 December 20x6.. $100,000 $120,000 80% 20% The inventory was not impaired as at the date of transfer or subsequently. (c) On 1 January 20x6, Z Co transferred an item of equipment to P Co at a transfer price of $172,000. The original cost of the equipment was $180,000 and the accumulated depreciation at the date of transfer was $36,000. The original useful life of the equipment was five years and the remaining useful life at the date of transfer was four years. Assume zero residual value. (d) P Co recognized interest expense charged by Y Co and Z Co during 20x6 as follows: binabato 000ORDS Interest expense charged by Y Co $1,500 Interest expense charged by Z Co $1,000 m The same amounts were recorded as interest income by Y Co and Z Co, respectively. (e) Assume a tax rate of 20%. Recognize tax effects on fair value adjustments. Required: 1. Prepare consolidation and equity accounting entries for the year ended 31 December 20x6, with narratives and workings. 2. Perform an analytical check on the balance in non-controlling interests and investment in associate as at 31 December 20x6, showing workings clearly. 3. Prepare the consolidation worksheets for the year ended 31 December 20x6. P6.9 Comprehensive problem set P Co acquired an interest in Y Co and Z Co. Details of the acquisitions are as follows: Y Co Z CO 1 January 20x4 90% 1 January 20x5 30% Date of acquisition Percentage acquired by P Co. Shareholders' equity at date of acquisition: Share capital ........ Retained earnings. $ 500,000 700,000 $1,200,000 $200,000 400,000 $600,000 The differences between fair value and book value at acquisition date were for the following assets Y CO Z Co Book value Fair value Book value Fair value Inventory..... Intangibles $220,000 $320,000 $300,000 On 1 November 20x5, Y Co sold inventory to P Co at a transfer price of $200,000, and recorded a gross profit of $60,000 on the sale. The subsequent resale of this batch of inventory is as follows: Inventory of Y Co at acquisition date was sold to third parties within six months of acquisition Intangible assets of Z Co had a remaining useful life of five years from the date of acquisition. The fair value of non-controlling interests of Y Co at acquisition date was $140,000, The financial statements of P Co, Y Co, and Z Co for the year ended 31 December 20x6 are shown below. Income Statement For Year Ended 31 December 20x6 Profit before tax. Profit after tax.... Dividends declared Profit retained Retained earnings, 1 January 20x6. Retained earnings, 31 December 20x6.. P CO $2,800,000 (560,000) $2,240,000 (200,000) $2,040,000 2,800,000 $4,840,000 Y CO $1,200,000 (240,000) $ 960,000 (120,000) $ 840,000 800,000 $1,640,000 Z CO $ 500,000 (80,000) $ 420,000 (100,000) $ 320,000 700,000 $1,020,000 Statement of Financial Position As at 31 December 20x6 z Co $ 700,000 P Co Y CO $2,340,000 $1,000,000 1,400,000 500,000 560,000 550,000 40,000 Foxed assets, net book value. Investment in Y Co, at cost. Investment in Z Co, at cost Inventory..... Intercompany receivable Amount owing by P Co. Accounts receivable Cash. 230,000 1,200,000 30,000 $6,030,000 800,000 100,000 $2,490,000 50,000 300,000 50,000 $1,330,000 $ 350,000 $ 110,000 Accounts payable.... Intercompany payable Amount owing to Z Co Share capital...... Retained earnings $ 100,000 40,000 50,000 1,000,000 4,840,000 $6,030,000 500,000 1,640,000 $2,490,000 200,000 1,020,000 $1,330,000 Mditional information: Resold to third parties during 20x5. Resold to third parties during 20x6.. In inventory as at 31 December 20x6.. 20% 6096 20% (b) In 20x6, P Co sold excess inventory to Y Co as follows: Transfer price of inventory. Original cost of inventory. Percentage resold to third parties during 20x6. Percentage in inventory as at 31 December 20x6.. $100,000 $120,000 80% 20% The inventory was not impaired as at the date of transfer or subsequently. (c) On 1 January 20x6, Z Co transferred an item of equipment to P Co at a transfer price of $172,000. The original cost of the equipment was $180,000 and the accumulated depreciation at the date of transfer was $36,000. The original useful life of the equipment was five years and the remaining useful life at the date of transfer was four years. Assume zero residual value. (d) P Co recognized interest expense charged by Y Co and Z Co during 20x6 as follows: binabato 000ORDS Interest expense charged by Y Co $1,500 Interest expense charged by Z Co $1,000 m The same amounts were recorded as interest income by Y Co and Z Co, respectively. (e) Assume a tax rate of 20%. Recognize tax effects on fair value adjustments. Required: 1. Prepare consolidation and equity accounting entries for the year ended 31 December 20x6, with narratives and workings. 2. Perform an analytical check on the balance in non-controlling interests and investment in associate as at 31 December 20x6, showing workings clearly. 3. Prepare the consolidation worksheets for the year ended 31 December 20x6